Capital inflow problems occur when a sudden surge of foreign investment leads to economic imbalances such as currency appreciation, inflation, or asset bubbles. Managing these inflows requires careful monetary and fiscal policies to protect your economy from destabilizing effects. Explore the rest of the article to learn effective strategies for addressing capital inflow challenges.

Table of Comparison

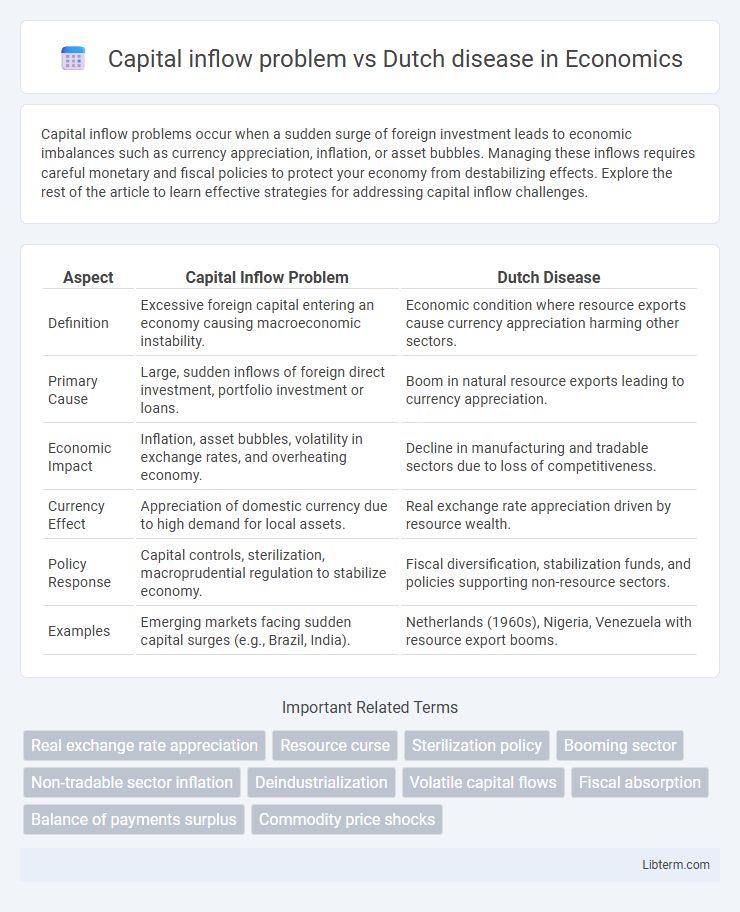

| Aspect | Capital Inflow Problem | Dutch Disease |

|---|---|---|

| Definition | Excessive foreign capital entering an economy causing macroeconomic instability. | Economic condition where resource exports cause currency appreciation harming other sectors. |

| Primary Cause | Large, sudden inflows of foreign direct investment, portfolio investment or loans. | Boom in natural resource exports leading to currency appreciation. |

| Economic Impact | Inflation, asset bubbles, volatility in exchange rates, and overheating economy. | Decline in manufacturing and tradable sectors due to loss of competitiveness. |

| Currency Effect | Appreciation of domestic currency due to high demand for local assets. | Real exchange rate appreciation driven by resource wealth. |

| Policy Response | Capital controls, sterilization, macroprudential regulation to stabilize economy. | Fiscal diversification, stabilization funds, and policies supporting non-resource sectors. |

| Examples | Emerging markets facing sudden capital surges (e.g., Brazil, India). | Netherlands (1960s), Nigeria, Venezuela with resource export booms. |

Introduction to Capital Inflow Problems and Dutch Disease

Capital inflow problems arise when large volumes of foreign capital enter an economy rapidly, potentially causing exchange rate appreciation and overheating. Dutch disease refers to the economic phenomenon where a resource boom or capital inflow leads to a decline in the manufacturing sector, driven by currency appreciation and loss of competitiveness. Both issues highlight challenges in managing sudden capital surges to maintain economic stability and diversified growth.

Defining Capital Inflows: Types and Triggers

Capital inflows refer to the movement of funds into a country, primarily categorized as foreign direct investment (FDI), portfolio investment, and other investments such as loans or deposits. These inflows are triggered by factors like interest rate differentials, political stability, market potential, and natural resource discoveries. Understanding these types and triggers is crucial to analyzing the capital inflow problem, which can lead to Dutch disease by appreciating the real exchange rate and adversely affecting export competitiveness.

Understanding Dutch Disease: Core Concepts

Dutch Disease occurs when a sudden capital inflow, such as natural resource exports or foreign investments, leads to currency appreciation, making other export sectors less competitive. This phenomenon causes a shift in labor and resources towards booming sectors, often resulting in a decline in manufacturing and agriculture exports. Understanding Dutch Disease is crucial for policymakers to balance capital inflow benefits while preventing long-term economic imbalances and loss of sectoral diversity.

Economic Impacts of Surging Capital Inflows

Surging capital inflows can lead to an appreciation of the domestic currency, reducing export competitiveness and triggering deindustrialization, a core aspect of Dutch disease. This appreciation raises the cost of local goods and services, diminishing the tradable sector's output while expanding the non-tradable sector, which often results in economic imbalances and reduced diversification. Furthermore, sudden stops or reversals of capital inflows increase financial volatility, undermine macroeconomic stability, and exacerbate vulnerability to external shocks.

Dutch Disease Symptoms in Emerging Markets

Dutch Disease symptoms in emerging markets manifest through currency appreciation, which undermines export competitiveness and leads to a decline in manufacturing and agricultural sectors. This phenomenon often results from large capital inflows, such as foreign aid or resource exports, causing resource reallocation and wage inflation. The combination of a volatile exchange rate and decreased tradable sector performance exacerbates economic instability and hampers sustainable growth.

Currency Appreciation and Export Competitiveness

Capital inflow often leads to currency appreciation, which reduces export competitiveness by making domestically produced goods more expensive on the international market. The Dutch disease describes this phenomenon where resource windfalls, such as natural resource exports or capital inflows, cause real exchange rate appreciation harming the manufacturing and export sectors. Managing capital inflows to prevent excessive currency appreciation is critical for sustaining export competitiveness and avoiding the negative economic effects associated with the Dutch disease.

Sectoral Imbalances: Booming vs. Lagging Sectors

Capital inflows can create sectoral imbalances by fueling a booming resource or financial sector while causing manufacturing or tradable sectors to lag, a phenomenon often linked to Dutch disease. The appreciation of the real exchange rate due to large capital inflows makes exports less competitive, leading to deindustrialization and a skewed economic structure. Managing these imbalances requires policies that support diversification and mitigate overreliance on capital-rich sectors to sustain long-term growth.

Policy Responses: Mitigating Capital Inflow Risks

Policy responses to mitigate capital inflow risks include implementing macroprudential measures such as capital controls, foreign exchange interventions, and tightening reserve requirements to manage excessive liquidity and currency appreciation pressures. Central banks often adopt sterilized interventions to neutralize inflationary effects while promoting financial stability. Structural reforms aimed at diversifying the economy reduce vulnerability to Dutch disease by strengthening non-resource sectors and enhancing long-term sustainable growth.

Case Studies: Real Examples of Capital Inflow and Dutch Disease

Capital inflows often lead to currency appreciation, hurting export competitiveness, as seen in Nigeria's oil boom where foreign investment caused currency overvaluation and manufacturing decline, a classic Dutch disease outcome. Indonesia's experience during the 1990s capital inflow surge highlights similar effects, with rapid capital entry triggering inflation and resource misallocation away from tradable sectors. Conversely, South Korea mitigated Dutch disease by channeling capital inflows into technology and infrastructure, maintaining export growth despite large foreign investment.

Conclusion: Strategies for Sustainable Economic Growth

Addressing capital inflow problems requires balanced macroeconomic policies to prevent overheating and maintain exchange rate stability, while mitigating Dutch disease involves diversifying the economic base beyond resource-dependent sectors. Sustainable economic growth hinges on strengthening institutional frameworks, investing in human capital, and promoting innovation to enhance productivity and resilience. Strategic fiscal management and flexible monetary policies are essential to absorb capital inflows without undermining competitiveness or long-term economic stability.

Capital inflow problem Infographic

libterm.com

libterm.com