Rational expectations theory assumes individuals use all available information efficiently to forecast future economic variables, leading to predictions that, on average, are accurate and unbiased. This concept plays a crucial role in modern economics by influencing policy analysis and market behavior, emphasizing that systematic errors in expectations are unlikely. Discover how understanding rational expectations can transform your perspective on economic decision-making throughout the article.

Table of Comparison

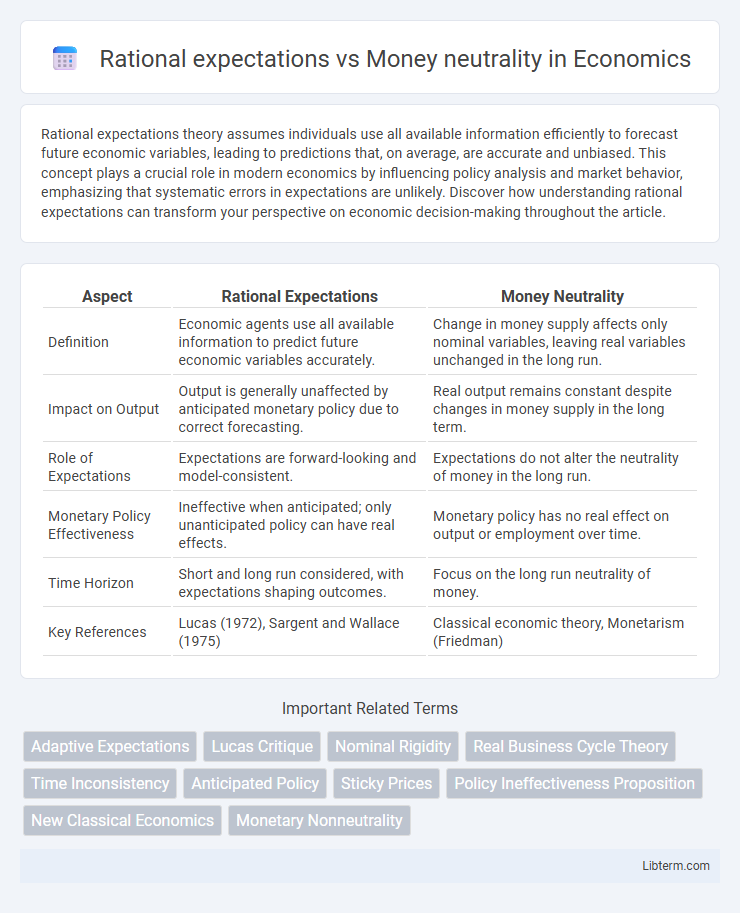

| Aspect | Rational Expectations | Money Neutrality |

|---|---|---|

| Definition | Economic agents use all available information to predict future economic variables accurately. | Change in money supply affects only nominal variables, leaving real variables unchanged in the long run. |

| Impact on Output | Output is generally unaffected by anticipated monetary policy due to correct forecasting. | Real output remains constant despite changes in money supply in the long term. |

| Role of Expectations | Expectations are forward-looking and model-consistent. | Expectations do not alter the neutrality of money in the long run. |

| Monetary Policy Effectiveness | Ineffective when anticipated; only unanticipated policy can have real effects. | Monetary policy has no real effect on output or employment over time. |

| Time Horizon | Short and long run considered, with expectations shaping outcomes. | Focus on the long run neutrality of money. |

| Key References | Lucas (1972), Sargent and Wallace (1975) | Classical economic theory, Monetarism (Friedman) |

Introduction to Rational Expectations and Money Neutrality

Rational expectations theory posits that individuals form forecasts about economic variables using all available information, ensuring unbiased and model-consistent predictions. Money neutrality asserts that changes in the money supply influence nominal variables like prices and wages but leave real economic indicators such as output and employment unaffected in the long run. Understanding the interaction between rational expectations and money neutrality is essential for analyzing monetary policy effectiveness and the dynamic response of the economy to shocks.

Historical Background of Rational Expectations Theory

Rational Expectations Theory emerged in the 1960s, primarily through the work of economist John F. Muth, who argued that individuals form forecasts about the future using all available information and economic models. This theory challenged traditional Keynesian views, which often assumed systematic errors in expectations, by introducing the idea that agents anticipate policy effects, making money neutrality a central concept in macroeconomics. The development of Rational Expectations laid the groundwork for new classical economics, emphasizing that monetary policy has limited real effects in the long run due to agents' forward-looking behavior.

Defining Money Neutrality in Macroeconomics

Money neutrality in macroeconomics refers to the concept that changes in the money supply only affect nominal variables, such as prices and wages, without influencing real variables like output, employment, or real GDP in the long run. Under rational expectations, economic agents use all available information, including policy changes, to predict economic outcomes, making monetary policy ineffective in altering real economic activity permanently. This distinction emphasizes that while money neutrality holds true in the long run, short-term deviations can occur due to information asymmetries or adjustment costs.

Key Differences Between Rational Expectations and Money Neutrality

Rational expectations refer to the hypothesis that individuals form forecasts about economic variables using all available information, leading to unbiased and model-consistent predictions. Money neutrality suggests that changes in the money supply only affect nominal variables like prices and wages, without impacting real economic factors such as output or employment in the long run. The key difference lies in rational expectations emphasizing forward-looking behavior and information efficiency, while money neutrality focuses on the long-term irrelevance of monetary changes for real economic activity.

The Role of Expectations in Economic Decision-Making

Rational expectations theory asserts that individuals and firms use all available information efficiently to forecast future economic variables, influencing consumption, investment, and wage-setting decisions. This anticipatory behavior impacts economic outcomes by integrating expectations into price and wage adjustments, which challenges the concept of money neutrality that suggests nominal variables do not affect real output in the long run. Understanding how expectations shape economic decision-making clarifies why monetary policy can have short-term real effects despite the long-term neutrality of money.

Short-Run vs. Long-Run Effects of Monetary Policy

Rational expectations theory suggests that economic agents quickly incorporate information about monetary policy, minimizing its impact on real variables in the long run. Money neutrality posits that changes in the money supply only affect nominal variables, with no real effects in the long run, but short-run rigidities such as price and wage stickiness allow monetary policy to influence output and employment temporarily. Empirical evidence supports that while monetary expansions can boost economic activity short-term, expectations adjust and real effects dissipate, confirming the contrast between short-run non-neutrality and long-run neutrality of money.

Empirical Evidence Supporting or Refuting Money Neutrality

Empirical evidence on money neutrality presents mixed results, with many studies validating short-run non-neutrality as changes in money supply can influence real output and employment. Research using natural experiments and VAR models often supports short-term deviations from money neutrality, while long-run analyses tend to confirm money's neutral role in affecting real variables such as GDP and unemployment rates. Key data from post-war US monetary policy and European Central Bank interventions provide critical insights into the transient effects versus the eventual neutral impact of monetary changes on real economic outcomes.

Criticisms and Limitations of Rational Expectations

Rational expectations often face criticism for assuming that all agents have access to complete and accurate information, which overlooks real-world information asymmetries and cognitive biases. This assumption limits the model's applicability in explaining persistent economic fluctuations and market inefficiencies where expectations systematically deviate from actual outcomes. Furthermore, the theory struggles to account for unexpected shocks and the role of adaptive behavior, challenging its compatibility with the empirical evidence on money neutrality and short-term price rigidities.

Policy Implications: Monetary Policy under Different Assumptions

Under rational expectations, monetary policy may have limited short-term effects on output since agents anticipate policy changes and adjust behavior accordingly, leading to price-level adjustments rather than real economic shifts. Money neutrality implies that changes in the money supply only affect nominal variables and leave real variables like output and employment unchanged in the long run. Policymakers must therefore consider that systematic monetary interventions might not influence real economic activity if markets are fully efficient and agents hold rational expectations, emphasizing the importance of credible and transparent policies to manage inflation expectations effectively.

Conclusion: Reconciling Rational Expectations and Money Neutrality

Reconciling rational expectations with money neutrality highlights that while rational agents anticipate monetary policy effects, money's neutral long-term impact persists, as price levels adjust fully. Microeconomic foundations of expectations ensure short-term deviations occur due to information lags or frictions, but equilibrium restores money neutrality over time. Thus, integrating rational expectations refines understanding of monetary influences without contradicting money neutrality's classical premise.

Rational expectations Infographic

libterm.com

libterm.com