The credit multiplier measures how much the banking system can expand the money supply through lending based on its reserves. Understanding the credit multiplier is essential for grasping how banks create money and influence economic growth. Discover how this concept impacts Your financial opportunities in the full article.

Table of Comparison

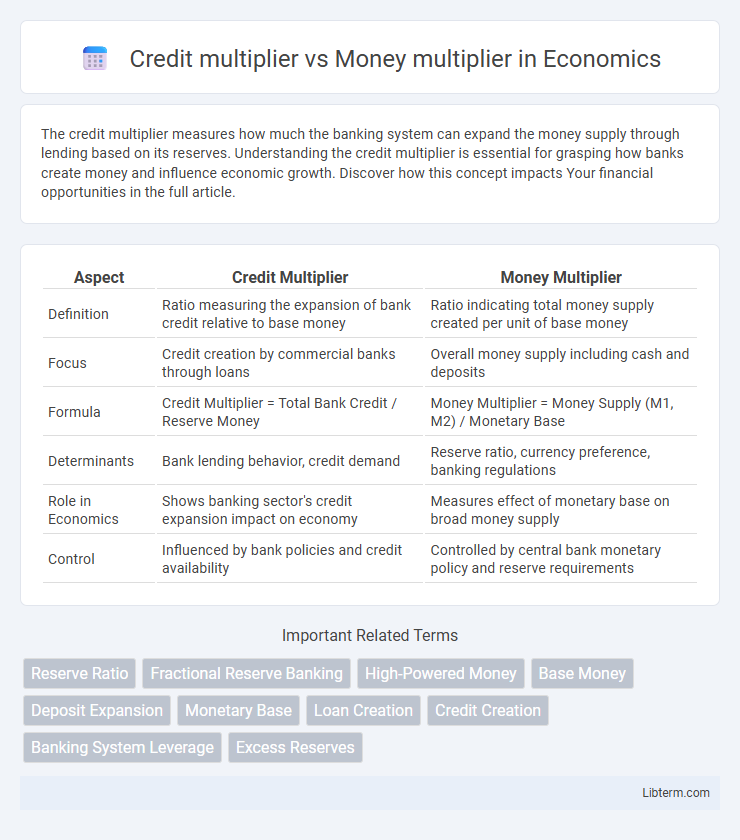

| Aspect | Credit Multiplier | Money Multiplier |

|---|---|---|

| Definition | Ratio measuring the expansion of bank credit relative to base money | Ratio indicating total money supply created per unit of base money |

| Focus | Credit creation by commercial banks through loans | Overall money supply including cash and deposits |

| Formula | Credit Multiplier = Total Bank Credit / Reserve Money | Money Multiplier = Money Supply (M1, M2) / Monetary Base |

| Determinants | Bank lending behavior, credit demand | Reserve ratio, currency preference, banking regulations |

| Role in Economics | Shows banking sector's credit expansion impact on economy | Measures effect of monetary base on broad money supply |

| Control | Influenced by bank policies and credit availability | Controlled by central bank monetary policy and reserve requirements |

Introduction to Credit Multiplier and Money Multiplier

The credit multiplier measures the expansion of total bank credit relative to the reserves held by banks, reflecting how banks create loans from their reserves. The money multiplier indicates the maximum potential increase in the money supply generated by the banking system from an initial deposit, highlighting the relationship between reserves and total money in circulation. Both multipliers illustrate different aspects of money creation but focus respectively on credit issuance and overall money supply growth.

Defining Credit Multiplier

The credit multiplier measures the amount of bank credit created from a unit of reserves, reflecting how banks extend loans beyond their reserves through the credit creation process. Unlike the money multiplier, which focuses on the total money supply including currency and deposits, the credit multiplier specifically emphasizes the expansion of credit liabilities by commercial banks. It is a key concept in understanding the relationship between bank lending and the overall money supply in the economy.

Defining Money Multiplier

The money multiplier refers to the ratio that measures the maximum amount of commercial bank money that can be created, given a certain amount of central bank money or monetary base. It is calculated as the inverse of the reserve requirement ratio, reflecting how initial deposits lead to increased total money supply through fractional reserve banking. In contrast, the credit multiplier emphasizes the expansion of bank lending and credit creation, focusing on how banks generate loans beyond their reserves.

Key Differences Between Credit and Money Multipliers

The credit multiplier measures the banking system's ability to create loans from deposits, reflecting how much credit banks generate, while the money multiplier indicates the potential maximum money supply resulting from an initial deposit, considering reserve requirements. Key differences include that the credit multiplier depends on banks' lending behavior and borrowers' demand for loans, whereas the money multiplier is primarily driven by central bank policies and reserve ratios. Unlike the fixed reserve-based money multiplier, the credit multiplier is dynamic, influenced by varying credit creation and repayment cycles in the economy.

Mathematical Formulas: Credit vs. Money Multiplier

The credit multiplier is mathematically expressed as the inverse of the reserve requirement ratio, representing the maximum potential increase in bank credit, formulated as Credit Multiplier = 1 / Reserve Ratio. In contrast, the money multiplier incorporates both the reserve ratio and the currency ratio, calculated as Money Multiplier = (1 + Currency Ratio) / (Reserve Ratio + Currency Ratio), reflecting the total money supply expansion in the economy. These formulas distinguish the money multiplier's broader scope in encompassing currency held by the public, while the credit multiplier focuses solely on bank lending capacity.

Role in Banking System and Monetary Policy

The credit multiplier reflects banks' ability to create loans based on reserves, directly influencing credit availability and economic activity, while the money multiplier indicates the total money supply generated from a given monetary base through deposit creation. In the banking system, the credit multiplier highlights the process of credit extension affecting liquidity and interest rates, whereas the money multiplier measures overall money supply expansion affecting inflation and purchasing power. Monetary policy relies on both multipliers to regulate economic growth and control inflation by adjusting reserve requirements, interest rates, and central bank interventions.

Factors Influencing the Multipliers

The credit multiplier is influenced by factors such as banks' lending policies, reserve requirements, and borrowers' credit demand, impacting the expansion of bank credit. The money multiplier depends on the reserve ratio set by central banks, currency held by the public, and commercial banks' excess reserves, determining the total money supply generated from base money. Differences in regulatory frameworks and economic conditions also shape the effectiveness and magnitude of both multipliers.

Practical Implications for the Economy

The credit multiplier measures how banks create loans from deposits, directly affecting credit availability and economic growth, while the money multiplier reflects the total money supply generated from base money through banking activities. A higher credit multiplier indicates more efficient loan creation capacity, boosting investment and consumption, whereas changes in the money multiplier signal shifts in liquidity and monetary policy effectiveness. Understanding the distinction helps policymakers balance inflation control with economic expansion by targeting credit flow and money supply dynamics.

Limitations and Criticisms of Multipliers

Credit multipliers face limitations due to regulatory constraints and the banking sector's cautious lending amid economic uncertainty, which reduces their effectiveness in expanding credit supply. Money multipliers are criticized for assuming a stable reserve ratio and constant currency-deposit ratio, neglecting the dynamic behavior of banks and depositors, leading to inaccurate predictions of money supply changes. Both multipliers oversimplify complex financial systems by ignoring factors such as central bank interventions, shadow banking activities, and changes in monetary policy frameworks.

Conclusion: Relevance in Modern Financial Systems

The credit multiplier and money multiplier play crucial roles in understanding the dynamics of money creation within modern banking systems, highlighting the interplay between bank lending and central bank reserves. The credit multiplier emphasizes the impact of banks' ability to extend loans on the total money supply, while the money multiplier focuses on the relationship between central bank reserves and commercial bank deposits. In contemporary financial systems, the credit multiplier is often considered more relevant due to its direct connection with credit availability and economic activity in a largely deregulated banking environment.

Credit multiplier Infographic

libterm.com

libterm.com