The implicit tax rate measures the hidden tax burden embedded in economic decisions, reflecting the difference between pre-tax and after-tax returns on investments or income. This rate highlights how government policies can reduce the effective earnings from savings, work, or capital without an explicit tax charge. Explore the rest of this article to understand how the implicit tax rate impacts your financial choices and economic behavior.

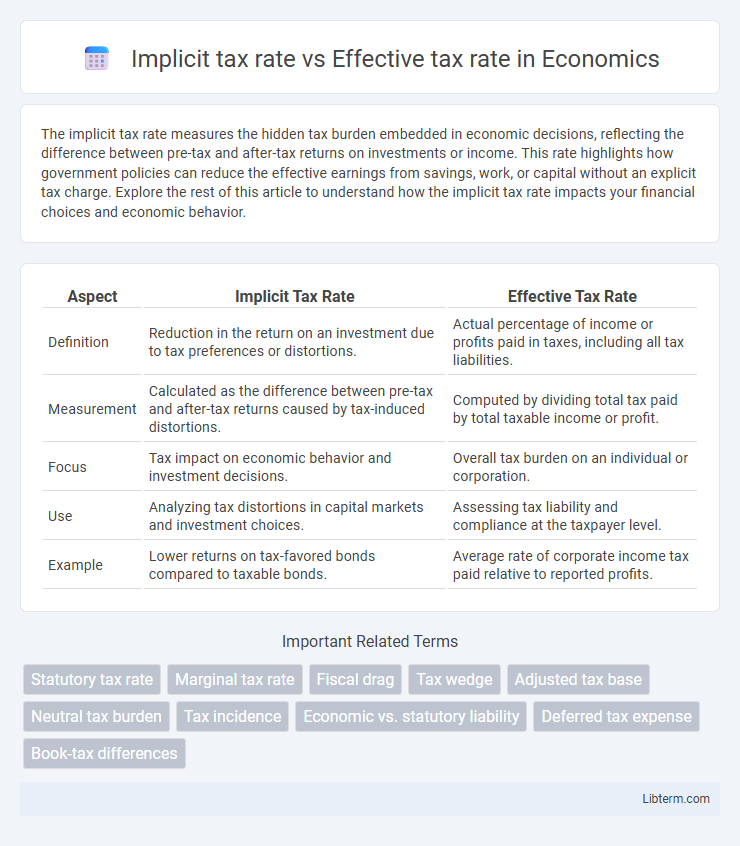

Table of Comparison

| Aspect | Implicit Tax Rate | Effective Tax Rate |

|---|---|---|

| Definition | Reduction in the return on an investment due to tax preferences or distortions. | Actual percentage of income or profits paid in taxes, including all tax liabilities. |

| Measurement | Calculated as the difference between pre-tax and after-tax returns caused by tax-induced distortions. | Computed by dividing total tax paid by total taxable income or profit. |

| Focus | Tax impact on economic behavior and investment decisions. | Overall tax burden on an individual or corporation. |

| Use | Analyzing tax distortions in capital markets and investment choices. | Assessing tax liability and compliance at the taxpayer level. |

| Example | Lower returns on tax-favored bonds compared to taxable bonds. | Average rate of corporate income tax paid relative to reported profits. |

Introduction to Tax Rate Concepts

The implicit tax rate measures the economic cost of taxation by comparing pre-tax and post-tax returns or prices, providing insight into the hidden tax burden on economic decisions. The effective tax rate represents the actual percentage of taxable income paid in taxes, reflecting the average tax burden on an individual or corporation. Understanding these two tax rate concepts helps analyze both the economic incidence of taxation and the real tax liability faced by taxpayers.

Defining Implicit Tax Rate

The implicit tax rate measures the reduction in returns on an investment due to taxation, calculated as the difference between before-tax and after-tax rates of return divided by the before-tax return. This rate captures the total tax burden on economic income, including both explicit taxes like corporate income tax and implicit taxes such as capital gains taxes embedded in asset valuations. Unlike the effective tax rate, which reflects the average tax paid on reported income, the implicit tax rate provides a broader view of tax effects on overall investment profitability.

Understanding Effective Tax Rate

Understanding the effective tax rate is crucial for accurately measuring a company's overall tax burden as it reflects the average rate at which its pre-tax profits are taxed. Unlike the implicit tax rate, which estimates the tax impact on specific financial choices or investments, the effective tax rate provides a comprehensive view by dividing total tax expense by pre-tax income. This metric helps investors and analysts assess tax efficiency and compare tax liabilities across different firms or jurisdictions.

Key Differences Between Implicit and Effective Tax Rates

The implicit tax rate measures the economic cost of taxes by comparing pre-tax and after-tax returns, reflecting the reduction in value due to taxation, whereas the effective tax rate calculates the actual percentage of income paid in taxes based on taxable income and tax liabilities. Implicit tax rates capture the broader economic impact of taxes on investment decisions and capital allocation, while effective tax rates focus on the direct tax burden faced by individuals or corporations. Understanding these differences is crucial for evaluating tax policy effects on economic behavior versus fiscal revenue analysis.

Calculation Methods for Implicit Tax Rate

The implicit tax rate is calculated by comparing the difference between the pre-tax and after-tax returns on an investment or asset, often expressed as a percentage of the asset's pre-tax value. This rate considers the impact of tax incentives, deductions, and credits embedded within fiscal policies that indirectly affect economic choices, differentiating it from the effective tax rate, which is a direct measure of the tax paid as a percentage of taxable income. Precise calculation involves analyzing market prices and accounting for tax-induced distortions, making it a critical metric in evaluating tax burdens beyond statutory tax rates.

How to Determine Effective Tax Rate

The Effective Tax Rate (ETR) is calculated by dividing the total tax expense by the pre-tax accounting income, reflecting the average rate at which income is taxed. Unlike the Implicit Tax Rate, which measures the tax burden of a government subsidy or economic benefit, the ETR provides a comprehensive view of a company's actual tax liability relative to its earnings. Accurate determination of the ETR requires detailed financial statements and reconciliation of taxable income with accounting income.

Practical Examples of Both Tax Rates

The implicit tax rate reflects the percentage difference between the before-tax and after-tax returns on an investment, often seen in real estate holding scenarios where property appreciation is taxed upon sale. The effective tax rate, exemplified by an individual's total tax paid divided by taxable income, is commonly observed in paycheck deductions or corporate income tax calculations. For instance, a company may face an implicit tax rate on retained earnings due to deferred tax liabilities, while simultaneously experiencing an effective tax rate of 25% based on its annual taxable income.

Implications for Individuals and Businesses

Implicit tax rate reflects the total tax burden embedded in economic decisions, influencing individuals' investment choices and businesses' capital allocation strategies. Effective tax rate reveals the actual percentage of income paid in taxes, impacting cash flow, profitability, and financial planning for both individuals and corporations. Understanding these distinctions guides optimization of tax liabilities and strategic financial decisions to enhance economic efficiency and compliance.

Policy Significance of Tax Rate Measurements

Implicit tax rate measures the economic burden of taxation by comparing pre- and post-tax returns, offering insights into the distortions taxes create in economic behavior. Effective tax rate reflects the actual tax paid relative to taxable income, highlighting the tax system's impact on taxpayers' financial obligations. Policymakers use both rates to evaluate tax efficiency, identify hidden tax costs, and design equitable tax reforms that minimize economic distortions.

Summary and Key Takeaways

The implicit tax rate measures the total tax burden on an investment by comparing pre-tax and post-tax returns, reflecting all taxes paid, whereas the effective tax rate calculates the average rate of income tax imposed on taxable income. Key takeaways include that the implicit tax rate provides a comprehensive view of taxation impact beyond just income taxes, capturing indirect and non-income taxes, while the effective tax rate is useful for assessing the statutory tax burden on earnings. Understanding both rates is crucial for evaluating overall tax efficiency and investment attractiveness.

Implicit tax rate Infographic

libterm.com

libterm.com