The Taylor principle is a key concept in monetary policy asserting that central banks should raise nominal interest rates by more than the increase in inflation to stabilize the economy. This strategy helps prevent runaway inflation by ensuring real interest rates increase, curbing excessive spending and price rises. Explore the article to understand how the Taylor principle shapes your economic environment and influences central bank decisions.

Table of Comparison

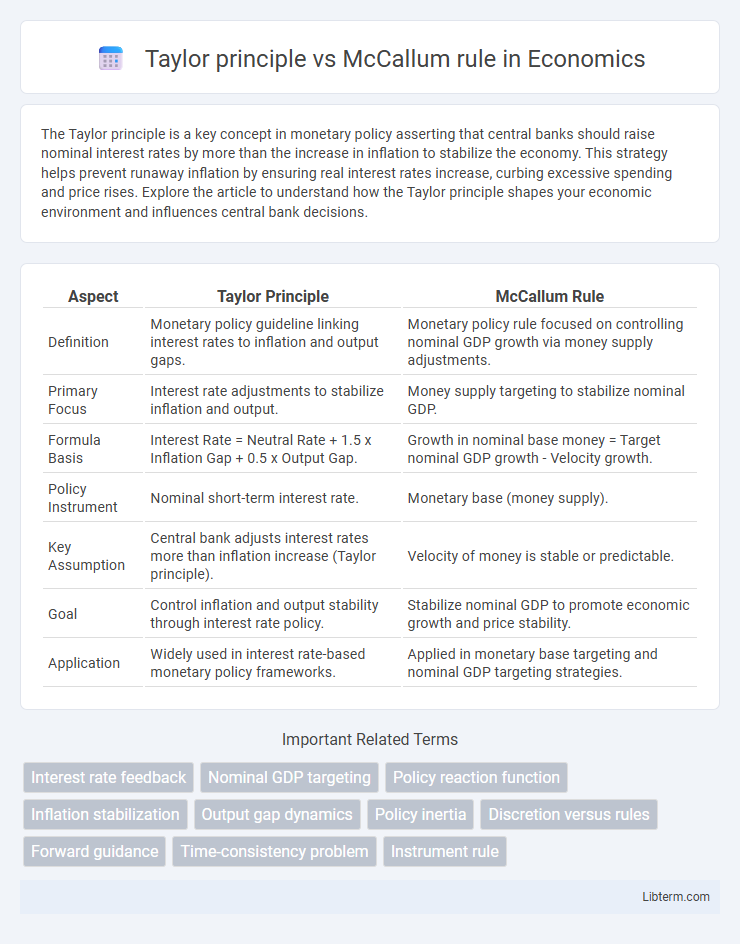

| Aspect | Taylor Principle | McCallum Rule |

|---|---|---|

| Definition | Monetary policy guideline linking interest rates to inflation and output gaps. | Monetary policy rule focused on controlling nominal GDP growth via money supply adjustments. |

| Primary Focus | Interest rate adjustments to stabilize inflation and output. | Money supply targeting to stabilize nominal GDP. |

| Formula Basis | Interest Rate = Neutral Rate + 1.5 x Inflation Gap + 0.5 x Output Gap. | Growth in nominal base money = Target nominal GDP growth - Velocity growth. |

| Policy Instrument | Nominal short-term interest rate. | Monetary base (money supply). |

| Key Assumption | Central bank adjusts interest rates more than inflation increase (Taylor principle). | Velocity of money is stable or predictable. |

| Goal | Control inflation and output stability through interest rate policy. | Stabilize nominal GDP to promote economic growth and price stability. |

| Application | Widely used in interest rate-based monetary policy frameworks. | Applied in monetary base targeting and nominal GDP targeting strategies. |

Introduction to Monetary Policy Rules

Monetary policy rules guide central banks in adjusting interest rates to stabilize the economy. The Taylor principle emphasizes setting the nominal interest rate above the inflation rate to ensure real interest rates rise during inflation, promoting price stability. The McCallum rule focuses on controlling the monetary base growth to target nominal GDP, providing an alternative framework based on monetary aggregates rather than interest rates.

Understanding the Taylor Principle

The Taylor Principle asserts that central banks should raise nominal interest rates by more than the increase in inflation to stabilize the economy and anchor inflation expectations. This mechanism prevents the real interest rate from falling when inflation rises, thereby controlling inflationary pressures. In contrast, the McCallum Rule emphasizes targeting nominal GDP growth using monetary aggregates, highlighting a different approach to maintaining economic stability.

Overview of the McCallum Rule

The McCallum Rule provides a monetary policy guideline that targets the growth rate of the nominal base money supply, aiming to stabilize nominal GDP by adjusting money supply in response to deviations from a target path. Unlike the Taylor Principle, which adjusts interest rates based on inflation and output gaps, the McCallum Rule emphasizes direct control of monetary aggregates to achieve macroeconomic stability. This rule is grounded in the quantity theory of money and is particularly useful in environments where interest rate policies face zero lower bound constraints.

Core Differences: Taylor Principle vs McCallum Rule

The Taylor Principle emphasizes adjusting nominal interest rates more than the inflation rate to stabilize inflation, focusing on a rule-based interest rate policy linked to inflation and output gaps. The McCallum Rule prioritizes controlling nominal GDP growth through targeting the monetary base, highlighting the use of monetary aggregates over interest rates for economic stabilization. Core differences lie in the Taylor Principle's reliance on interest rate adjustments versus the McCallum Rule's focus on monetary base targeting and nominal GDP stability.

Target Variables: Interest Rates vs Monetary Aggregates

The Taylor principle emphasizes adjusting nominal interest rates in response to deviations in inflation and output, targeting interest rates as the primary monetary policy instrument to stabilize the economy. In contrast, the McCallum rule focuses on targeting monetary aggregates, such as the growth rate of the monetary base, to control nominal GDP and achieve price stability. While the Taylor principle relies on interest rate adjustments, the McCallum rule prioritizes monetary supply changes to influence economic variables.

Policy Responses to Economic Shocks

The Taylor principle advocates adjusting nominal interest rates more than the inflation rate to stabilize inflation following economic shocks, promoting predictable monetary policy responses. In contrast, the McCallum rule emphasizes targeting nominal GDP growth by adjusting monetary aggregates to buffer output fluctuations and achieve economic stability. Both frameworks guide central banks in crafting policy responses, with Taylor focusing on interest rates and inflation, while McCallum prioritizes nominal GDP targeting to manage economic shocks effectively.

Effectiveness in Inflation Control

The Taylor principle emphasizes adjusting nominal interest rates by more than the change in inflation to stabilize prices, making it highly effective in anchoring inflation expectations and controlling inflation. The McCallum rule focuses on targeting the growth rate of the monetary base, directly influencing monetary supply to achieve price stability, which can be more adaptable in environments with uncertain velocity of money. Empirical studies suggest the Taylor principle often provides more robust inflation control in practice, while the McCallum rule can be effective during episodes of financial instability or when interest rate policies face constraints.

Practical Applications in Central Banking

The Taylor principle guides central banks to adjust nominal interest rates more than inflation changes, ensuring real interest rates rise to stabilize the economy, which helps in maintaining price stability and managing inflation expectations. In contrast, the McCallum rule emphasizes targeting the monetary base growth rate relative to the nominal GDP growth, providing a framework for controlling inflation through monetary aggregates rather than direct interest rate adjustments. Central banks apply the Taylor principle for interest rate policy in inflation targeting regimes, while the McCallum rule informs monetary base control in contexts prioritizing money supply management to influence inflation and economic stability.

Criticisms and Limitations of Each Rule

The Taylor principle faces criticism for its rigid response to inflation, potentially causing procyclical monetary policy during supply shocks and ignoring financial market dynamics. The McCallum rule is limited by its dependence on accurate measurement of the monetary base and velocity, which can be volatile and difficult to estimate, leading to ineffective policy outcomes in certain economic conditions. Both rules struggle with real-world complexities such as fiscal policy interactions and unexpected economic shocks, reducing their practical reliability.

Future Perspectives on Monetary Policy Rules

Future perspectives on monetary policy rules emphasize integrating the Taylor principle, which advocates adjusting nominal interest rates more than inflation changes to stabilize output, with the McCallum rule's focus on nominal GDP targeting through monetary base control. Emerging research highlights the potential for hybrid frameworks combining these approaches to enhance policy responsiveness amid evolving economic conditions and financial innovation. Advances in real-time data analysis and machine learning may further refine rule-based policy designs, improving central banks' ability to manage inflation and economic growth sustainably.

Taylor principle Infographic

libterm.com

libterm.com