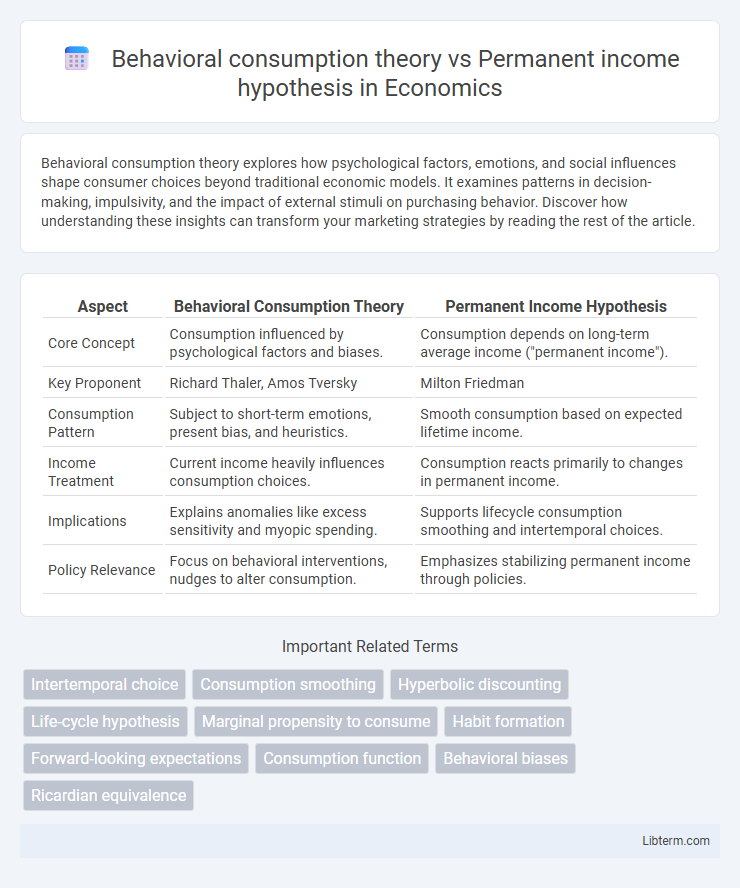

Behavioral consumption theory explores how psychological factors, emotions, and social influences shape consumer choices beyond traditional economic models. It examines patterns in decision-making, impulsivity, and the impact of external stimuli on purchasing behavior. Discover how understanding these insights can transform your marketing strategies by reading the rest of the article.

Table of Comparison

| Aspect | Behavioral Consumption Theory | Permanent Income Hypothesis |

|---|---|---|

| Core Concept | Consumption influenced by psychological factors and biases. | Consumption depends on long-term average income ("permanent income"). |

| Key Proponent | Richard Thaler, Amos Tversky | Milton Friedman |

| Consumption Pattern | Subject to short-term emotions, present bias, and heuristics. | Smooth consumption based on expected lifetime income. |

| Income Treatment | Current income heavily influences consumption choices. | Consumption reacts primarily to changes in permanent income. |

| Implications | Explains anomalies like excess sensitivity and myopic spending. | Supports lifecycle consumption smoothing and intertemporal choices. |

| Policy Relevance | Focus on behavioral interventions, nudges to alter consumption. | Emphasizes stabilizing permanent income through policies. |

Introduction to Consumption Theories

Behavioral consumption theory emphasizes psychological factors and decision-making biases that influence consumer spending, contrasting with the Permanent Income Hypothesis, which posits that individuals base consumption on expected long-term average income. While the Permanent Income Hypothesis, developed by Milton Friedman, suggests consumption smooths out over time in response to predictable income changes, behavioral consumption theory incorporates elements like bounded rationality and mental accounting to explain deviations from this pattern. Understanding these consumption theories provides crucial insights into how consumer behavior responds to income fluctuations, uncertainty, and cognitive biases in economic modeling.

Overview of Behavioral Consumption Theory

Behavioral Consumption Theory emphasizes the role of psychological factors, such as consumer confidence and mental accounting, in shaping spending behaviors, deviating from traditional assumptions of rational decision-making. It highlights how past experiences, habits, and cognitive biases influence consumption choices, leading to deviations from the smooth consumption paths predicted by the Permanent Income Hypothesis. This approach accounts for observed anomalies like under- or over-spending relative to lifetime income, offering a nuanced understanding of consumer behavior dynamics.

Key Concepts in Permanent Income Hypothesis

The Permanent Income Hypothesis (PIH) emphasizes that consumers base their consumption on expected long-term average income rather than current income fluctuations, highlighting the role of lifetime resources in consumption decisions. Key concepts include the separation of income into permanent and transitory components, where only permanent income influences sustainable consumption patterns. This contrasts with Behavioral Consumption Theory, which accounts for psychological factors and deviations from rational expectations in consumer behavior.

Psychological Factors Influencing Consumer Behavior

Behavioral consumption theory emphasizes the role of psychological factors such as mental accounting, loss aversion, and self-control in shaping consumer spending patterns, highlighting deviations from traditional economic rationality. In contrast, the Permanent Income Hypothesis (PIH) assumes consumers base their consumption decisions primarily on expected lifetime income, downplaying immediate psychological influences. Understanding these differing perspectives reveals how cognitive biases and emotional responses significantly impact short-term consumption beyond the lifetime income smoothing predicted by PIH.

Income Expectations in Permanent Income Hypothesis

The Permanent Income Hypothesis (PIH) emphasizes that consumers base their consumption on expected long-term average income rather than current income fluctuations, smoothing consumption over time despite temporary income changes. Behavioral consumption theory challenges this by highlighting that consumers often deviate from such optimal smoothing due to biases, heuristics, and present-biased preferences. Income expectations in PIH are crucial because inaccurate or changing forecasts of permanent income directly influence consumption patterns, whereas behavioral models account for psychological factors affecting these expectations.

Short-Term vs Long-Term Consumption Decisions

Behavioral consumption theory highlights how psychological factors and cognitive biases cause consumers to deviate from rational spending, often prioritizing short-term gratification over long-term financial planning. Permanent Income Hypothesis posits that individuals base consumption decisions on their expected lifetime income, smoothing spending patterns to maintain stability despite short-term income fluctuations. This contrast underscores that behavioral theory explains short-term consumption volatility, while the Permanent Income Hypothesis models consistent long-term consumption behavior.

Empirical Evidence: Behavioral Theory vs Permanent Income

Empirical evidence reveals that behavioral consumption theory better accounts for anomalies such as the excess sensitivity of consumption to current income and liquidity constraints, which the permanent income hypothesis (PIH) struggles to explain fully. Unlike PIH's assumption of forward-looking, perfectly rational agents smoothing consumption based on lifetime income, behavioral models incorporate psychological factors like mental accounting and present bias, providing a stronger fit to observed consumption patterns in microeconomic data. Studies demonstrate that consumption responds more to recent income changes and exhibits deviation from the smooth consumption predicted by PIH, supporting behavioral explanations over the classical permanent income framework.

Implications for Economic Policy

Behavioral consumption theory highlights the impact of psychological factors, such as consumption habits and self-control issues, suggesting that policies should incorporate mechanisms like commitment devices or targeted savings programs to enhance consumer welfare. The Permanent Income Hypothesis (PIH) assumes rational expectations and smooth consumption over time, implying that fiscal policies focused on temporary income changes have limited effects on consumption patterns. Policymakers must consider these contrasting frameworks to design interventions that effectively address short-term behavioral biases while supporting long-term income stability.

Limitations of Each Theory

Behavioral consumption theory faces limitations due to its reliance on psychological factors, which can introduce subjectivity and variability in modeling consumer behavior, making predictions less stable across different populations. Permanent income hypothesis assumes rational expectations and stable income, which often fails to account for liquidity constraints and precautionary saving motives in real-life consumption decisions. Both theories struggle to fully capture the complexities of consumption patterns influenced by market imperfections, credit availability, and changing socio-economic conditions.

Conclusion: Synthesizing Insights from Both Approaches

Behavioral consumption theory and the Permanent Income Hypothesis (PIH) offer complementary insights into consumer spending patterns, with the former emphasizing psychological biases and heuristics, while the latter focuses on rational income expectations. Synthesizing these approaches reveals that real-world consumption behavior integrates both rational long-term income smoothing and short-term deviations driven by cognitive and emotional factors. Understanding this nuanced interaction enhances predictive models of consumer demand and informs more effective fiscal and monetary policies.

Behavioral consumption theory Infographic

libterm.com

libterm.com