The classical dichotomy is a key concept in economics that separates real variables, like output and employment, from nominal variables, such as money supply and price levels. This separation implies that changes in the money supply do not affect real economic factors in the long run. Discover how understanding the classical dichotomy can clarify the effects of monetary policy on your economic decisions by reading the full article.

Table of Comparison

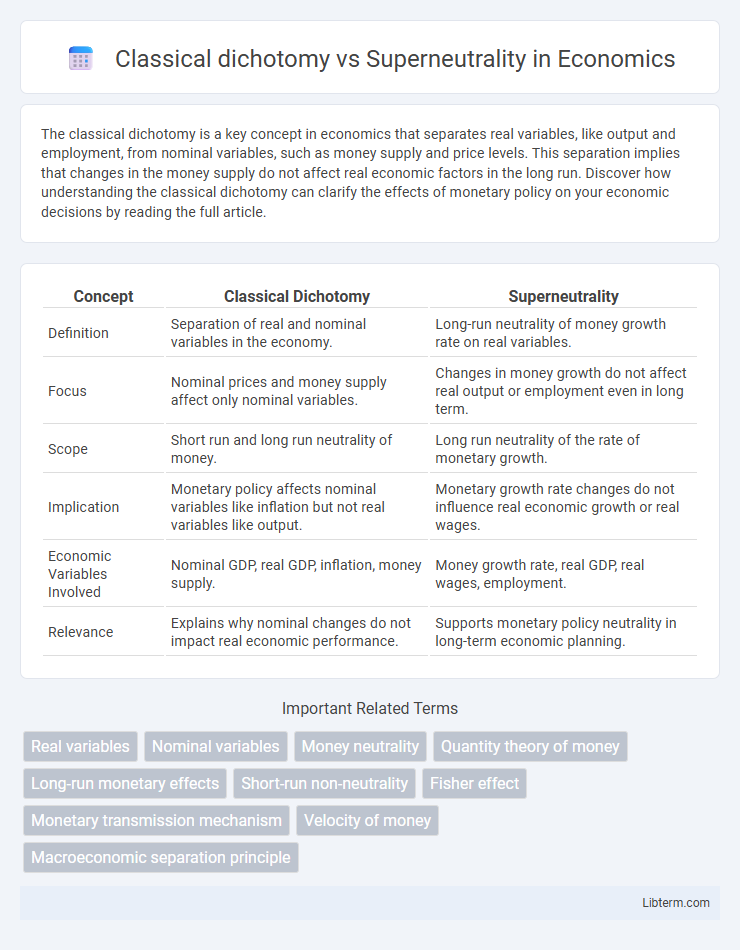

| Concept | Classical Dichotomy | Superneutrality |

|---|---|---|

| Definition | Separation of real and nominal variables in the economy. | Long-run neutrality of money growth rate on real variables. |

| Focus | Nominal prices and money supply affect only nominal variables. | Changes in money growth do not affect real output or employment even in long term. |

| Scope | Short run and long run neutrality of money. | Long run neutrality of the rate of monetary growth. |

| Implication | Monetary policy affects nominal variables like inflation but not real variables like output. | Monetary growth rate changes do not influence real economic growth or real wages. |

| Economic Variables Involved | Nominal GDP, real GDP, inflation, money supply. | Money growth rate, real GDP, real wages, employment. |

| Relevance | Explains why nominal changes do not impact real economic performance. | Supports monetary policy neutrality in long-term economic planning. |

Understanding Classical Dichotomy: A Foundational Overview

Classical dichotomy refers to the theoretical separation between real variables, such as output and employment, and nominal variables, like money supply and price levels, implying that changes in money supply only affect nominal variables in the long run. This concept serves as a foundational principle in classical economics, emphasizing that real economic outcomes remain unaffected by monetary variations, reinforcing the neutrality of money. Understanding this dichotomy is essential for analyzing how monetary policy influences inflation without altering real GDP or employment in equilibrium conditions.

Defining Superneutrality in Monetary Economics

Superneutrality in monetary economics refers to the long-term insensitivity of real economic variables, such as output and employment, to changes in the growth rate of the money supply. Unlike the Classical dichotomy, which separates nominal and real variables, superneutrality implies that even changes in the rate of monetary expansion do not affect real variables beyond short-run nominal rigidities. Empirical studies often test superneutrality by examining whether sustained inflation or deflation impacts real GDP growth or capital accumulation over extended periods.

Historical Context: Origins and Evolution

The classical dichotomy originated in classical economics, emphasizing the separation of real and nominal variables, dating back to early 19th-century theorists like David Ricardo and John Stuart Mill. Superneutrality, an extension of the classical dichotomy, evolved during the 20th century as economists like Robert Lucas analyzed long-run neutrality of money, stressing that changes in money growth rates do not affect real economic variables. Both concepts have shaped macroeconomic thought by clarifying the long-term neutrality of money while differing in their focus on short-run versus long-run economic effects.

Theoretical Frameworks: Comparing Classical and Modern Perspectives

Classical dichotomy separates real and nominal variables, asserting that changes in money supply only affect nominal variables without influencing real output or employment, foundational in classical economic theory. Superneutrality extends this idea by proposing that not only the level but also the rate of change of money supply has no long-term impact on real variables, a concept explored in modern macroeconomic models. Contemporary frameworks challenge these classical views by integrating expectations, price rigidities, and monetary non-neutralities, highlighting conditions under which money supply variations influence real economic activity.

Classical Dichotomy: Real vs Nominal Variables

The classical dichotomy distinguishes real variables, such as output and employment, from nominal variables, like price levels and wages, asserting that changes in nominal variables do not affect real economic outcomes in the long run. This separation underpins many classical economic theories, emphasizing the neutrality of money in determining real factors. In contrast, superneutrality extends this concept, suggesting that even changes in the growth rate of money supply have no impact on real variables.

Superneutrality: Impact of Money Growth on the Economy

Superneutrality refers to the concept in monetary economics where changes in the growth rate of the money supply impact only nominal variables like the price level, without affecting real economic variables such as output or employment in the long run. This contrasts with classical dichotomy, which separates real and nominal variables but doesn't explicitly address the dynamic implications of money growth rates. Empirical studies suggest that while superneutrality holds under certain conditions, persistent changes in money growth can influence real interest rates and investment, challenging the strict neutrality assumption.

Key Assumptions and Limitations

The classical dichotomy assumes a clear separation between real and nominal variables, implying that money only affects nominal aspects without influencing real economic variables like output or employment. Superneutrality extends this concept by asserting that not only the current money supply but also its growth rate has no effect on real variables, relying on the assumption of flexible prices and perfect markets. Limitations of both concepts include unrealistic assumptions such as price flexibility and rational expectations, which often fail in the presence of nominal rigidities, monetary frictions, and short-term economic fluctuations.

Implications for Economic Policy and Modeling

Classical dichotomy separates real and nominal variables, implying monetary neutrality where changes in money supply affect only price levels, not real output, guiding policymakers to prioritize real factors for economic growth. Superneutrality extends this concept, suggesting that even changes in the growth rate of money supply have no long-term impact on real variables, reinforcing the argument for limited effectiveness of monetary policy in influencing real economic outcomes. Economic modeling based on these principles often employs real business cycle frameworks, emphasizing real shocks over nominal disturbances and advocating rules-based monetary policies to maintain price stability without distorting real economic growth.

Critiques and Counterarguments in Economic Thought

Critiques of the classical dichotomy emphasize its unrealistic assumption that money is neutral in the long run, ignoring evidence of money's influence on real variables like output and employment. Counterarguments to superneutrality highlight empirical findings where changes in money growth rates affect not only price levels but also real interest rates and investment, challenging the notion that money's effects are purely nominal. Contemporary economic thought often questions the strict separation of nominal and real sectors, advocating for models that incorporate monetary imperfections and sticky prices to better reflect observed economic dynamics.

Practical Applications: Lessons for Modern Macroeconomics

Classical dichotomy separates real and nominal variables, implying monetary changes do not affect real output, while superneutrality extends this by asserting long-term money supply changes do not influence real variables even through growth rates. In modern macroeconomic policy, understanding these concepts aids in designing inflation targeting and monetary neutrality strategies, ensuring nominal shocks do not distort real economic growth. Empirical research on superneutrality guides central banks in forecasting the limited long-term impact of monetary expansions on productivity and employment levels.

Classical dichotomy Infographic

libterm.com

libterm.com