Mean Reversion Theory suggests that asset prices and returns eventually move back toward their historical average or mean level over time. This concept is widely used in financial markets to identify potential buying or selling opportunities when prices deviate significantly from their long-term average. Explore the rest of the article to understand how you can apply mean reversion strategies to enhance your investment decisions.

Table of Comparison

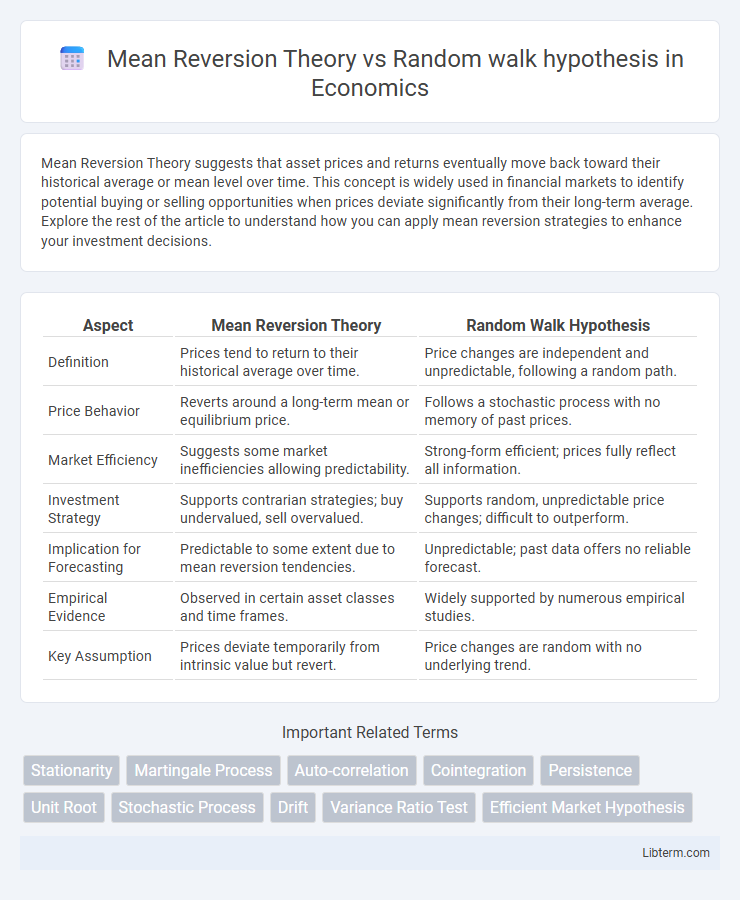

| Aspect | Mean Reversion Theory | Random Walk Hypothesis |

|---|---|---|

| Definition | Prices tend to return to their historical average over time. | Price changes are independent and unpredictable, following a random path. |

| Price Behavior | Reverts around a long-term mean or equilibrium price. | Follows a stochastic process with no memory of past prices. |

| Market Efficiency | Suggests some market inefficiencies allowing predictability. | Strong-form efficient; prices fully reflect all information. |

| Investment Strategy | Supports contrarian strategies; buy undervalued, sell overvalued. | Supports random, unpredictable price changes; difficult to outperform. |

| Implication for Forecasting | Predictable to some extent due to mean reversion tendencies. | Unpredictable; past data offers no reliable forecast. |

| Empirical Evidence | Observed in certain asset classes and time frames. | Widely supported by numerous empirical studies. |

| Key Assumption | Prices deviate temporarily from intrinsic value but revert. | Price changes are random with no underlying trend. |

Introduction to Mean Reversion Theory

Mean Reversion Theory asserts that asset prices and historical returns eventually revert to their long-term mean or average level, suggesting predictable price movements based on past performance. This theory relies on statistical measures such as moving averages and variance for identifying deviations from equilibrium. Mean Reversion contrasts sharply with the Random Walk Hypothesis, which posits that price changes are independent and unpredictable, following a path with no discernible pattern or mean to which prices revert.

Overview of the Random Walk Hypothesis

The Random Walk Hypothesis asserts that stock prices evolve according to a random path, making future price movements unpredictable and independent of past trends. This theory implies that financial markets are efficient, as all known information is already reflected in current prices. Consequently, attempts to outperform the market through technical analysis or historical data are largely ineffective under this hypothesis.

Key Principles of Mean Reversion

Mean Reversion Theory posits that asset prices and returns eventually move back towards their historical average or mean value, driven by underlying economic forces and investor behavior correcting overvaluations or undervaluations. Key principles include the tendency for price deviations to be temporary, statistical evidence of mean reversion in time series data, and the predictability of future price movements based on past mean values. This contrasts with the Random Walk Hypothesis, which suggests price changes are independent and unpredictable, making mean reversion a critical differentiator in financial modeling and trading strategies.

Core Concepts Behind the Random Walk Model

The Random Walk Hypothesis posits that stock prices evolve according to a random path, where future price changes are independent of past movements, making market predictions fundamentally unpredictable. In this model, price changes follow a martingale process, implying that the best estimate for tomorrow's price is simply today's price plus a random error term. Core to this theory is the Efficient Market Hypothesis, which argues that all available information is instantly reflected in asset prices, preventing systematic exploitation through historical data analysis.

Historical Context and Academic Origins

Mean Reversion Theory emerged in the early 20th century through the work of economist Alfred Cowles, who observed stock prices tending to revert to their historical averages, reflecting long-term equilibrium in financial markets. The Random Walk Hypothesis, formalized by economist Paul Samuelson and popularized by Burton Malkiel in the 1960s, challenged this view by arguing that stock price movements are independent and unpredictable, following a stochastic process akin to a random walk. These contrasting theories stem from different interpretations of market efficiency and price behavior, shaping academic research in finance on asset price dynamics and market predictability.

Empirical Evidence: Mean Reversion in Financial Markets

Empirical evidence supports Mean Reversion Theory by demonstrating that asset prices and returns often revert to their historical averages over time, particularly in equities, bonds, and commodities. Studies have shown significant negative autocorrelation in stock returns over intermediate horizons, indicating that price deviations tend to correct rather than persist randomly. In contrast, the Random Walk Hypothesis, which suggests price changes are independent and unpredictable, struggles to explain observed momentum reversals and predictable long-term price trends documented in financial market data.

Evidence Supporting the Random Walk Hypothesis

Empirical studies in financial markets often demonstrate price changes that follow a random walk, indicating unpredictability and weak serial correlation in stock returns. Research using statistical tests such as variance ratio tests and autocorrelation analysis frequently supports the absence of mean reversion in market prices. This evidence suggests that past price movements cannot reliably forecast future prices, aligning with the Efficient Market Hypothesis and reinforcing the random walk model.

Criticisms and Limitations of Each Approach

Mean Reversion Theory is criticized for oversimplifying market dynamics by assuming prices will revert to an average, ignoring structural changes and prolonged trends that can persist indefinitely. The Random Walk Hypothesis faces limitations due to its assumption of completely unpredictable price movements, which can neglect identifiable patterns and market inefficiencies observed in empirical studies. Both theories struggle with real-world application as they often fail to account for behavioral biases, macroeconomic factors, and the impact of sudden market shocks.

Implications for Traders and Investors

Mean Reversion Theory suggests that asset prices and returns eventually move back toward their historical averages, enabling traders to capitalize on temporary mispricings by buying undervalued and selling overvalued assets. In contrast, the Random Walk Hypothesis posits that price changes are unpredictable and follow a stochastic process, implying that past price movements cannot be used to forecast future trends, which challenges the effectiveness of technical analysis. Investors relying on mean reversion strategies often implement statistical models and timing techniques, whereas proponents of the random walk approach favor diversification and passive investment to mitigate risks associated with market inefficiency.

Conclusion: Comparing Predictive Power and Practical Applications

Mean Reversion Theory offers predictive power by suggesting asset prices tend to revert to historical averages, facilitating strategies based on price corrections. Random Walk Hypothesis implies price changes are entirely unpredictable, challenging the effectiveness of forecasting models. Practical applications favor Mean Reversion for mean-reverting markets like commodities, while Random Walk supports diversified, long-term investment approaches in efficient markets.

Mean Reversion Theory Infographic

libterm.com

libterm.com