Moral hazard occurs when one party takes on risk because they do not bear the full consequences of their actions, often leading to careless or unethical behavior. This concept is crucial in insurance, finance, and economics as it affects decision-making and risk management strategies. Discover how understanding moral hazard can protect your interests and enhance your risk awareness by reading the rest of the article.

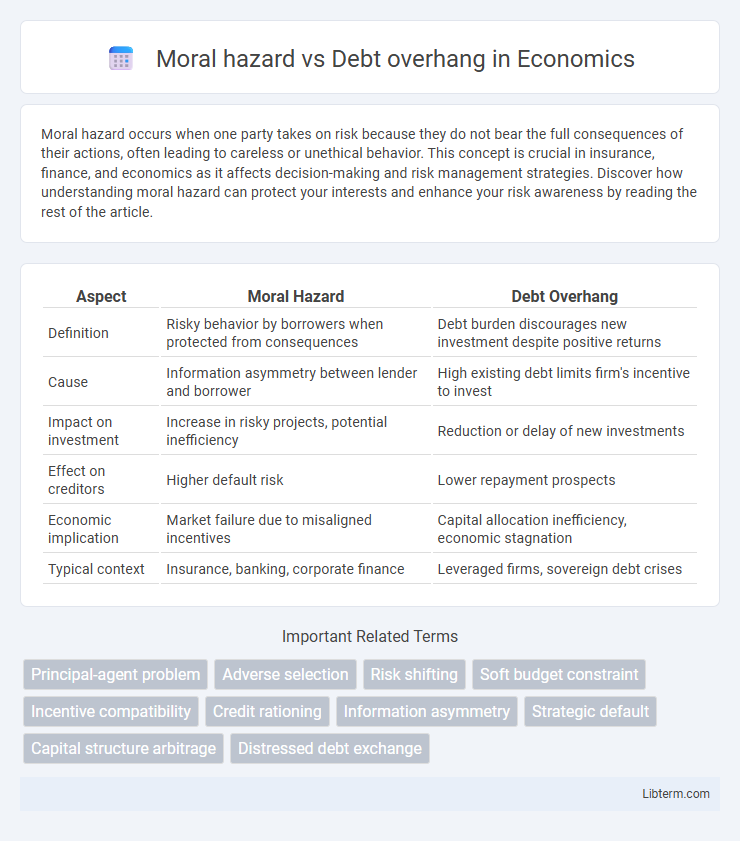

Table of Comparison

| Aspect | Moral Hazard | Debt Overhang |

|---|---|---|

| Definition | Risky behavior by borrowers when protected from consequences | Debt burden discourages new investment despite positive returns |

| Cause | Information asymmetry between lender and borrower | High existing debt limits firm's incentive to invest |

| Impact on investment | Increase in risky projects, potential inefficiency | Reduction or delay of new investments |

| Effect on creditors | Higher default risk | Lower repayment prospects |

| Economic implication | Market failure due to misaligned incentives | Capital allocation inefficiency, economic stagnation |

| Typical context | Insurance, banking, corporate finance | Leveraged firms, sovereign debt crises |

Introduction to Moral Hazard and Debt Overhang

Moral hazard arises when individuals or organizations engage in riskier behavior because they do not bear the full consequences of that risk, often due to asymmetric information or protection through insurance or guarantees. Debt overhang occurs when a firm's existing debt is so substantial that it discourages new investment, as the benefits of the investment primarily accrue to existing creditors rather than equity holders. Both concepts critically impact financial decision-making by influencing risk-taking incentives and investment dynamics within firms and markets.

Defining Moral Hazard in Finance

Moral hazard in finance refers to a situation where one party takes on excessive risk because they do not bear the full consequences of that risk, often due to asymmetric information or protection by insurance or guarantees. This behavior contrasts with debt overhang, where existing debt discourages new investment because anticipated returns primarily serve to repay current creditors. Understanding moral hazard is crucial for designing contracts and regulations that align incentives and reduce reckless financial decision-making.

Understanding Debt Overhang Explained

Debt overhang occurs when a company's existing debt is so large that it discourages new investment, as profits primarily serve to repay old creditors rather than fund growth. This situation contrasts with moral hazard, where borrowers take excessive risks because they do not bear the full consequences of failure. Understanding debt overhang is crucial for evaluating the reluctance of firms to pursue valuable projects despite positive net present value due to the burden of existing liabilities.

Core Differences: Moral Hazard vs Debt Overhang

Moral hazard arises when a party takes excessive risks because they do not bear the full consequences, often seen in financial institutions engaging in risky behavior due to expected bailouts. Debt overhang occurs when a company's existing debt burden discourages new investment because the benefits primarily accrue to existing creditors rather than equity holders. The core difference lies in moral hazard emphasizing risk-taking incentives post-contract, while debt overhang centers on the distortion in investment incentives caused by heavy pre-existing debt.

Causes of Moral Hazard in Lending

Moral hazard in lending arises when borrowers take on excessive risks because they do not bear the full consequences of their actions, often due to asymmetric information and misaligned incentives between lenders and borrowers. This behavior is caused by a lack of proper monitoring, inadequate collateral, and expectations of bailouts or debt forgiveness. In contrast, debt overhang occurs when existing debt discourages borrowers from investing in positive-net-present-value projects, but moral hazard specifically stems from the incentive to exploit lender protections or guarantees.

Factors Leading to Debt Overhang

Debt overhang arises when existing debt obligations discourage new investment due to the anticipation that future returns will primarily benefit creditors rather than equity holders. Key factors leading to debt overhang include high leverage ratios, reduced profitability, and asymmetric information between borrowers and lenders that limits access to additional financing. This contrasts with moral hazard, where risk-taking behavior increases after obtaining debt or insurance, whereas debt overhang specifically impedes optimal investment due to the burden of existing debt.

Economic Consequences of Moral Hazard

Moral hazard in finance occurs when borrowers take excessive risks because they do not bear the full consequences of failure, leading to inefficient capital allocation and increased systemic risk. This behavior exacerbates economic instability by encouraging overleveraging, which can trigger financial crises and reduce overall market trust. Unlike debt overhang, where firms avoid new investments due to existing high debt, moral hazard directly distorts incentives, causing resource misallocation that hampers long-term economic growth.

Impact of Debt Overhang on Investment

Debt overhang significantly reduces a firm's incentive to invest because the benefits of new projects primarily accrue to existing debt holders rather than equity holders, leading to underinvestment. When a company faces excessive debt, the expected gains from additional investment are often eaten up by debt repayments, discouraging equity holders from funding growth opportunities. This underinvestment hampers the firm's long-term value creation and can trigger a downward financial spiral.

Policy Solutions to Mitigate Moral Hazard and Debt Overhang

Policy solutions to mitigate moral hazard include implementing stricter regulatory oversight, enhancing transparency requirements, and designing contracts with performance-based incentives to align interests between borrowers and lenders. Addressing debt overhang involves debt restructuring mechanisms, such as debt write-downs or swaps, and encouraging equity injections to restore borrower creditworthiness and incentivize investment. Coordinated efforts between policymakers and financial institutions are crucial to balance risk-sharing while promoting economic stability and sustainable growth.

Conclusion: Navigating Financial Risks

Moral hazard arises when individuals or institutions take excessive risks because they do not bear the full consequences, while debt overhang occurs when heavy indebtedness discourages new investment due to anticipated debt repayment. Effective risk management requires balancing incentives to limit reckless behavior without stifling growth opportunities. Policymakers must design regulations that mitigate moral hazard and alleviate debt overhang to promote sustainable financial stability.

Moral hazard Infographic

libterm.com

libterm.com