Deep market analysis reveals hidden trends and opportunities that are often overlooked by surface-level research, providing a competitive edge for investors and businesses alike. Understanding the layers of buyer behavior, supply dynamics, and pricing strategies allows you to make informed decisions that maximize returns and minimize risks. Explore the full article to uncover how deep market insights can transform your investment approach.

Table of Comparison

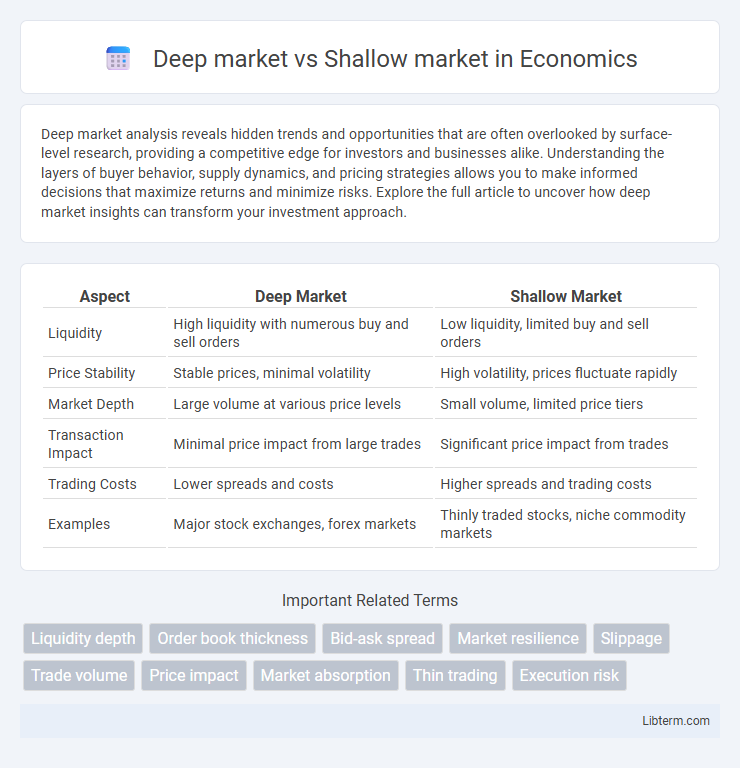

| Aspect | Deep Market | Shallow Market |

|---|---|---|

| Liquidity | High liquidity with numerous buy and sell orders | Low liquidity, limited buy and sell orders |

| Price Stability | Stable prices, minimal volatility | High volatility, prices fluctuate rapidly |

| Market Depth | Large volume at various price levels | Small volume, limited price tiers |

| Transaction Impact | Minimal price impact from large trades | Significant price impact from trades |

| Trading Costs | Lower spreads and costs | Higher spreads and trading costs |

| Examples | Major stock exchanges, forex markets | Thinly traded stocks, niche commodity markets |

Understanding Deep and Shallow Markets

Deep markets exhibit high liquidity with numerous buy and sell orders at various price levels, ensuring minimal price impact during large transactions. Shallow markets have limited trading volume and fewer orders, causing significant price volatility and wider bid-ask spreads. Understanding these market depths is crucial for investors to manage risk and execute trades efficiently.

Key Characteristics of Deep Markets

Deep markets exhibit high liquidity, featuring large volumes of buy and sell orders that enable smooth transactions without significant price impact. They possess a diverse range of participants, including institutional investors and retail traders, contributing to market stability and tighter bid-ask spreads. Price discovery is efficient in deep markets, reflecting accurate asset values due to continuous trading activity and ample market depth.

Key Attributes of Shallow Markets

Shallow markets are characterized by low liquidity, limited trading volume, and a small number of buyers and sellers, which leads to higher volatility and price fluctuations. These markets often experience wider bid-ask spreads and reduced market efficiency due to fewer participants and less frequent transactions. Shallow markets typically lack depth in order books, making large orders more likely to impact prices significantly.

Liquidity Differences Between Deep and Shallow Markets

Deep markets exhibit high liquidity characterized by a large volume of buy and sell orders, enabling smooth execution of large trades without significant price impact. Shallow markets have low liquidity, resulting in wider bid-ask spreads and increased price volatility due to limited order flow and fewer market participants. The liquidity disparity affects transaction costs, market stability, and the ability to enter or exit positions efficiently.

Price Volatility in Deep vs Shallow Markets

Deep markets exhibit lower price volatility due to high liquidity and large volumes of buy and sell orders, allowing price changes to be absorbed smoothly. In contrast, shallow markets have higher price volatility because limited liquidity and thin order books cause prices to fluctuate sharply with relatively small trades. Traders in shallow markets face increased risks of sudden price swings, impacting market stability and execution costs.

Impact on Traders: Deep Market vs Shallow Market

A deep market, characterized by high liquidity and substantial trading volume, allows traders to execute large orders with minimal price impact, reducing slippage and enhancing trade efficiency. Conversely, a shallow market has limited liquidity and trading activity, causing significant price fluctuations and higher slippage when executing sizeable trades, increasing trading risks. Traders in deep markets benefit from tighter bid-ask spreads and more stable pricing, while those in shallow markets face greater volatility and execution challenges.

Examples of Deep Markets in the Financial World

Deep markets in the financial world include major stock exchanges such as the New York Stock Exchange (NYSE) and the NASDAQ, where high liquidity and large trading volumes enable smooth execution of large orders without significant price impact. Foreign exchange (Forex) markets, particularly the EUR/USD currency pair, exemplify deep markets with continuous trading and vast participation from banks, corporations, and investors globally. Government bond markets, such as U.S. Treasuries, also represent deep markets due to their high liquidity and critical role in global finance.

Common Examples of Shallow Markets

Common examples of shallow markets include niche collectibles, small-cap stocks, and certain real estate segments in less populated areas, where limited buyers and sellers result in low trading volumes and higher price volatility. These markets often experience wider bid-ask spreads and reduced liquidity, making transactions more difficult and expensive compared to deep markets like major currency exchanges or large-cap equities. Investors in shallow markets face increased risk due to potential price manipulation and difficulty in executing large orders without significant market impact.

Market Depth and Its Measurement Tools

Market depth represents the volume of buy and sell orders at various price levels, reflecting liquidity and potential price stability in trading environments. Deep markets have extensive order books with significant volume across multiple price points, allowing for large trades with minimal price impact, whereas shallow markets feature limited order quantities, leading to higher volatility and slippage risk. Measurement tools such as Level II quotes, order book analysis, and the bid-ask spread provide insights into market depth by revealing the concentration and distribution of orders, enabling traders to assess liquidity and execution risk effectively.

Strategies for Trading in Deep and Shallow Markets

Trading in deep markets involves leveraging high liquidity and narrow bid-ask spreads to execute large orders with minimal price impact, often using algorithmic strategies and limit orders for optimal entry and exit points. In contrast, shallow markets require traders to implement cautious position sizing, employ stop-loss orders, and favor shorter holding periods to mitigate risks from higher volatility and wider spreads. Understanding market depth data and order book dynamics is essential for tailoring strategies that maximize profitability in both deep and shallow trading environments.

Deep market Infographic

libterm.com

libterm.com