Systemic risk refers to the potential collapse of an entire financial system or market due to the failure of a single entity or group, causing widespread economic disruption. Understanding how systemic risk spreads and impacts various sectors is crucial for developing effective regulatory policies and safeguarding your investments. Explore the rest of the article to learn how systemic risk can be identified and managed.

Table of Comparison

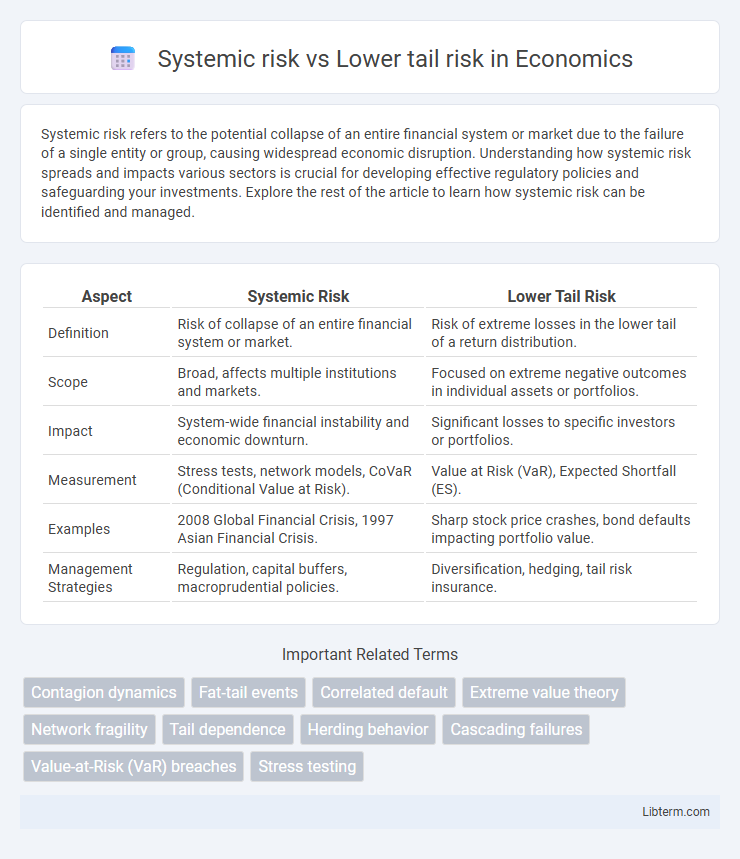

| Aspect | Systemic Risk | Lower Tail Risk |

|---|---|---|

| Definition | Risk of collapse of an entire financial system or market. | Risk of extreme losses in the lower tail of a return distribution. |

| Scope | Broad, affects multiple institutions and markets. | Focused on extreme negative outcomes in individual assets or portfolios. |

| Impact | System-wide financial instability and economic downturn. | Significant losses to specific investors or portfolios. |

| Measurement | Stress tests, network models, CoVaR (Conditional Value at Risk). | Value at Risk (VaR), Expected Shortfall (ES). |

| Examples | 2008 Global Financial Crisis, 1997 Asian Financial Crisis. | Sharp stock price crashes, bond defaults impacting portfolio value. |

| Management Strategies | Regulation, capital buffers, macroprudential policies. | Diversification, hedging, tail risk insurance. |

Introduction to Systemic Risk and Lower Tail Risk

Systemic risk refers to the potential collapse of an entire financial system or market, triggered by the interconnectedness of institutions and the propagation of distress across the economy. Lower tail risk focuses specifically on extreme negative outcomes in the lower tail of a probability distribution, representing rare but severe losses in asset returns or investment portfolios. Understanding systemic risk involves analyzing contagion effects and macroeconomic vulnerabilities, while lower tail risk emphasizes the statistical assessment of extreme adverse events to manage and mitigate potential financial shocks.

Defining Systemic Risk: Scope and Impact

Systemic risk refers to the potential collapse or dysfunction of an entire financial system or market, triggered by the failure of one or more significant entities or events, resulting in widespread economic consequences. Unlike lower tail risk, which captures the probability of extreme losses in an individual asset or portfolio, systemic risk encompasses interconnectedness and contagion effects across institutions and markets. Understanding systemic risk involves assessing the scope of contagion channels, interdependencies, and the potential for large-scale disruptions impacting global financial stability.

Understanding Lower Tail Risk in Finance

Lower tail risk in finance specifically measures the probability and impact of extreme negative returns falling into the worst-performing segment of an investment's return distribution, capturing potential losses beyond standard volatility metrics. Systemic risk, contrastingly, refers to the risk of collapse within an entire financial system or market, often triggered by interconnected failures among institutions. Understanding lower tail risk is crucial for portfolio managers aiming to safeguard assets during rare but severe market downturns that systemic risk factors may exacerbate.

Key Differences Between Systemic and Lower Tail Risks

Systemic risk involves the potential for an entire financial system or market to collapse due to interconnected vulnerabilities among institutions, whereas lower tail risk specifically pertains to extreme negative outcomes in the distribution of asset returns. Systemic risk affects the broader economy and financial stability, often linked to contagion effects and large-scale defaults, while lower tail risk focuses on the probability and impact of rare, severe losses in individual portfolios or assets. Measurement of systemic risk uses indicators like CoVaR and systemic risk indexes, contrasting with lower tail risk metrics such as Value at Risk (VaR) and Expected Shortfall (ES) at extreme quantiles.

Sources and Triggers of Systemic Risk

Systemic risk originates from interconnected financial institutions, market dependencies, and macroeconomic shocks that can disrupt the entire financial system, often triggered by the failure of a major bank or a widespread loss of confidence. Lower tail risk, contrastingly, pertains to extreme negative outcomes in specific asset returns or portfolios rather than the whole system's collapse. Key sources of systemic risk include leverage buildup, liquidity shortages, and regulatory failures, while triggers often encompass credit defaults, asset price crashes, or sudden policy changes.

Identifying Lower Tail Events in Financial Markets

Lower tail risk in financial markets refers to the probability of extreme negative returns that lie in the lower tail of a return distribution, often signaling rapid asset value declines. Identifying lower tail events involves statistical techniques such as Value at Risk (VaR) and Conditional VaR (CVaR), which focus explicitly on tail quantiles to measure potential losses during market downturns. Unlike systemic risk, which deals with the risk of widespread financial system failure, lower tail risk emphasizes localized, severe losses typically impacting specific assets or portfolios.

Measurement Techniques for Systemic and Lower Tail Risks

Measurement techniques for systemic risk frequently involve network analysis and stress testing to capture interconnectedness and contagion effects within financial systems. Lower tail risk is often assessed using Value at Risk (VaR) and Expected Shortfall (ES), focusing on extreme losses beyond a certain quantile of the loss distribution. Advanced models such as CoVaR and Marginal Expected Shortfall (MES) integrate both systemic risk and lower tail dependencies to identify institutions' vulnerability during market downturns.

Mitigation Strategies for Systemic and Lower Tail Risks

Mitigation strategies for systemic risk emphasize enhancing financial system resilience through robust regulatory frameworks, improved risk monitoring, and diversified asset portfolios to prevent widespread failures. Lower tail risk mitigation involves stress testing, tail risk hedging using options or derivatives, and maintaining capital reserves to manage extreme negative outcomes in individual investments or sectors. Both approaches prioritize proactive risk identification and capital adequacy to minimize potential cascading impacts on the broader economy.

Real-World Examples: Systemic vs. Lower Tail Risk Events

Systemic risk is exemplified by the 2008 global financial crisis, where the collapse of Lehman Brothers triggered widespread banking failures and market contagion, highlighting interconnected financial systems' vulnerabilities. Lower tail risk is observed in events such as sudden stock price crashes, like the 1987 Black Monday, where extreme negative returns cause significant losses to individual portfolios without necessarily threatening the entire financial system. Understanding these real-world examples clarifies how systemic risk impacts broader economic stability, while lower tail risk primarily affects individual asset returns and investor portfolios.

Implications for Risk Management and Regulation

Systemic risk represents the potential collapse of an entire financial system, necessitating regulatory frameworks that emphasize interconnectedness and financial stability to prevent cascading failures. Lower tail risk involves extreme negative outcomes in individual asset returns, guiding risk management towards stress testing, tail-risk hedging, and robust capital buffers. Effective regulation balances systemic risk oversight with targeted measures addressing lower tail events to enhance resilience across financial institutions.

Systemic risk Infographic

libterm.com

libterm.com