Exchange rates determine the value of one currency relative to another, influencing international trade, travel expenses, and investment decisions. Fluctuations in exchange rates can impact the cost of imports and exports, affecting businesses and consumers alike. Explore the rest of the article to understand how exchange rates affect your financial choices and the global economy.

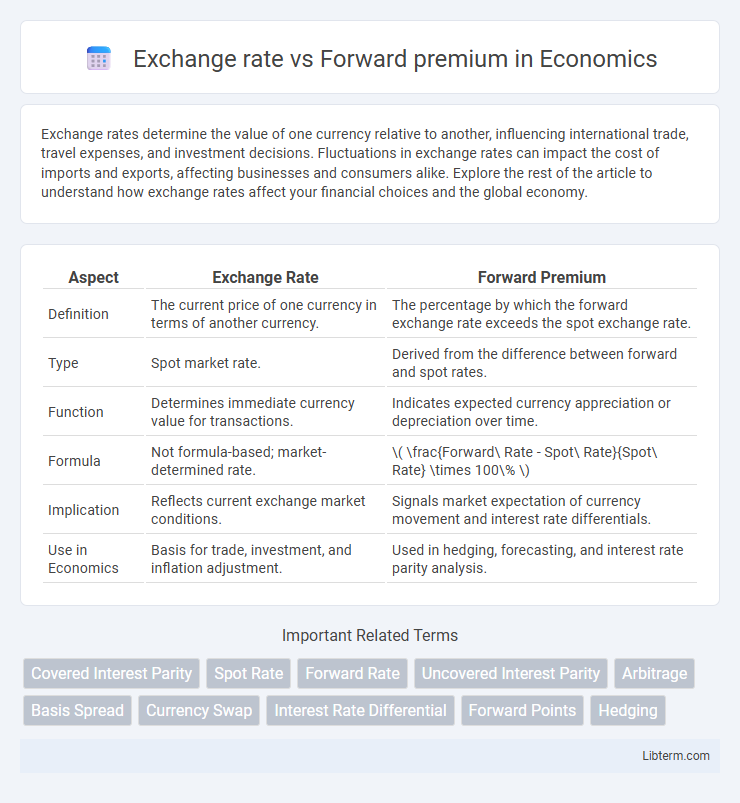

Table of Comparison

| Aspect | Exchange Rate | Forward Premium |

|---|---|---|

| Definition | The current price of one currency in terms of another currency. | The percentage by which the forward exchange rate exceeds the spot exchange rate. |

| Type | Spot market rate. | Derived from the difference between forward and spot rates. |

| Function | Determines immediate currency value for transactions. | Indicates expected currency appreciation or depreciation over time. |

| Formula | Not formula-based; market-determined rate. | \( \frac{Forward\ Rate - Spot\ Rate}{Spot\ Rate} \times 100\% \) |

| Implication | Reflects current exchange market conditions. | Signals market expectation of currency movement and interest rate differentials. |

| Use in Economics | Basis for trade, investment, and inflation adjustment. | Used in hedging, forecasting, and interest rate parity analysis. |

Understanding Exchange Rates: An Overview

Exchange rates represent the current price at which one currency can be exchanged for another, reflecting market supply and demand factors essential for international trade and finance. Forward premium refers to the difference between the forward exchange rate and the spot exchange rate, indicating market expectations of currency value changes over time. Understanding the relationship between exchange rates and forward premiums helps businesses and investors hedge currency risk and anticipate future currency movements effectively.

What is a Forward Premium?

A forward premium occurs when the forward exchange rate of a currency is higher than its spot exchange rate, indicating the currency is expected to strengthen in the future. This premium reflects interest rate differentials between two countries, where the currency with a higher interest rate tends to trade at a forward discount, while the currency with a lower interest rate trades at a forward premium. Investors use forward premiums to hedge currency risk and forecast future exchange rate movements based on prevailing interest rate environments.

Key Differences: Spot Rate vs. Forward Rate

The spot exchange rate is the current price at which one currency can be exchanged for another, reflecting immediate settlement in the foreign exchange market. In contrast, the forward exchange rate is an agreed-upon price for exchanging currencies at a specific future date, often used to hedge against exchange rate risk. The forward premium or discount represents the percentage difference between the spot rate and the forward rate, indicating market expectations of future currency movements.

Factors Influencing Exchange Rates

Exchange rates are influenced by factors such as interest rate differentials, inflation rates, political stability, and economic performance, which affect currency demand and supply. Forward premium reflects expectations of future exchange rate movements driven primarily by differences in interest rates between two countries, capturing market sentiment and risk perceptions. These dynamics interplay as forward premiums adjust for anticipated exchange rate changes, while spot rates respond to immediate economic conditions.

Determinants of Forward Premiums

Forward premiums are primarily determined by interest rate differentials between two countries, reflecting the covered interest rate parity theory. Expectations of future spot rates, influenced by inflation rates, political stability, and economic performance, also significantly impact the forward premium. Market liquidity, central bank interventions, and transaction costs further affect the magnitude and volatility of the forward premium in foreign exchange markets.

Interest Rate Parity and Forward Premium

Interest Rate Parity (IRP) explains the relationship between spot exchange rates and forward premiums by linking interest rate differentials to expected currency movements. The forward premium is the percentage difference between the forward exchange rate and the spot exchange rate, reflecting market expectations based on interest rate discrepancies between two countries. When IRP holds, the forward premium equals the interest rate differential, eliminating arbitrage opportunities in forex markets.

How Exchange Rate Movements Affect Forward Premiums

Exchange rate movements directly influence forward premiums by reflecting market expectations of currency value changes over time. When a currency is expected to depreciate, forward rates typically show a premium for selling that currency in the future, signaling higher costs. Conversely, anticipated appreciation results in lower or negative forward premiums, indicating cheaper future exchange rates relative to the spot rate.

Practical Applications: Hedging with Forward Contracts

Hedging with forward contracts allows businesses to lock in an exchange rate, reducing exposure to currency risk caused by fluctuations in spot rates compared to forward premiums. Companies use forward premiums as indicators of expected currency appreciation or depreciation, aiding in strategic decision-making for international transactions. This practical application stabilizes cash flows and safeguards profit margins in foreign exchange operations.

Risks Associated with Exchange Rates and Forward Premiums

Exchange rate fluctuations expose businesses to transaction and translation risks, impacting cash flow and financial statements. Forward premiums reflect market expectations of currency depreciation, but relying on forward contracts for hedging introduces counterparty risk and potential liquidity constraints. Misestimating forward premiums can lead to ineffective risk management, resulting in unexpected losses from unhedged currency positions.

Conclusion: Navigating Exchange Rate and Forward Premium Dynamics

Understanding the interplay between exchange rates and forward premiums is crucial for effective currency risk management and investment decisions. Forward premiums reflect market expectations about future spot rates, often influenced by interest rate differentials and economic indicators, providing valuable insights for forecasting currency movements. Mastering these dynamics enables businesses and investors to hedge exposure and optimize financial strategies in volatile forex markets.

Exchange rate Infographic

libterm.com

libterm.com