Factor-proportions trade theory explains how countries specialize in producing goods using abundant factors of production like labor or capital, leading to more efficient international trade. This theory highlights how differences in resource endowments influence comparative advantage and global trade patterns. Discover how understanding factor-proportions trade can enhance your grasp of international economics by reading the full article.

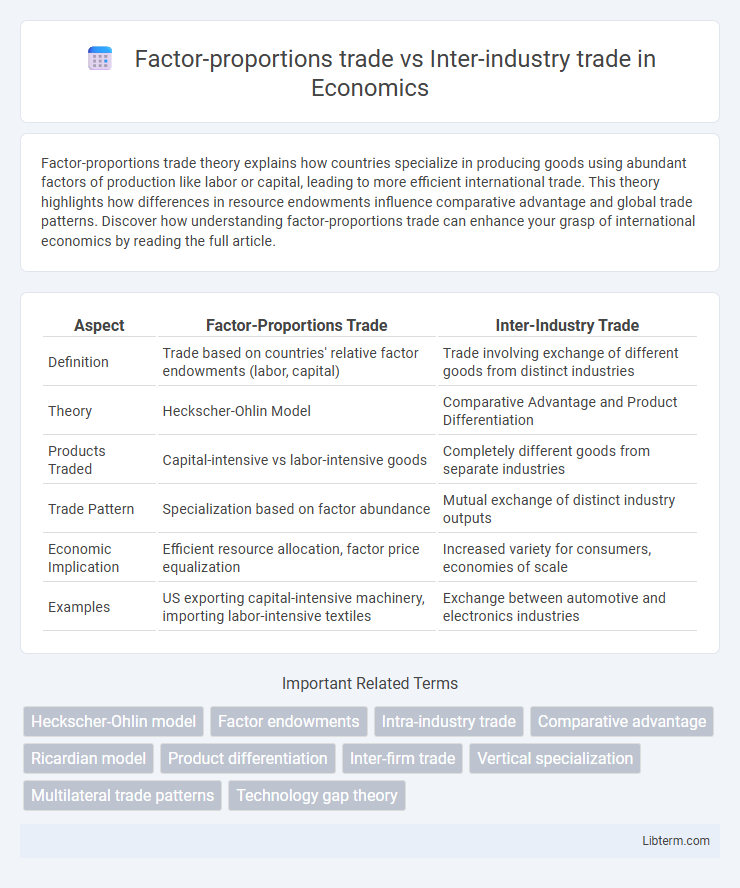

Table of Comparison

| Aspect | Factor-Proportions Trade | Inter-Industry Trade |

|---|---|---|

| Definition | Trade based on countries' relative factor endowments (labor, capital) | Trade involving exchange of different goods from distinct industries |

| Theory | Heckscher-Ohlin Model | Comparative Advantage and Product Differentiation |

| Products Traded | Capital-intensive vs labor-intensive goods | Completely different goods from separate industries |

| Trade Pattern | Specialization based on factor abundance | Mutual exchange of distinct industry outputs |

| Economic Implication | Efficient resource allocation, factor price equalization | Increased variety for consumers, economies of scale |

| Examples | US exporting capital-intensive machinery, importing labor-intensive textiles | Exchange between automotive and electronics industries |

Introduction to International Trade Theories

The factor-proportions trade theory explains international trade by emphasizing differences in countries' relative endowments of labor, capital, and land, suggesting that nations export goods that intensively use their abundant factors. Inter-industry trade, by contrast, involves the exchange of completely different products across countries, typically explained by comparative advantage and product specialization. These theories serve as foundational frameworks within international trade, helping to analyze global patterns of exports and imports based on resource allocation and industrial structure.

Defining Factor-Proportions Trade

Factor-proportions trade theory explains international trade patterns based on countries' relative endowments of production factors such as labor, capital, and land. Nations export goods that intensively use their abundant factors and import goods requiring factors that are scarce domestically. This contrasts with inter-industry trade, which involves exchanging different types of goods across industries rather than variations in factor intensity within industries.

Understanding Inter-Industry Trade

Inter-industry trade refers to the exchange of goods between countries that specialize in different industries, often driven by differences in factor endowments as explained by the factor-proportions theory. This type of trade occurs when nations export products that use their abundant factors intensively while importing goods that require factors that are scarce domestically. Understanding inter-industry trade is crucial for analyzing how comparative advantage shapes global trade patterns and influences industry-specific economic development.

Historical Context and Evolution

Factor-proportions trade, rooted in the Heckscher-Ohlin model developed in the early 20th century, explains trade patterns based on countries' relative factor endowments such as labor and capital. Inter-industry trade emerged later in the mid-20th century through empirical observations that countries often exchange goods from different industries, challenging the factor-proportions theory. Over time, trade theory evolved to incorporate both models, recognizing that international commerce involves specialization in distinct industries as well as variations in factor intensities within industries.

Key Differences Between the Two Trade Types

Factor-proportions trade is based on differences in relative factor endowments, such as labor and capital, between countries, leading to trade in goods that intensively use these factors, while inter-industry trade involves the exchange of entirely different products belonging to separate industries. Factor-proportions trade aligns with the Heckscher-Ohlin model predicting that countries export goods that use abundant factors intensively, whereas inter-industry trade reflects comparative advantage differences and specialization in distinct sectors. The key distinction lies in factor intensity and industry classification, with factor-proportions trade emphasizing input factor differences within industries and inter-industry trade focusing on trade across unrelated industries.

Economic Models Underpinning Each Concept

Factor-proportions trade is grounded in the Heckscher-Ohlin model, which explains international trade patterns based on countries' relative abundance of labor and capital, illustrating how nations export goods that intensively use their abundant factors. Inter-industry trade, explained by the Ricardian model and traditional comparative advantage theory, focuses on differences in technology and productivity across industries, leading countries to specialize and trade distinct products from different sectors. These economic models clarify how resource endowments and technological disparities drive the nature and composition of international trade flows.

Examples of Factor-Proportions Trade in Practice

Factor-proportions trade occurs when countries export goods that intensively use their abundant production factors, such as capital or labor, exemplified by the United States exporting capital-intensive machinery and Mexico exporting labor-intensive textiles. Inter-industry trade, by contrast, involves the exchange of entirely different goods between industries, like the trade of automobiles from Germany for agricultural products from Brazil. The Leontief Paradox and patterns observed in global trade highlight how factor endowments influence export profiles, demonstrating the real-world applications of the Heckscher-Ohlin model.

Real-World Cases of Inter-Industry Trade

Inter-industry trade involves the exchange of distinct goods between countries, exemplified by Japan exporting automobiles while importing crude oil from the Middle East, reflecting their differing factor endowments and industrial specializations. This contrasts with the factor-proportions model, which predicts trade based on relative abundances of labor, capital, and natural resources, driving countries to export goods intensively using their abundant factors. Real-world cases highlight how inter-industry trade aligns with structural economic differences, as seen in Saudi Arabia's petroleum exports and Japan's technological products imports, emphasizing complementary production sectors rather than similar industries.

Implications for Policy and Global Economy

Factor-proportions trade theory emphasizes resource endowments affecting comparative advantage, guiding policies toward efficient allocation of capital and labor to boost exports and economic growth. Inter-industry trade, involving exchange of distinct goods between countries, encourages specialization and can lead to diversified economies but may require policies that support industry-specific competitiveness and innovation. Policymakers must balance these approaches, fostering both efficient resource use and dynamic trade patterns to enhance global economic integration and resilience.

Conclusion: Assessing Trade Patterns and Future Trends

Factor-proportions trade explains global trade patterns by countries exporting goods that intensively use their abundant production factors, leading to specialization based on resource endowments. Inter-industry trade involves the exchange of fundamentally different products between industries, often reflecting differences in technological development and consumer preferences. Future trends suggest that increasing globalization and technological innovation will blur distinctions, promoting intra-industry trade growth while factor endowments continue to influence comparative advantages.

Factor-proportions trade Infographic

libterm.com

libterm.com