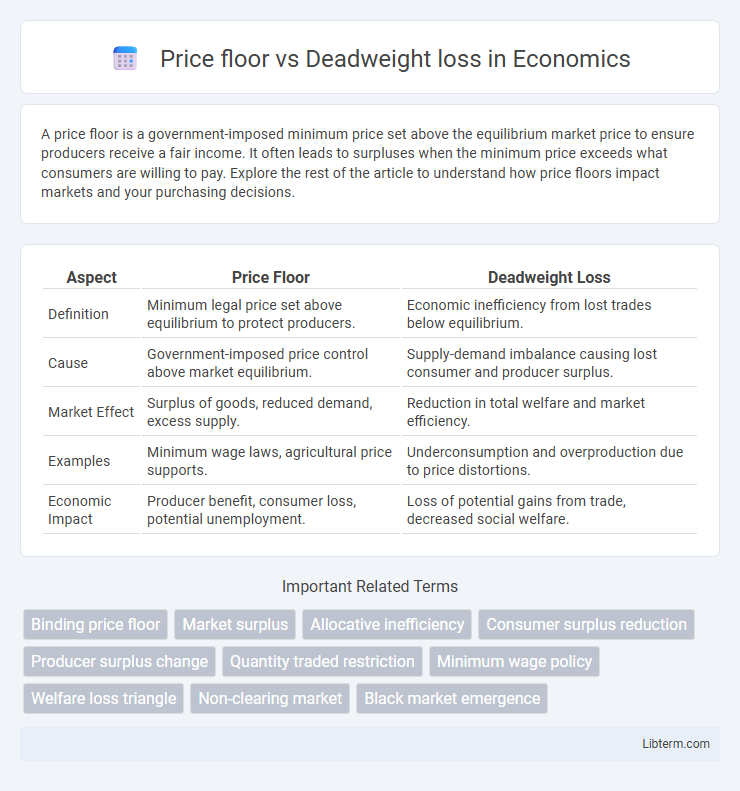

A price floor is a government-imposed minimum price set above the equilibrium market price to ensure producers receive a fair income. It often leads to surpluses when the minimum price exceeds what consumers are willing to pay. Explore the rest of the article to understand how price floors impact markets and your purchasing decisions.

Table of Comparison

| Aspect | Price Floor | Deadweight Loss |

|---|---|---|

| Definition | Minimum legal price set above equilibrium to protect producers. | Economic inefficiency from lost trades below equilibrium. |

| Cause | Government-imposed price control above market equilibrium. | Supply-demand imbalance causing lost consumer and producer surplus. |

| Market Effect | Surplus of goods, reduced demand, excess supply. | Reduction in total welfare and market efficiency. |

| Examples | Minimum wage laws, agricultural price supports. | Underconsumption and overproduction due to price distortions. |

| Economic Impact | Producer benefit, consumer loss, potential unemployment. | Loss of potential gains from trade, decreased social welfare. |

Understanding Price Floors: Definition and Purpose

A price floor is a government-imposed minimum price set above the equilibrium price to ensure producers receive a fair income, commonly applied in markets like agriculture and labor. By preventing prices from falling too low, price floors aim to stabilize incomes and encourage production, but this intervention often results in surplus supply due to reduced consumer demand. This surplus leads to deadweight loss, representing the loss of economic efficiency where potential trades between buyers and sellers fail to occur.

Deadweight Loss Explained: Economic Impact

Deadweight loss occurs when a price floor, set above the equilibrium price, reduces the quantity of goods traded below the efficient market level, creating economic inefficiency. This results in lost consumer and producer surplus as some mutually beneficial trades do not occur, causing resources to be misallocated. The deadweight loss represents the total loss of potential gains from trade, negatively impacting market welfare and overall economic efficiency.

How Price Floors Create Market Inefficiencies

Price floors, set above equilibrium prices, lead to excess supply as producers are willing to supply more than consumers demand, causing market surpluses. These surpluses result in deadweight loss, representing the lost economic efficiency where potential trades between buyers and sellers do not occur. The inability of the market to clear at the imposed price floor disrupts allocative efficiency, leading to wasted resources and reduced overall welfare.

Examples of Price Floors in Real-World Markets

Price floors, such as minimum wage laws and agricultural price supports, set a legal minimum price above the market equilibrium, leading to excess supply and deadweight loss. For example, the U.S. minimum wage creates a price floor in the labor market, potentially causing unemployment by increasing labor costs above the equilibrium wage. Similarly, European Union agricultural subsidies enforce price floors on crops like wheat, generating surpluses and inefficiencies that result in deadweight loss by misallocating resources and reducing overall economic welfare.

Graphical Representation: Price Floor vs Deadweight Loss

A price floor set above the equilibrium price creates a surplus, graphically shown as the gap between quantity supplied and quantity demanded at the set price. This surplus results in a deadweight loss depicted by the triangular area between the supply and demand curves from the equilibrium quantity to the quantity traded under the price floor. The deadweight loss represents the lost consumer and producer surplus due to decreased market efficiency caused by the distortion from the price floor.

Consequences of Price Floors on Consumers and Producers

Price floors, set above equilibrium prices, lead to surplus supply as producers increase output while consumers reduce demand, resulting in deadweight loss that represents lost economic efficiency. Consumers face higher prices and decreased consumption, reducing consumer surplus, while producers may benefit from higher prices but suffer from unsold inventory and market inefficiencies. This imbalance distorts resource allocation, causing welfare losses for both consumers and producers that exceed the intended protective effects of the price floor.

Deadweight Loss Measurement: Methods and Formulas

Deadweight loss from a price floor is measured by calculating the loss in consumer and producer surplus due to market inefficiencies caused by artificially high prices. Common methods include using the area of the triangle formed between the supply and demand curves at the imposed price floor and equilibrium, with the formula DWL = 0.5 x (Quantity Reduction) x (Price Difference). Precise measurement requires determining the reduction in traded quantity and the vertical distance between supply and demand at that quantity gap.

Short-Term vs Long-Term Effects of Price Floors

Price floors, set above equilibrium prices, create surpluses leading to deadweight loss by reducing market efficiency in both short-term and long-term scenarios. In the short-term, producers may benefit from higher prices, but consumers face reduced quantity demanded, causing immediate welfare losses. Over the long-term, persistent price floors distort market signals, discourage investment and innovation, and exacerbate deadweight loss as surpluses increase and resource misallocation worsens.

Policy Implications: Minimizing Deadweight Loss

Implementing a price floor above the equilibrium price commonly leads to deadweight loss by creating surpluses and inefficiencies in the market. Policymakers can minimize deadweight loss by carefully setting price floors close to the equilibrium price or by combining them with complementary measures such as targeted subsidies or supply adjustments. Analyzing market elasticity and consumer-producer behavior helps design price floors that protect producers without significantly distorting market outcomes or diminishing overall welfare.

Key Differences Between Price Floor Effects and Other Market Interventions

Price floors set a minimum price above equilibrium, causing excess supply and creating deadweight loss by reducing trade efficiency. Unlike taxes or quotas, price floors lead to surplus that sellers cannot sell, distorting market equilibrium and decreasing consumer surplus. Market interventions such as subsidies increase quantity traded, whereas price floors restrict trade volume, intensifying deadweight loss through unsold goods.

Price floor Infographic

libterm.com

libterm.com