Coasean bargaining refers to a negotiation process where parties involved in a conflict or externality reach a mutually beneficial agreement without government intervention. This concept emphasizes the importance of clearly defined property rights and low transaction costs for efficient outcomes. Explore the article to understand how Coasean bargaining can resolve disputes and improve economic efficiency.

Table of Comparison

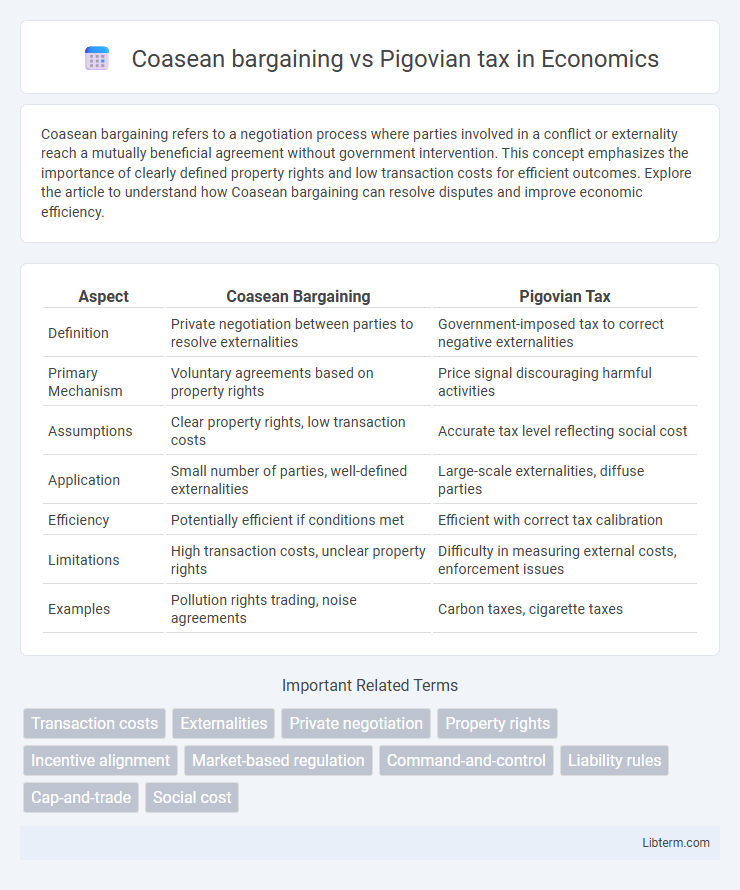

| Aspect | Coasean Bargaining | Pigovian Tax |

|---|---|---|

| Definition | Private negotiation between parties to resolve externalities | Government-imposed tax to correct negative externalities |

| Primary Mechanism | Voluntary agreements based on property rights | Price signal discouraging harmful activities |

| Assumptions | Clear property rights, low transaction costs | Accurate tax level reflecting social cost |

| Application | Small number of parties, well-defined externalities | Large-scale externalities, diffuse parties |

| Efficiency | Potentially efficient if conditions met | Efficient with correct tax calibration |

| Limitations | High transaction costs, unclear property rights | Difficulty in measuring external costs, enforcement issues |

| Examples | Pollution rights trading, noise agreements | Carbon taxes, cigarette taxes |

Understanding Coasean Bargaining: Key Concepts

Coasean bargaining centers on resolving externalities through private negotiation between affected parties, where clearly defined property rights and low transaction costs enable efficient outcomes without government intervention. It relies on the assumption that parties can costlessly bargain to internalize externalities, leading to mutually beneficial agreements regardless of the initial allocation of rights. The Coase theorem highlights the importance of legal frameworks and enforcement mechanisms to facilitate these negotiations and achieve social optimality in externality management.

The Basics of Pigovian Taxes

Pigovian taxes are designed to correct negative externalities by imposing a cost equal to the external damage caused by a producer's activities, aligning private costs with social costs. This tax incentivizes firms to reduce harmful behaviors, internalizing the externality without requiring direct negotiation between parties. Unlike Coasean bargaining, which relies on defined property rights and voluntary agreements, Pigovian taxes provide a government-mandated solution to market failures stemming from externalities.

Externalities: The Core Issue

Coasean bargaining addresses externalities by enabling private parties to negotiate mutually beneficial agreements without government intervention, assuming low transaction costs and well-defined property rights. In contrast, Pigovian tax directly internalizes external costs by imposing a tax equal to the externality's social damage, incentivizing individuals or firms to reduce harmful activities. Both methods aim to correct market failures caused by externalities but differ fundamentally in their mechanisms and practical applicability.

Property Rights in Coasean Theory

Coasean bargaining centers on well-defined property rights as the foundation for resolving externalities through private negotiation, enabling parties to achieve efficient outcomes without government intervention. Strong assignment and enforceability of property rights reduce transaction costs and allow affected parties to internalize external costs and benefits directly. Unlike Pigovian taxes, which rely on government-imposed corrective pricing to address externalities, Coasean theory emphasizes the role of legal rights and voluntary agreements in allocating resources efficiently.

Government Intervention through Pigovian Taxes

Government intervention through Pigovian taxes directly addresses negative externalities by imposing a cost equivalent to the external damage, incentivizing firms and individuals to reduce harmful behaviors. Unlike Coasean bargaining, which relies on private negotiation to internalize externalities, Pigovian taxes provide a systematic, market-based approach enforceable at the policy level. This method ensures efficient resource allocation by aligning private costs with social costs, reducing pollution and other externalities more predictably.

Efficiency in Addressing Negative Externalities

Coasean bargaining achieves efficiency in addressing negative externalities by enabling parties to negotiate mutually beneficial agreements that internalize external costs without government intervention. The efficiency of Pigovian tax lies in its ability to correct market failures by imposing a tax equal to the external cost, thereby incentivizing polluters to reduce harmful activities. While Coasean bargaining relies on low transaction costs and clear property rights, Pigovian taxes provide a scalable solution when negotiation is impractical or infeasible.

Transaction Costs and Their Impact

Coasean bargaining depends on low transaction costs to enable private parties to negotiate efficient solutions to externalities without government intervention, facilitating direct agreement and resource allocation. High transaction costs, such as negotiation expenses or information asymmetry, can impede Coasean bargaining, rendering private agreements impractical or inefficient. Conversely, Pigovian taxes impose government-mandated fees on negative externalities, effectively bypassing transaction costs by internalizing external costs through market price adjustments.

Real-World Examples: Coasean Bargaining vs Pigovian Tax

Coasean bargaining resolves externalities through negotiation between affected parties, exemplified by the Schelling's housing externality case where neighbors negotiated property improvements without government intervention. In contrast, Pigovian taxes impose corrective fees on activities generating negative externalities, as illustrated by carbon taxes implemented in Sweden, effectively reducing greenhouse gas emissions. Real-world application of Coasean bargaining is often limited by transaction costs, whereas Pigovian taxes provide a scalable, government-enforced solution for widespread environmental and social externalities.

Limitations and Criticisms of Each Approach

Coasean bargaining faces limitations in practices with high transaction costs, unclear property rights, or numerous stakeholders, making negotiation inefficient or impractical. Pigovian taxes, while aiming to internalize externalities, often suffer from difficulties in accurately estimating the social cost of externalities and risk of regulatory capture. Both approaches can struggle with enforcement challenges and equity concerns, limiting their effectiveness in real-world environmental policy applications.

Choosing the Right Solution for Policy Makers

Policy makers must assess the nature of externalities and transaction costs when choosing between Coasean bargaining and Pigovian taxes. Coasean bargaining is optimal when property rights are well-defined and negotiation costs are low, enabling efficient private solutions to externalities. Pigovian taxes suit cases with high transaction costs or diffuse impacts, providing a government-driven incentive structure to internalize social costs effectively.

Coasean bargaining Infographic

libterm.com

libterm.com