External diseconomies occur when a company's growth or production negatively impacts other businesses or the community, leading to increased costs and reduced efficiency beyond the firm's control. Factors such as environmental pollution, traffic congestion, or resource depletion contribute to these external costs, which are not reflected in the company's expenses. To understand how external diseconomies affect Your industry and strategies for mitigation, continue reading the rest of this article.

Table of Comparison

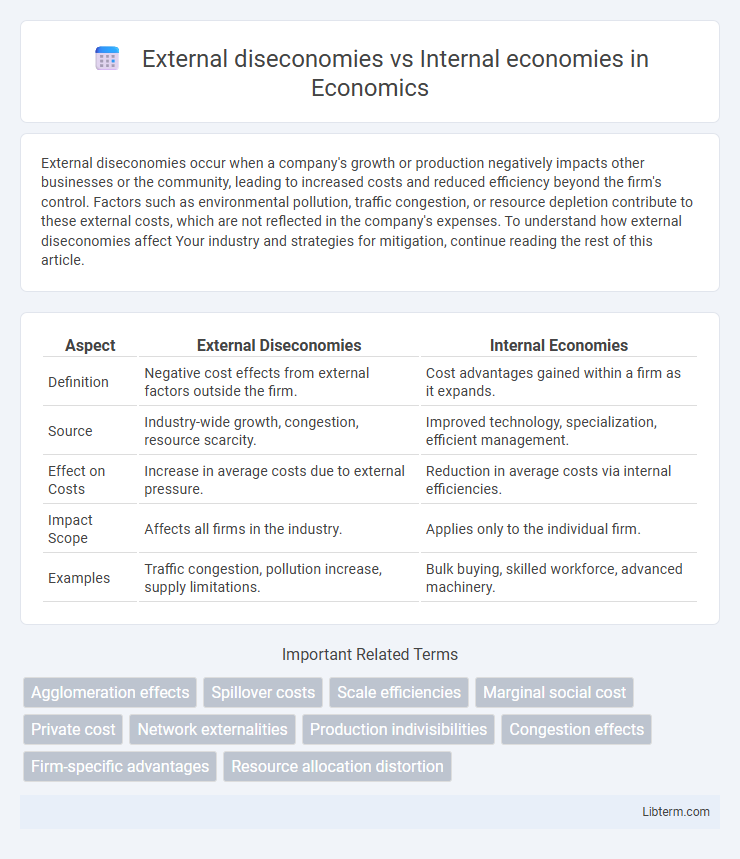

| Aspect | External Diseconomies | Internal Economies |

|---|---|---|

| Definition | Negative cost effects from external factors outside the firm. | Cost advantages gained within a firm as it expands. |

| Source | Industry-wide growth, congestion, resource scarcity. | Improved technology, specialization, efficient management. |

| Effect on Costs | Increase in average costs due to external pressure. | Reduction in average costs via internal efficiencies. |

| Impact Scope | Affects all firms in the industry. | Applies only to the individual firm. |

| Examples | Traffic congestion, pollution increase, supply limitations. | Bulk buying, skilled workforce, advanced machinery. |

Understanding External Diseconomies: Definition and Types

External diseconomies occur when the cost of production increases due to factors outside the firm, affecting multiple businesses in a region or industry. Common types include pollution, increased traffic congestion, and resource depletion, which raise operational costs and reduce overall productivity. These negative externalities contrast with internal economies, where cost advantages arise from factors within a firm, such as improved technology or better management.

Exploring Internal Economies: Meaning and Classification

Internal economies refer to cost advantages that arise within a firm as it expands its production scale, leading to increased efficiency and reduced average costs. These economies are classified into technical economies, achieved through improved machinery and production techniques; managerial economies, derived from specialized management expertise; financial economies, resulting from better borrowing terms; and marketing economies, obtained by spreading advertising costs over larger output volumes. Understanding these classifications helps firms optimize operations and gain competitive advantages by leveraging internal growth factors.

Key Differences Between External Diseconomies and Internal Economies

External diseconomies occur when an industry's growth imposes costs on other firms or the environment, such as increased pollution or resource shortages, reducing overall efficiency outside the firm. Internal economies arise from within a firm, including factors like bulk purchasing, technological improvements, or managerial expertise, leading to lower average costs as production scales up. The key difference lies in the source: external diseconomies originate from external industry or market conditions adversely affecting firms, while internal economies stem from the firm's own operational efficiencies and scale advantages.

Causes of External Diseconomies in Industries

External diseconomies in industries arise primarily from factors outside the individual firm, such as environmental pollution, increased traffic congestion, and the depletion of natural resources. These negative spillovers often result from the collective actions of multiple firms within a region, causing higher operating costs and reduced productivity. Urban overcrowding and infrastructural strain further exacerbate external diseconomies, diminishing the overall efficiency of industrial clusters.

Determinants and Sources of Internal Economies

Internal economies arise from factors within a firm such as advanced technology adoption, efficient management practices, and increased specialization of labor that reduce per-unit costs as production scales. Key determinants include managerial economies, technical economies, financial economies, and marketing economies, each contributing to improved operational efficiency. External diseconomies, by contrast, occur due to negative industry-wide factors like resource scarcity, increased competition, or environmental regulations that raise costs independent of individual firm efforts.

Impact of External Diseconomies on Business Performance

External diseconomies occur when factors outside a business, such as increased industry-wide input costs or negative environmental effects, elevate operational expenses and reduce profitability. These external pressures often lead to diminished competitive advantage and lower efficiency, as businesses cannot control or mitigate such cost increases independently. Consequently, the impact on business performance includes reduced output, higher prices for consumers, and potential market contraction due to decreased overall industry productivity.

Internal Economies: Benefits for Growing Firms

Internal economies of scale arise when a growing firm reduces its average costs through increased production efficiency, such as specialization of labor, advanced technology adoption, and bulk purchasing of raw materials. These benefits enhance competitive advantage by improving profitability and enabling reinvestment in innovation and capacity expansion. Internal economies help firms achieve sustainable growth by optimizing resources and streamlining operations within the organization.

Managing the Effects of External Diseconomies

Managing the effects of external diseconomies involves strategies such as regulatory intervention, environmental controls, and fostering collaboration among firms to mitigate negative impacts like pollution or congestion. Policymakers often implement taxes, subsidies, or zoning laws to internalize external costs, thereby encouraging more efficient resource use. Effective management balances economic growth with minimizing external costs to maintain overall industry sustainability.

Case Studies: External Diseconomies vs Internal Economies in Real Sectors

In the manufacturing sector, Toyota's implementation of lean production illustrates internal economies through cost savings achieved within the firm by optimizing workflow and reducing waste. Conversely, the textile industry in Bangladesh experiences external diseconomies as overcrowded factories lead to increased pollution and infrastructure strain, raising costs for all firms in the cluster. These case studies highlight how internal economies enhance firm efficiency, while external diseconomies emerge from negative external impacts affecting entire industrial regions.

Strategic Approaches to Maximize Internal Economies and Minimize External Diseconomies

Firms maximize internal economies by investing in advanced technology, enhancing workforce skills, and streamlining production processes to reduce average costs per unit as output scales. Strategic partnerships and integrated supply chains optimize resource allocation, fostering operational efficiency and innovation. Minimizing external diseconomies involves advocating for favorable regulatory policies, collaborating with industry clusters to mitigate negative spillovers, and engaging in sustainable practices that reduce environmental and social costs affecting the broader business ecosystem.

External diseconomies Infographic

libterm.com

libterm.com