Specific tax is a fixed amount charged per unit of a good or service, regardless of its price, affecting costs directly. This type of tax can influence consumer choices and producer behavior by increasing the overall expense without proportionally adjusting for price variations. Explore the rest of the article to understand how specific taxes impact markets and your financial decisions.

Table of Comparison

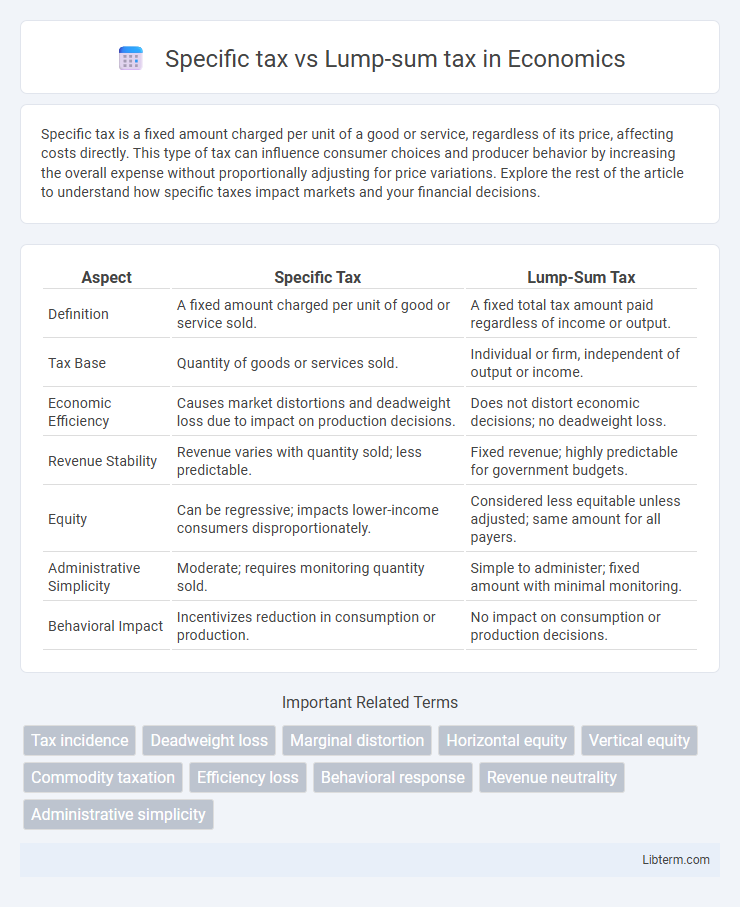

| Aspect | Specific Tax | Lump-Sum Tax |

|---|---|---|

| Definition | A fixed amount charged per unit of good or service sold. | A fixed total tax amount paid regardless of income or output. |

| Tax Base | Quantity of goods or services sold. | Individual or firm, independent of output or income. |

| Economic Efficiency | Causes market distortions and deadweight loss due to impact on production decisions. | Does not distort economic decisions; no deadweight loss. |

| Revenue Stability | Revenue varies with quantity sold; less predictable. | Fixed revenue; highly predictable for government budgets. |

| Equity | Can be regressive; impacts lower-income consumers disproportionately. | Considered less equitable unless adjusted; same amount for all payers. |

| Administrative Simplicity | Moderate; requires monitoring quantity sold. | Simple to administer; fixed amount with minimal monitoring. |

| Behavioral Impact | Incentivizes reduction in consumption or production. | No impact on consumption or production decisions. |

Understanding Specific Tax: Definition and Mechanism

Specific tax is a fixed amount of tax levied on each unit of a good or service sold, calculated per quantity rather than as a percentage of price. It directly increases the cost per unit, influencing production and consumption decisions by raising the marginal cost for producers. This mechanism contrasts with lump-sum tax, which is a fixed total tax irrespective of output or sales, not affecting marginal costs or market prices.

Lump-Sum Tax: Overview and Characteristics

Lump-sum tax is a fixed tax amount imposed regardless of the taxpayer's income or economic activity, making it non-distortionary and simple to administer. Unlike specific taxes, which vary with quantity or value of goods, lump-sum taxes do not influence production or consumption decisions, preserving economic efficiency. This tax type is commonly used when the government seeks stable revenue without affecting market behavior.

Key Differences Between Specific and Lump-Sum Taxes

Specific tax is a fixed amount charged per unit of a good or service sold, directly increasing the price for each item, while lump-sum tax is a fixed amount imposed regardless of the quantity purchased or produced. Specific taxes affect market behavior and quantities by altering marginal costs, leading to changes in supply and demand, whereas lump-sum taxes do not affect marginal costs and hence do not distort market decisions. The primary difference lies in their impact on economic incentives: specific taxes create deadweight loss due to quantity changes, whereas lump-sum taxes are considered non-distortionary because they do not influence consumption or production choices.

Economic Impacts of Specific Taxation

Specific tax imposes a fixed amount per unit of good sold, directly increasing production costs and reducing supply, which often leads to higher market prices and decreased consumer surplus. Economic impacts include distorted market efficiency by causing deadweight loss through reduced quantities traded and altered input and output combinations in production. This taxation method can disproportionately affect industries with low price elasticity, exacerbating producer burden and influencing resource allocation across sectors.

Effects of Lump-Sum Tax on Households and Businesses

Lump-sum taxes impose a fixed amount on households and businesses regardless of income or production levels, leading to a predictable tax burden that does not distort economic decisions or behavior. These taxes do not affect marginal incentives for labor or investment, minimizing efficiency losses and encouraging resource allocation based on market conditions rather than tax considerations. However, lump-sum taxes can be regressive, disproportionately impacting low-income households since the tax amount remains constant regardless of ability to pay.

Administrative Ease: Specific Tax vs Lump-Sum Tax

Specific tax simplifies administration through straightforward calculations based on quantity or value, enabling easier monitoring and collection by tax authorities. Lump-sum tax offers maximal administrative ease by imposing a fixed amount regardless of behavior or transactions, significantly reducing compliance and enforcement burdens. Both methods reduce complexity, but lump-sum tax provides the highest administrative efficiency due to its flat, predetermined nature.

Equity Considerations in Tax Policy

Specific taxes, imposed as a fixed amount per unit of a good or service, often disproportionately impact lower-income individuals since they constitute a larger share of their income, raising equity concerns in tax policy. Lump-sum taxes, which are fixed amounts regardless of income or consumption, are considered more equitable because they do not distort economic behavior or disproportionately burden specific groups. Equity considerations in tax policy emphasize progressivity and fairness, making lump-sum taxes theoretically more neutral but less practical, while specific taxes require careful calibration to minimize regressive effects.

Revenue Generation: Which Tax is More Efficient?

Specific taxes, levied as a fixed amount per unit of goods or services, generate consistent revenue tied directly to the transaction volume, making them reliable for sectors with stable consumption patterns. Lump-sum taxes charge taxpayers a fixed total amount regardless of behavior, ensuring predictable revenue but lacking responsiveness to economic activity variations. Specific taxes are generally more efficient in revenue generation when consumption levels are stable and measurable, while lump-sum taxes provide stable income without distorting economic decisions but may be less equitable or politically feasible.

Real-World Examples: Implementation and Outcomes

Specific taxes, such as the fuel excise tax in the United States, impose a fixed amount per unit of goods, ensuring stable revenue but potentially distorting consumption patterns. Lump-sum taxes, like the head tax implemented historically in certain cities, charge a fixed amount per individual regardless of consumption, minimizing inefficiency but raising equity concerns. Real-world outcomes show specific taxes effectively reduce negative externalities, while lump-sum taxes are easier to administer but often politically unpopular due to perceived unfairness.

Choosing the Right Tax System: Policy Implications

Choosing the right tax system requires evaluating the impact of specific taxes, which target goods or activities and can influence consumer behavior, versus lump-sum taxes that impose a fixed amount regardless of consumption. Specific taxes are effective in discouraging negative externalities like pollution but may lead to market distortions, while lump-sum taxes generate stable revenue without altering economic decisions but are considered less equitable due to their regressive nature. Policymakers must balance efficiency, equity, and administrative simplicity when deciding between these tax structures to optimize economic outcomes and social welfare.

Specific tax Infographic

libterm.com

libterm.com