Marshallian Efficiency refers to an economic state where resources are allocated in a way that maximizes total consumer and producer surplus without any waste. This concept is rooted in Alfred Marshall's work on welfare economics, emphasizing optimal distribution in competitive markets. Explore the rest of this article to understand how Marshallian Efficiency impacts market outcomes and your economic decisions.

Table of Comparison

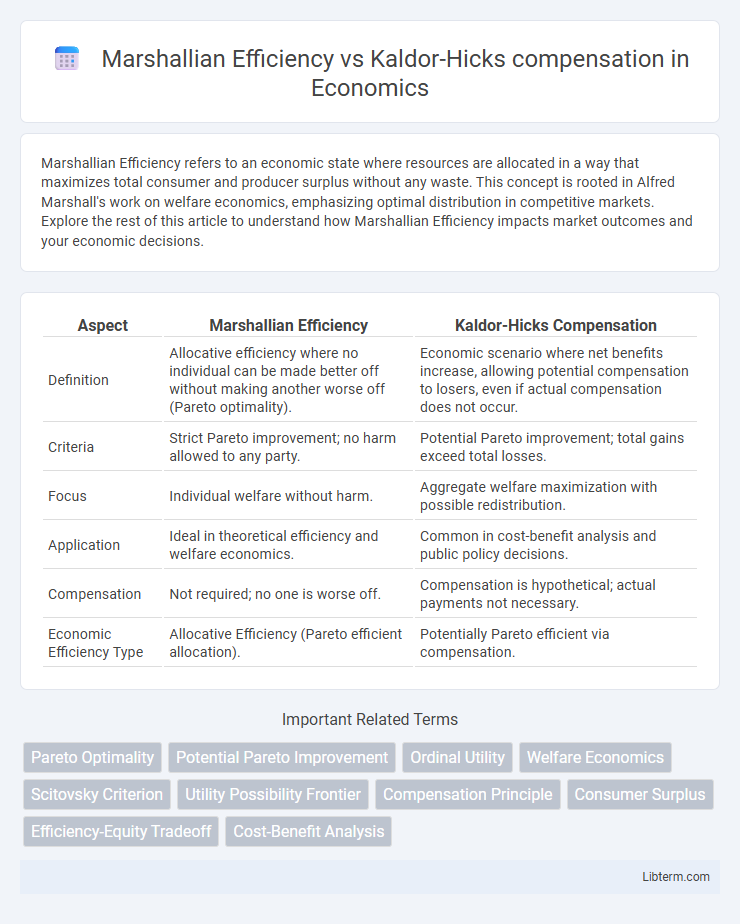

| Aspect | Marshallian Efficiency | Kaldor-Hicks Compensation |

|---|---|---|

| Definition | Allocative efficiency where no individual can be made better off without making another worse off (Pareto optimality). | Economic scenario where net benefits increase, allowing potential compensation to losers, even if actual compensation does not occur. |

| Criteria | Strict Pareto improvement; no harm allowed to any party. | Potential Pareto improvement; total gains exceed total losses. |

| Focus | Individual welfare without harm. | Aggregate welfare maximization with possible redistribution. |

| Application | Ideal in theoretical efficiency and welfare economics. | Common in cost-benefit analysis and public policy decisions. |

| Compensation | Not required; no one is worse off. | Compensation is hypothetical; actual payments not necessary. |

| Economic Efficiency Type | Allocative Efficiency (Pareto efficient allocation). | Potentially Pareto efficient via compensation. |

Introduction to Economic Efficiency Concepts

Marshallian efficiency emphasizes resource allocation where no individual can be made better off without making someone else worse off, reflecting Pareto optimality. Kaldor-Hicks efficiency allows for potential compensation, where gains by winners exceed losses by losers, even if compensation does not occur, enabling broader policy evaluations. These concepts underpin welfare economics by distinguishing strict efficiency from more flexible criteria accommodating redistributive effects.

Defining Marshallian Efficiency

Marshallian efficiency, rooted in welfare economics, occurs when resources are allocated to maximize total social surplus without making any individual worse off, embodying the Pareto optimality principle. It requires that all voluntary trades lead to improved or equal utility for every participant, ensuring no net loss in welfare. This contrasts with Kaldor-Hicks efficiency, which allows for compensation and potential winners offsetting losers without guaranteeing that all parties are better off.

Understanding Kaldor-Hicks Compensation Principle

The Kaldor-Hicks compensation principle evaluates economic efficiency by considering whether winners from a policy change could hypothetically compensate the losers, resulting in a net social gain, even if actual compensation does not occur. Unlike Marshallian efficiency, which requires unanimous improvements with no one worse off, Kaldor-Hicks efficiency accepts changes that improve overall welfare despite potential individual losses. This approach is widely applied in cost-benefit analysis, guiding decisions where the aggregate benefits exceed the aggregate costs.

Key Differences Between Marshallian and Kaldor-Hicks Criteria

Marshallian efficiency requires that no individual is made worse off by a resource allocation and emphasizes actual Pareto improvements, whereas Kaldor-Hicks efficiency allows for potential compensation to losers, focusing on net social welfare gains. The Marshallian criterion demands unanimous consent for changes, while Kaldor-Hicks accepts changes that increase total benefits despite some individuals experiencing losses. Consequently, Marshallian efficiency is a stricter standard centered on individual welfare preservation, contrasted with Kaldor-Hicks' pragmatic approach prioritizing overall efficiency and possible compensation mechanisms.

Application of Marshallian Efficiency in Real-world Markets

Marshallian efficiency, also known as Pareto efficiency, occurs when resources are allocated in a way that no individual can be made better off without making someone else worse off, which is crucial in markets aiming for optimal resource distribution. In real-world markets, Marshallian efficiency is applied in assessing competitive equilibria, ensuring that prices reflect true scarcities and consumer preferences, thus maximizing total welfare. This concept underpins regulatory policies and market designs, such as auction mechanisms and antitrust evaluations, to enhance economic efficiency without harming any participant.

Practical Uses of Kaldor-Hicks Compensation in Policy

Kaldor-Hicks compensation is widely applied in public policy to evaluate projects where total benefits exceed total costs, despite some groups incurring losses. This criterion supports cost-benefit analysis by allowing policies that increase overall social welfare if the winners could theoretically compensate the losers, even if actual compensation does not occur. Its practical use in infrastructure development, environmental regulations, and urban planning helps justify decisions that maximize net social gains while recognizing distributional impacts.

Strengths and Weaknesses of Marshallian Efficiency

Marshallian efficiency measures economic efficiency by focusing on Pareto optimality, where no individual can be made better off without making someone else worse off, ensuring strict allocative efficiency. A key strength is its clear criterion for welfare improvements, but it struggles with practical application due to the difficulty in identifying unequivocal winners and losers in real-world transactions. Its major weakness lies in ignoring potential compensations, making it less flexible than the Kaldor-Hicks criterion, which allows for efficiency improvements if winners could hypothetically compensate losers.

Evaluating the Limitations of Kaldor-Hicks Compensation

Kaldor-Hicks compensation often fails to ensure actual compensation occurs, leading to potential distributional injustices despite theoretical efficiency gains. Unlike Marshallian efficiency, which requires no losers in resource allocation, Kaldor-Hicks permits improvements even if some agents are worse off, raising ethical and practical concerns. This limitation challenges the real-world applicability of Kaldor-Hicks as a reliable measure for welfare-enhancing policy decisions.

Case Studies: Marshallian vs Kaldor-Hicks Outcomes

Case studies reveal that Marshallian efficiency prioritizes Pareto improvements where no individual is worse off, exemplified by negotiated agreements in environmental policy where all stakeholders benefit. In contrast, Kaldor-Hicks efficiency accepts potential losers if overall societal gains outweigh losses, as seen in infrastructure projects where compensation mechanisms are proposed but not always enacted. Evaluations often show Marshallian outcomes promote equitable, consensus-driven solutions, while Kaldor-Hicks outcomes facilitate projects with net economic benefits despite distributional conflicts.

Conclusion: Choosing the Right Efficiency Criterion

Selecting the appropriate efficiency criterion depends on policy goals and fairness considerations, where Marshallian efficiency prioritizes Pareto improvements ensuring no one is worse off, while Kaldor-Hicks efficiency allows for potential compensation, accepting net social gains despite possible individual losses. In practical economic analysis, Kaldor-Hicks efficiency is often favored due to its applicability in real-world scenarios where perfect compensation is rarely feasible, enabling cost-benefit analysis to guide decision-making. Policymakers must weigh the trade-offs between strict welfare improvements and pragmatic resource allocation to implement efficient and equitable economic outcomes.

Marshallian Efficiency Infographic

libterm.com

libterm.com