The informal sector encompasses unregulated and unregistered economic activities that often operate outside government oversight, including small-scale trade, casual labor, and home-based businesses. These activities contribute significantly to many economies by providing employment opportunities, especially where formal job markets are limited. Discover more about the informal sector's impact and how it shapes your community in the rest of this article.

Table of Comparison

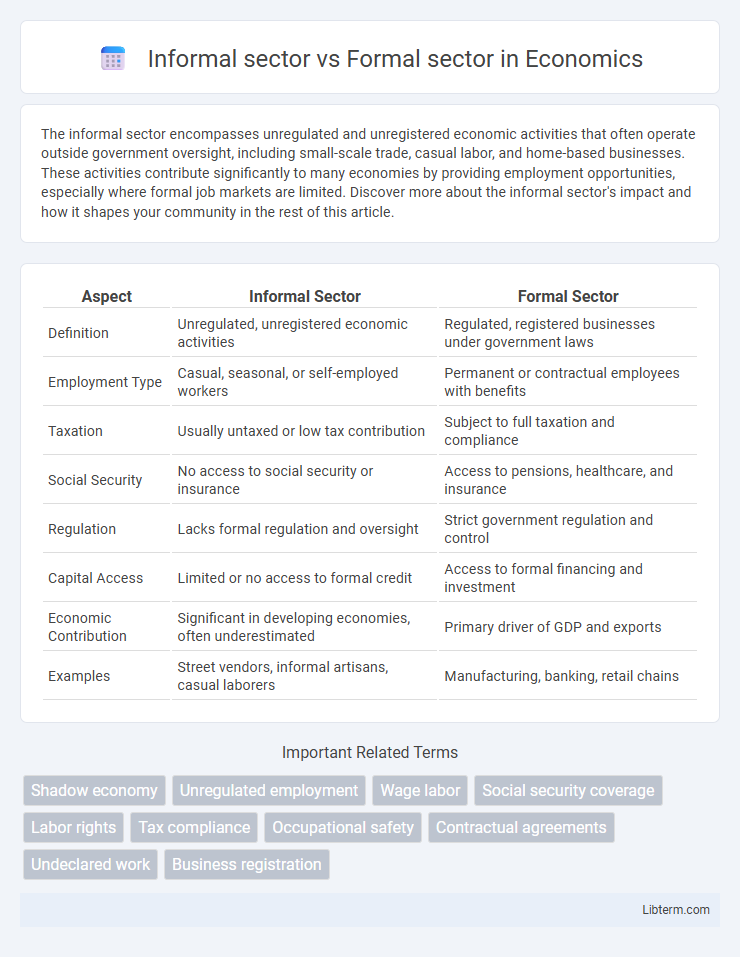

| Aspect | Informal Sector | Formal Sector |

|---|---|---|

| Definition | Unregulated, unregistered economic activities | Regulated, registered businesses under government laws |

| Employment Type | Casual, seasonal, or self-employed workers | Permanent or contractual employees with benefits |

| Taxation | Usually untaxed or low tax contribution | Subject to full taxation and compliance |

| Social Security | No access to social security or insurance | Access to pensions, healthcare, and insurance |

| Regulation | Lacks formal regulation and oversight | Strict government regulation and control |

| Capital Access | Limited or no access to formal credit | Access to formal financing and investment |

| Economic Contribution | Significant in developing economies, often underestimated | Primary driver of GDP and exports |

| Examples | Street vendors, informal artisans, casual laborers | Manufacturing, banking, retail chains |

Introduction to Formal and Informal Sectors

The informal sector comprises unregistered businesses and self-employed individuals operating without formal recognition, often lacking social security benefits and regulatory oversight. The formal sector includes officially registered entities that comply with government regulations, tax obligations, and labor laws, providing workers with legal protections and benefits. Both sectors significantly contribute to economic activity, with the informal sector frequently dominating in developing economies due to ease of entry and lower operating costs.

Defining Characteristics of the Formal Sector

The formal sector is characterized by registered businesses that comply with government regulations, including taxation, labor laws, and social security contributions. Employees in the formal sector typically enjoy job security, regular wages, and access to benefits such as healthcare and pensions. This sector's activities are documented, ensuring transparency and legal protections for both employers and workers.

Key Features of the Informal Sector

The informal sector is characterized by unregistered, small-scale businesses that typically operate without formal contracts, government regulation, or taxation, often providing flexible employment opportunities. Key features include low entry barriers, reliance on family labor, lack of social security benefits, and vulnerability to economic fluctuations. This sector plays a crucial role in developing economies by generating income and employment despite limited access to credit and technology.

Employment Trends in Both Sectors

Employment trends reveal that the informal sector accommodates a substantial portion of the global workforce, especially in developing economies, due to low entry barriers and lack of regulation. In contrast, the formal sector is characterized by regulated employment, higher job security, social benefits, and compliance with labor laws, attracting skilled workers and contributing significantly to economic growth. Recent data indicate a gradual shift toward formalization in many countries, driven by government policies aimed at reducing informality, improving tax collection, and enhancing workers' rights and social protections.

Economic Contributions: Formal vs Informal

The formal sector contributes significantly to GDP through regulated businesses, tax revenues, and structured employment, supporting economic stability and public services. In contrast, the informal sector drives economic activity by providing flexible job opportunities, fostering entrepreneurship, and sustaining livelihoods, especially in developing countries. Both sectors collectively enhance economic resilience, but their contributions differ in terms of regulation, productivity, and social protection mechanisms.

Social Implications and Worker Rights

The informal sector often lacks legal protections, social security, and minimum wage guarantees, exposing workers to exploitation and poor working conditions. In contrast, the formal sector provides regulated employment with enforced labor laws, social benefits, and access to healthcare and pensions, promoting worker stability and well-being. The disparity significantly impacts social equity, as informal workers face higher vulnerability without formal rights or institutional support.

Challenges Faced by Informal Sector Workers

Informal sector workers frequently encounter job insecurity, lack of social protection, and limited access to healthcare and pension schemes, which exacerbate their vulnerability. Their earnings tend to be unstable and substantially lower than those in the formal sector, often without legal contracts or labor rights. These challenges hinder economic mobility and perpetuate poverty among millions globally engaged in informal employment.

Regulatory Frameworks Governing Each Sector

The formal sector operates under strict regulatory frameworks that enforce labor laws, tax obligations, and social security contributions, ensuring legal protections and benefits for workers. In contrast, the informal sector is characterized by minimal or no regulatory oversight, leading to widespread issues such as lack of worker rights, unreported income, and limited access to social services. Effective policy interventions aim to integrate informal activities into the formal economy through simplified registration processes and inclusive labor regulations.

Pathways for Transition from Informal to Formal

Transitioning from the informal to the formal sector involves regulatory compliance, access to financial services, and skill enhancement programs that empower informal workers and enterprises. Government initiatives such as simplified business registration, microcredit availability, and social security integration create viable pathways for informal businesses to formalize operations. Establishing supportive legal frameworks and institutional support fosters sustainable economic inclusion, increased tax revenues, and better worker protections in the formal economy.

Future Outlook: Integrating Informal and Formal Economies

The future outlook for integrating informal and formal economies hinges on streamlining regulatory frameworks to support small-scale entrepreneurs and fostering digital platforms that enhance financial inclusion. Policymakers aim to bridge gaps by formalizing informal businesses through accessible taxation, social security benefits, and skill development initiatives. Technological advancements and inclusive policies will drive economic resilience by creating hybrid models that leverage both formal stability and informal flexibility.

Informal sector Infographic

libterm.com

libterm.com