Local currency plays a crucial role in facilitating everyday transactions and supporting the economic stability of a region. Understanding how it influences buying power and exchange rates can help you make better financial decisions. Dive into the article to explore the significance of local currency in the global market.

Table of Comparison

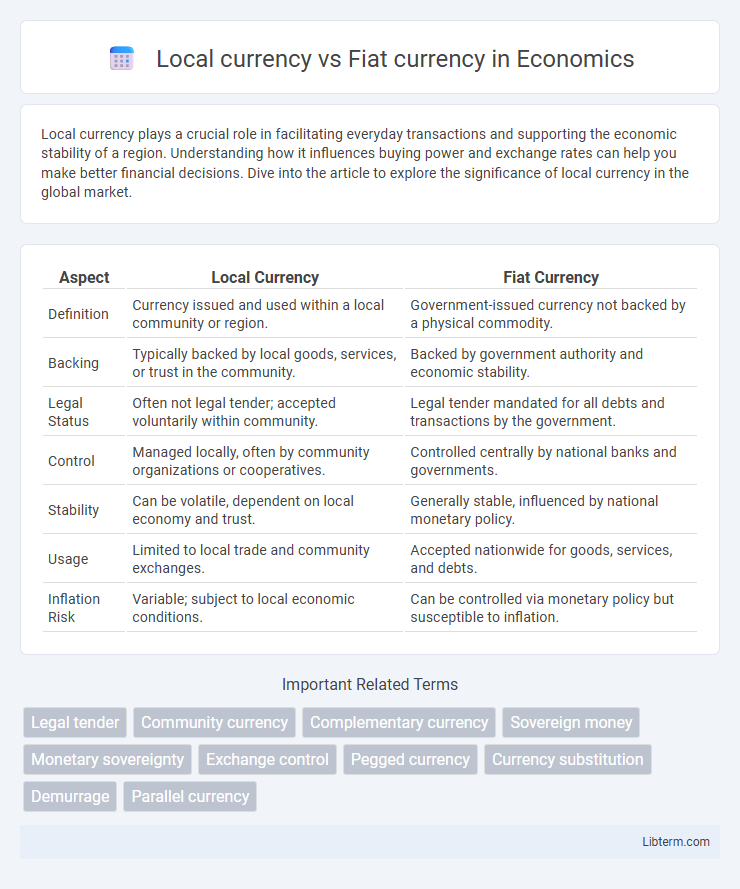

| Aspect | Local Currency | Fiat Currency |

|---|---|---|

| Definition | Currency issued and used within a local community or region. | Government-issued currency not backed by a physical commodity. |

| Backing | Typically backed by local goods, services, or trust in the community. | Backed by government authority and economic stability. |

| Legal Status | Often not legal tender; accepted voluntarily within community. | Legal tender mandated for all debts and transactions by the government. |

| Control | Managed locally, often by community organizations or cooperatives. | Controlled centrally by national banks and governments. |

| Stability | Can be volatile, dependent on local economy and trust. | Generally stable, influenced by national monetary policy. |

| Usage | Limited to local trade and community exchanges. | Accepted nationwide for goods, services, and debts. |

| Inflation Risk | Variable; subject to local economic conditions. | Can be controlled via monetary policy but susceptible to inflation. |

Introduction to Local and Fiat Currency

Local currency refers to the official money used within a specific country or region, serving as the primary medium of exchange for goods and services. Fiat currency is government-issued money that is not backed by a physical commodity but derives value from legal regulation and trust in the issuing authority. Both local and fiat currencies play crucial roles in facilitating economic transactions and maintaining financial stability in domestic markets.

Definition of Local Currency

Local currency refers to the monetary unit issued and used within a specific geographic region or community, facilitating trade and economic activities tailored to that area. It operates alongside or in place of national fiat currency, which is government-backed legal tender accepted universally across a country. Local currency often aims to boost local economies by encouraging spending within the community and supporting small businesses.

Definition of Fiat Currency

Fiat currency is government-issued money that is not backed by a physical commodity like gold or silver but derives its value from legal decree and public trust. Unlike local currencies, which are often limited to specific communities or regions, fiat currencies serve as the official medium of exchange within a country's entire economy. Central banks control the supply and regulation of fiat currency to stabilize the economy and manage inflation.

Historical Background of Currency Systems

Local currency systems have historically emerged to facilitate trade within specific communities, often backed by tangible assets or trust among participants, predating the widespread use of fiat currency. Fiat currency gained prominence in the 20th century when governments moved away from commodity-backed money, relying instead on legal tender status and centralized control by monetary authorities. This shift allowed for greater flexibility in monetary policy but also introduced complexities in inflation management and currency valuation.

Key Differences Between Local and Fiat Currencies

Local currency is typically issued and regulated within a specific region or community, often intended for use in localized transactions, while fiat currency is government-issued and accepted as legal tender across an entire country or multiple countries. Fiat currencies, such as the US dollar or euro, derive value from government decree and widespread acceptance, whereas local currencies gain value from community trust and limited circulation. Key differences include scope of use, regulatory authority, and the backing system, with fiat currencies often supported by national monetary policy and local currencies relying on social or economic incentives.

Advantages of Local Currencies

Local currencies enhance community economic resilience by keeping money circulating within a specific area, promoting local businesses and reducing economic leakage to outside regions. They encourage consumer spending on local goods and services, which boosts small businesses and fosters job creation. These currencies also help build a stronger sense of community identity and support sustainable economic development tailored to regional needs.

Advantages of Fiat Currencies

Fiat currencies offer widespread acceptance and stability backed by government regulation, making them reliable for daily transactions and international trade. Central banks control fiat money supply, enabling effective monetary policy to manage inflation and stimulate economic growth. Unlike local currencies, fiat currencies provide liquidity and are generally more trusted due to their legal tender status and global recognition.

Economic Impacts on Communities

Local currencies stimulate community economic activity by encouraging spending within a specific region, which strengthens local businesses and preserves wealth locally. Fiat currencies, controlled by central governments, provide broader stability and liquidity but may lead to capital outflow and reduced support for small businesses in local economies. Communities adopting local currencies often experience increased economic resilience and social cohesion compared to reliance solely on fiat money.

Challenges and Limitations of Each System

Local currency faces challenges such as limited acceptance beyond its community, which restricts trade and economic growth, alongside logistical issues in production and management. Fiat currency, while widely accepted and supported by government regulation, suffers from inflation risks, centralization concerns, and potential loss of purchasing power over time. Both systems encounter limitations in trust and stability, impacting their effectiveness in diverse economic contexts.

Future Trends in Currency Evolution

Future trends in currency evolution highlight the increasing integration of digital local currencies alongside traditional fiat currencies, driven by advancements in blockchain technology and growing demands for financial inclusivity. Central banks worldwide are exploring Central Bank Digital Currencies (CBDCs) to complement or even replace existing fiat systems, promoting transparency, security, and efficiency in transactions. Enhanced interoperability between local currencies and global fiat frameworks is anticipated to foster seamless cross-border payments and localized economic resilience.

Local currency Infographic

libterm.com

libterm.com