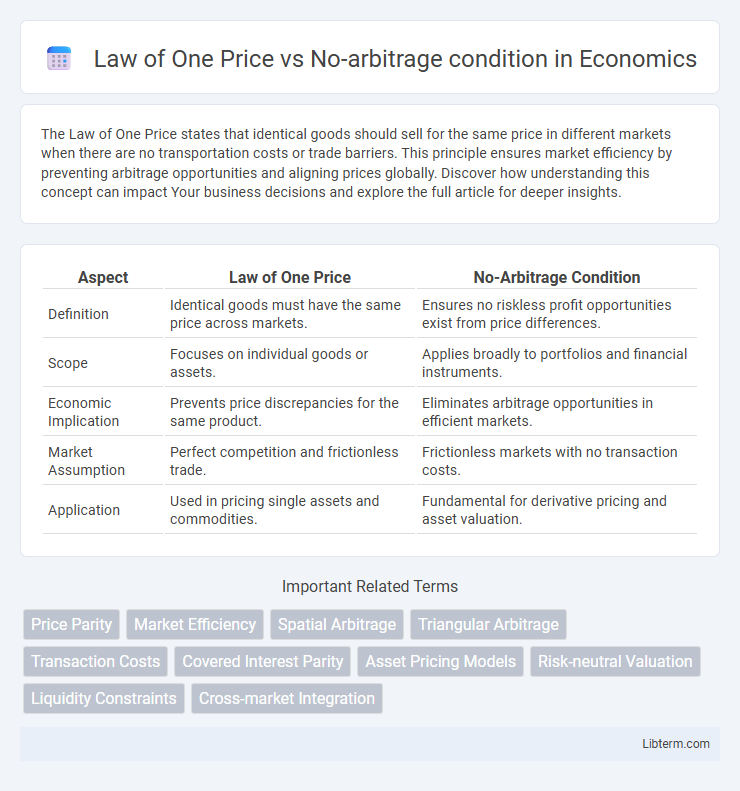

The Law of One Price states that identical goods should sell for the same price in different markets when there are no transportation costs or trade barriers. This principle ensures market efficiency by preventing arbitrage opportunities and aligning prices globally. Discover how understanding this concept can impact Your business decisions and explore the full article for deeper insights.

Table of Comparison

| Aspect | Law of One Price | No-Arbitrage Condition |

|---|---|---|

| Definition | Identical goods must have the same price across markets. | Ensures no riskless profit opportunities exist from price differences. |

| Scope | Focuses on individual goods or assets. | Applies broadly to portfolios and financial instruments. |

| Economic Implication | Prevents price discrepancies for the same product. | Eliminates arbitrage opportunities in efficient markets. |

| Market Assumption | Perfect competition and frictionless trade. | Frictionless markets with no transaction costs. |

| Application | Used in pricing single assets and commodities. | Fundamental for derivative pricing and asset valuation. |

Introduction to the Law of One Price

The Law of One Price states that identical goods must sell for the same price in different markets when transportation costs and barriers are negligible, ensuring price consistency globally. This principle underpins the no-arbitrage condition, which prevents riskless profit opportunities by enforcing price equality for equivalent assets across markets. Understanding the Law of One Price is crucial for analyzing asset pricing, arbitrage strategies, and market efficiency in financial economics.

Understanding the No-arbitrage Condition

The no-arbitrage condition ensures that prices of identical or equivalent assets do not allow riskless profit through arbitrage opportunities, maintaining market equilibrium. Unlike the Law of One Price, which states that identical goods should have identical prices in efficient markets, the no-arbitrage condition specifically prevents price discrepancies that traders can exploit without risk. This principle underpins financial models and asset pricing frameworks, guaranteeing consistent valuation across markets while excluding arbitrage possibilities.

Key Principles Behind the Law of One Price

The Law of One Price asserts that identical goods must sell for the same price in efficient markets to prevent arbitrage opportunities. This principle relies on market efficiency, no transportation costs, and perfect information to ensure price uniformity across locations. Violations of the Law of One Price signal potential arbitrage, which the no-arbitrage condition prohibits by requiring that no riskless profit can be made from price discrepancies.

Core Concepts of No-arbitrage in Financial Markets

The core concept of no-arbitrage in financial markets ensures that identical assets or portfolios cannot be priced differently, eliminating risk-free profit opportunities. This principle underpins fair value pricing and market efficiency, as deviations from no-arbitrage conditions would prompt arbitrageurs to exploit price differences until equilibrium is restored. By contrast, the Law of One Price strictly states that identical goods must sell for the same price in efficient markets, making no-arbitrage a broader condition that enforces consistent pricing across derivatives and complex financial instruments.

Similarities Between Law of One Price and No-arbitrage

The Law of One Price and the No-arbitrage condition both ensure that identical assets or goods cannot trade at different prices in efficient markets, preventing arbitrage opportunities. They rely on market mechanisms that enforce price uniformity through the possibility of riskless profits if discrepancies arise. These principles underpin fundamental models in financial economics, such as the pricing of derivatives and asset valuation.

Major Differences: Law of One Price vs No-arbitrage Condition

The Law of One Price asserts that identical goods must sell for the same price in efficient markets to prevent arbitrage opportunities. The No-arbitrage condition, however, is a broader principle used in financial modeling that ensures no risk-free profits exist from price discrepancies across derivative securities or assets. While the Law of One Price applies mainly to commodities and securities with identical cash flows, the No-arbitrage condition underpins pricing models for complex instruments, reflecting a fundamental equilibrium assumption in finance.

Real-world Examples Demonstrating Both Concepts

The Law of One Price states that identical goods must sell for the same price in efficient markets, exemplified by currency exchange rates aligning across global forex markets to prevent price discrepancies. The No-arbitrage condition ensures that no risk-free profit opportunities exist, as seen in stock markets where derivatives pricing models, like the Black-Scholes model, eliminate the chances of arbitrage by aligning options prices with underlying asset values. Real-world violations, such as price differentials in geographically separated commodity markets due to transaction costs or regulatory barriers, illustrate the practical limits of both concepts in imperfect markets.

Applications in Market Efficiency and Asset Pricing

The Law of One Price asserts that identical assets must trade at the same price across different markets, ensuring price uniformity and eliminating opportunities for arbitrage. The No-arbitrage condition extends this principle by prohibiting riskless profit opportunities in asset pricing models, which is fundamental for deriving fair value in financial markets. Both concepts underpin market efficiency by aligning asset prices with their intrinsic values, facilitating accurate derivative pricing, risk management, and portfolio optimization.

Implications for Traders and Investors

The Law of One Price asserts that identical assets must trade at the same price in efficient markets, eliminating price discrepancies and ensuring fair valuation. The no-arbitrage condition extends this principle by preventing riskless profit opportunities, which enforces equilibrium in derivative pricing and asset returns. Traders and investors rely on these concepts to identify mispricing, execute arbitrage strategies, and maintain portfolio efficiency by aligning prices with fundamental values.

Conclusion: Choosing Between Law of One Price and No-arbitrage

The Law of One Price establishes a fundamental benchmark that identical goods must sell for the same price in efficient markets, ensuring price uniformity. The No-arbitrage condition extends this principle by preventing riskless profit opportunities, thus encompassing a broader range of financial assets beyond identical goods. Choosing between them depends on the application scope: use the Law of One Price for commodity pricing and the No-arbitrage condition for complex financial instruments and derivative markets.

Law of One Price Infographic

libterm.com

libterm.com