The golden rule of accumulation emphasizes saving a consistent portion of your income to build wealth steadily over time. This principle relies on disciplined budgeting and long-term investing to harness the power of compound interest. Explore the rest of this article to learn how applying this rule can transform your financial future.

Table of Comparison

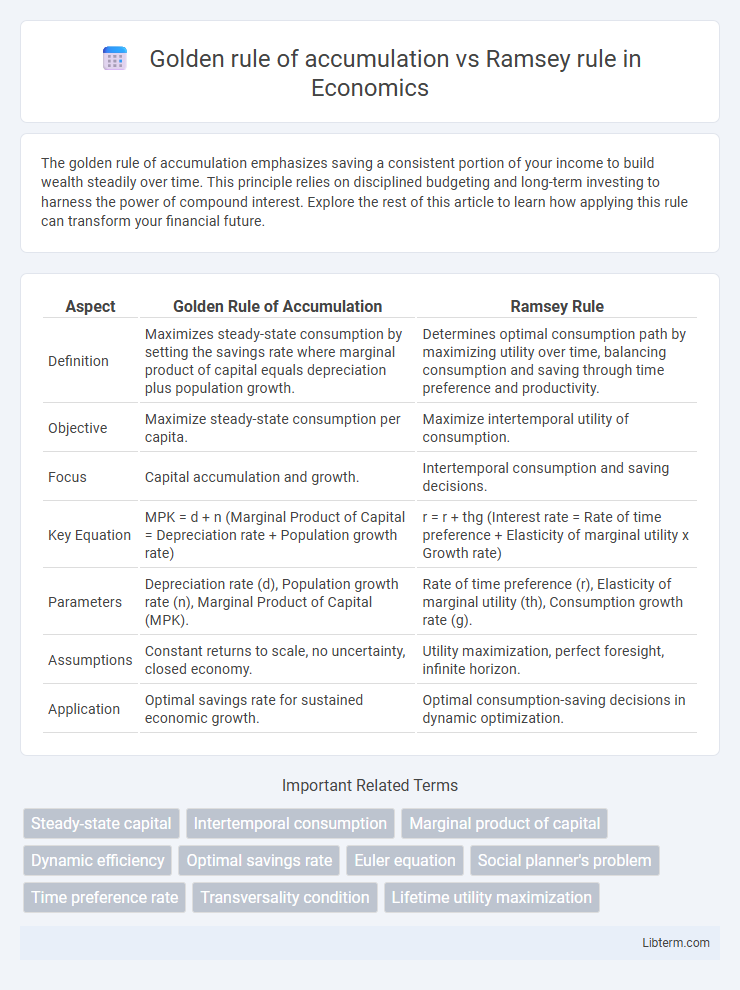

| Aspect | Golden Rule of Accumulation | Ramsey Rule |

|---|---|---|

| Definition | Maximizes steady-state consumption by setting the savings rate where marginal product of capital equals depreciation plus population growth. | Determines optimal consumption path by maximizing utility over time, balancing consumption and saving through time preference and productivity. |

| Objective | Maximize steady-state consumption per capita. | Maximize intertemporal utility of consumption. |

| Focus | Capital accumulation and growth. | Intertemporal consumption and saving decisions. |

| Key Equation | MPK = d + n (Marginal Product of Capital = Depreciation rate + Population growth rate) | r = r + thg (Interest rate = Rate of time preference + Elasticity of marginal utility x Growth rate) |

| Parameters | Depreciation rate (d), Population growth rate (n), Marginal Product of Capital (MPK). | Rate of time preference (r), Elasticity of marginal utility (th), Consumption growth rate (g). |

| Assumptions | Constant returns to scale, no uncertainty, closed economy. | Utility maximization, perfect foresight, infinite horizon. |

| Application | Optimal savings rate for sustained economic growth. | Optimal consumption-saving decisions in dynamic optimization. |

Introduction to Capital Accumulation Rules

The Golden rule of accumulation specifies the steady-state saving rate that maximizes consumption per capita by balancing capital accumulation and depreciation in the Solow growth model. The Ramsey rule determines the optimal intertemporal consumption path by equating the rate of time preference to the marginal product of capital minus depreciation, derived from the Ramsey-Cass-Koopmans model. Both rules provide fundamental frameworks for understanding efficient capital accumulation and long-term economic growth dynamics.

Defining the Golden Rule of Accumulation

The Golden Rule of Accumulation defines the optimal capital stock in an economy where the marginal product of capital equals the growth rate of the population, maximizing steady-state consumption per capita. It provides a benchmark for sustainable savings rates, ensuring that the economy balances investment and consumption efficiently. In contrast, the Ramsey rule incorporates time preferences and intertemporal utility, optimizing consumption paths over time rather than focusing solely on steady-state capital accumulation.

Understanding the Ramsey Rule

The Ramsey Rule determines the optimal savings rate by balancing consumption today against future consumption, maximizing overall utility in economic growth models. Unlike the Golden Rule of accumulation, which focuses on maximizing steady-state capital per worker, the Ramsey Rule incorporates time preference and marginal utility of consumption to guide dynamic savings decisions. This approach allows for a more comprehensive understanding of intertemporal consumption trade-offs and optimal capital accumulation paths.

Historical Context and Economic Foundations

The Golden Rule of accumulation, formulated by Edmund Phelps in the 1960s, establishes the optimal savings rate that maximizes steady-state consumption per capita within the Solow growth model framework. In contrast, the Ramsey rule, developed by Frank Ramsey in 1928, determines the optimal intertemporal consumption path by maximizing the utility of an infinitely-lived representative agent using the dynamic programming approach. Both rules are foundational to modern growth theory and intertemporal optimization, embedding assumptions about preferences, technology, and time preference rates to guide savings and consumption decisions over time.

Mathematical Formulation of Both Rules

The Golden Rule of accumulation is mathematically expressed as \( f'(k^*) = \delta + n \), where \( f'(k^*) \) represents the marginal product of capital at steady state, \( \delta \) is the depreciation rate, and \( n \) is the population growth rate, ensuring maximum steady-state consumption per capita. The Ramsey rule, derived from the intertemporal optimization problem, is given by \( \rho = r - \theta g \), where \( \rho \) is the rate of time preference, \( r \) is the interest rate or return on capital, \( \theta \) is the elasticity of intertemporal substitution, and \( g \) is the growth rate of consumption. While the Golden Rule focuses on maximizing steady-state consumption, the Ramsey rule guides optimal savings by balancing time preference and consumption growth through its Euler equation formulation.

Optimal Savings Rate: Golden Rule vs. Ramsey Rule

The Golden Rule of accumulation determines the optimal savings rate by maximizing steady-state consumption, typically resulting in a savings rate equal to the capital share of income. In contrast, the Ramsey Rule derives the optimal savings rate by maximizing the discounted utility of consumption over time, incorporating preferences like the rate of time preference and the elasticity of intertemporal substitution. While the Golden Rule offers a static benchmark, the Ramsey Rule provides a dynamic, welfare-based optimal savings path influenced by individual time preference and consumption growth expectations.

Policy Implications and Practical Applications

The Golden Rule of accumulation emphasizes maximizing steady-state consumption by balancing savings and capital accumulation, guiding long-term fiscal policies for sustainable growth. The Ramsey Rule incorporates intertemporal utility optimization, influencing optimal consumption and saving rates by accounting for time preference and elasticity of intertemporal substitution in economic models. Policy applications differ: the Golden Rule informs capital investment thresholds for economic stability, while the Ramsey Rule aids in designing dynamic tax policies and social welfare programs that optimize consumption over time.

Impact on Long-Term Economic Growth

The Golden Rule of accumulation emphasizes the optimal savings rate that maximizes steady-state consumption, directly influencing capital accumulation and long-term economic growth by balancing investment and consumption. The Ramsey rule extends this framework by incorporating individual preferences and time discounting, leading to an intertemporal consumption path that optimizes utility over infinite horizons. In long-term growth models, while the Golden Rule targets capital intensity for growth sustainability, the Ramsey rule guides consumption and savings decisions that shape capital accumulation dynamics and growth trajectories.

Comparative Analysis: Strengths and Limitations

The Golden Rule of Accumulation emphasizes maximizing steady-state capital per worker to optimize long-term consumption, providing a clear benchmark for savings rates in growth models. In contrast, the Ramsey Rule incorporates intertemporal utility maximization, balancing consumption today against future utility with endogenous savings decisions based on the rate of time preference and the elasticity of intertemporal substitution. While the Golden Rule offers simplicity and intuitive policy guidance, the Ramsey Rule's strength lies in its microeconomic foundation and flexibility, although it requires more complex assumptions about preferences and future dynamics, limiting its direct applicability in empirical settings.

Conclusion and Future Perspectives

The Golden Rule of accumulation establishes a steady-state capital stock optimizing consumption per worker, serving as a benchmark for long-term economic growth sustainability. The Ramsey Rule advances this by incorporating intertemporal utility maximization, guiding optimal savings rates based on individuals' time preferences and productivity growth. Future research may integrate endogenous technological change and heterogeneous agent models to refine policy implications for capital accumulation and welfare optimization.

Golden rule of accumulation Infographic

libterm.com

libterm.com