The money multiplier measures how much the money supply increases in the economy from a change in the monetary base, showing the relationship between reserves banks hold and the total money created through lending. Understanding this concept helps you grasp how central bank policies and commercial banking activities influence economic liquidity and inflation. Dive deeper into the mechanics and impacts of the money multiplier in the rest of this article.

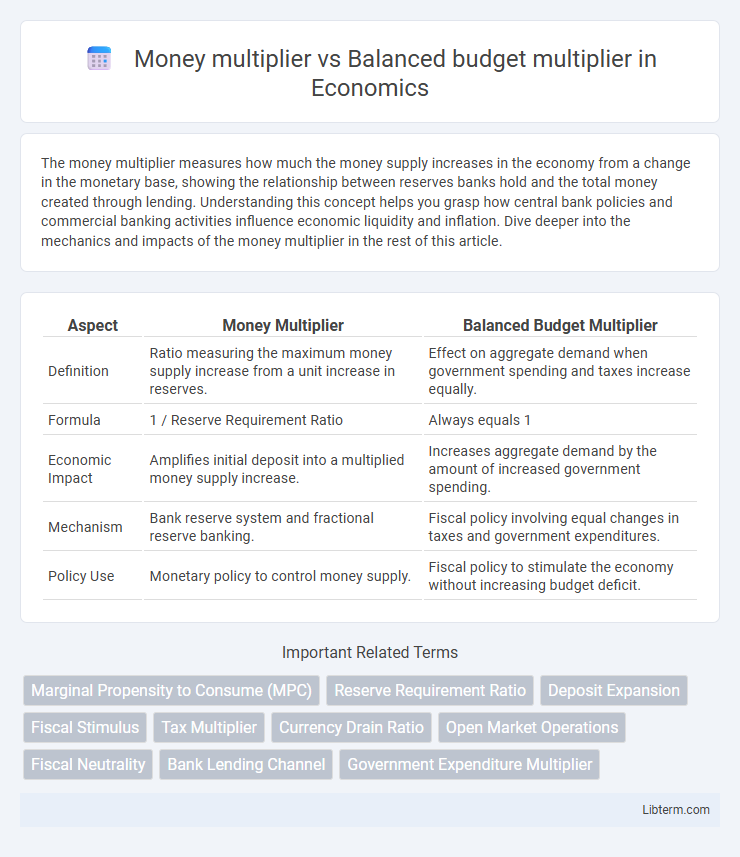

Table of Comparison

| Aspect | Money Multiplier | Balanced Budget Multiplier |

|---|---|---|

| Definition | Ratio measuring the maximum money supply increase from a unit increase in reserves. | Effect on aggregate demand when government spending and taxes increase equally. |

| Formula | 1 / Reserve Requirement Ratio | Always equals 1 |

| Economic Impact | Amplifies initial deposit into a multiplied money supply increase. | Increases aggregate demand by the amount of increased government spending. |

| Mechanism | Bank reserve system and fractional reserve banking. | Fiscal policy involving equal changes in taxes and government expenditures. |

| Policy Use | Monetary policy to control money supply. | Fiscal policy to stimulate the economy without increasing budget deficit. |

Introduction to Fiscal Multipliers

Fiscal multipliers measure the impact of government spending and taxation on aggregate demand and economic output. The money multiplier quantifies how initial changes in the monetary base expand through banking activities to influence the total money supply. In contrast, the balanced budget multiplier demonstrates that simultaneous equal changes in government spending and taxes can still affect overall economic output by altering aggregate demand dynamics.

Understanding Money Multiplier

The money multiplier quantifies the maximum amount of money the banking system generates from each unit of reserves, influenced by the reserve requirement ratio. It plays a crucial role in expanding the money supply through fractional reserve banking, where banks lend out a portion of deposits, triggering successive rounds of deposit creation. Understanding the money multiplier helps explain how central bank policies affect credit availability and overall economic activity.

Exploring the Balanced Budget Multiplier

The balanced budget multiplier measures the impact on national income when government spending and taxes increase by the same amount, typically resulting in a multiplier of one, meaning total output rises by the increase in government expenditure. Unlike the money multiplier, which focuses on the banking system's ability to create money through deposits and loans, the balanced budget multiplier directly links fiscal policy changes to aggregate demand without altering the money supply. This multiplier highlights the effectiveness of expansionary fiscal policy even when financed by equal tax hikes, emphasizing the distinct mechanisms by which fiscal tools influence economic activity.

Key Differences Between Money Multiplier and Balanced Budget Multiplier

The money multiplier quantifies the maximum amount of money the banking system can generate from a given base money supply, influenced by reserve ratios and currency holdings. The balanced budget multiplier measures the change in aggregate demand resulting from simultaneous equal changes in government spending and taxation, generally equating to one in simple Keynesian models. Key differences lie in their economic roles: the money multiplier affects money supply expansion, while the balanced budget multiplier evaluates fiscal policy impacts on output without altering the budget deficit.

Factors Influencing the Money Multiplier

The money multiplier is significantly influenced by the reserve ratio, currency holdings, and excess reserves, determining the extent to which the banking system can expand the money supply from base money. In contrast, the balanced budget multiplier shows how simultaneous changes in government spending and taxation affect aggregate demand without altering the budget deficit, remaining unaffected by banking practices. Understanding the reserve requirement and public cash preferences is crucial for accurately estimating the money multiplier's impact on economic activity.

Determinants of the Balanced Budget Multiplier

The balanced budget multiplier depends primarily on the marginal propensity to consume (MPC) and the marginal tax rate, which influence the overall change in aggregate demand when government spending and taxes increase equally. Its value typically equals one, highlighting that a simultaneous increase in government spending and taxes leads to an equivalent change in national income without altering the overall fiscal balance. Unlike the money multiplier, which is driven by banking reserves and deposit creation, the balanced budget multiplier centers on fiscal policy reactions and consumption patterns that directly impact aggregate demand.

Real-world Examples of Money Multiplier in Action

The money multiplier effect is prominently observed during quantitative easing, where central banks inject reserves to expand the money supply, as exemplified by the Federal Reserve's response to the 2008 financial crisis. In contrast, the balanced budget multiplier demonstrates fiscal policy impacts when government spending increases are exactly matched by tax increases, maintaining a neutral effect on aggregate demand. Real-world data from countries like Japan show that monetary policy via money multipliers often yields more immediate inflation and growth effects than balanced budget adjustments.

Applications of the Balanced Budget Multiplier

The balanced budget multiplier plays a critical role in fiscal policy by illustrating that equal changes in government spending and taxes lead to a direct, positive impact on aggregate demand, typically increasing GDP by the same amount as the spending change. This multiplier effect is especially vital in applications aimed at stimulating economic growth without expanding fiscal deficits, making it a preferred tool during periods of economic stagnation or recession. Policymakers use the balanced budget multiplier to craft targeted stimulus packages that maintain budget neutrality while effectively boosting economic activity and employment.

Policy Implications and Economic Outcomes

The money multiplier amplifies initial changes in the monetary base, influencing credit creation and liquidity, which impacts inflation and economic growth by affecting aggregate demand. In contrast, the balanced budget multiplier, typically equal to one, demonstrates that equal changes in government spending and taxes directly shift aggregate demand without altering the fiscal deficit, promoting fiscal discipline. Policymakers must weigh the money multiplier's capacity to stimulate economic activity through monetary expansion against the balanced budget multiplier's role in sustaining debt-neutral fiscal policies that stabilize long-term growth.

Conclusion: Choosing the Right Multiplier Approach

Selecting the appropriate multiplier depends on fiscal goals and economic context; the money multiplier influences money supply through banking reserves, while the balanced budget multiplier affects aggregate demand via equal changes in government spending and taxation. Policymakers aiming to stimulate demand without increasing deficits prefer the balanced budget multiplier, whereas those focusing on monetary expansion might prioritize the money multiplier's impact. Understanding the distinct mechanisms and outcomes of each multiplier enables effective economic policy tailored to growth, inflation control, or fiscal stability.

Money multiplier Infographic

libterm.com

libterm.com