Efficient markets reflect prices that fully incorporate all available information, ensuring assets are fairly valued at any given time. This concept impacts your investment strategies by reducing opportunities for consistently outperforming the market through stock picking or market timing. Discover how understanding market efficiency can enhance your financial decision-making in the rest of this article.

Table of Comparison

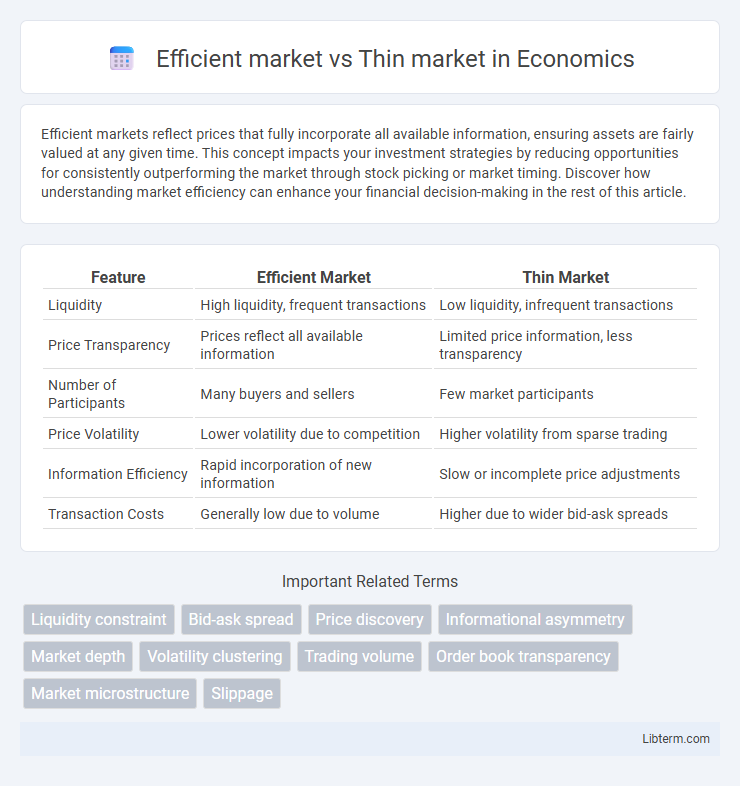

| Feature | Efficient Market | Thin Market |

|---|---|---|

| Liquidity | High liquidity, frequent transactions | Low liquidity, infrequent transactions |

| Price Transparency | Prices reflect all available information | Limited price information, less transparency |

| Number of Participants | Many buyers and sellers | Few market participants |

| Price Volatility | Lower volatility due to competition | Higher volatility from sparse trading |

| Information Efficiency | Rapid incorporation of new information | Slow or incomplete price adjustments |

| Transaction Costs | Generally low due to volume | Higher due to wider bid-ask spreads |

Introduction to Efficient and Thin Markets

Efficient markets are characterized by rapid price adjustments reflecting all available information, ensuring assets are fairly valued and minimizing arbitrage opportunities. Thin markets, on the other hand, have low trading volume and limited liquidity, causing price inefficiencies and increased volatility due to fewer buyers and sellers. Understanding these market structures is crucial for investment strategies, liquidity management, and assessing risk exposure.

Key Characteristics of Efficient Markets

Efficient markets are characterized by high liquidity, rapid dissemination of information, and numerous active participants ensuring asset prices reflect all available data almost instantly. These markets feature minimal transaction costs and tight bid-ask spreads, facilitating smooth buy and sell operations. Price adjustments in efficient markets occur swiftly in response to new information, maintaining fair value and reducing opportunities for arbitrage.

Key Characteristics of Thin Markets

Thin markets exhibit low trading volumes, limited liquidity, and wide bid-ask spreads, resulting in higher transaction costs and price volatility. These markets often lack sufficient participants, causing difficulty in executing large orders without significant price impact. Information asymmetry is more pronounced in thin markets, leading to less efficient price discovery compared to efficient markets.

Liquidity Differences: Efficient vs Thin Markets

Efficient markets exhibit high liquidity characterized by rapid trade execution, tight bid-ask spreads, and significant transaction volumes, facilitating seamless asset buying and selling. Thin markets, in contrast, suffer from low liquidity, where infrequent trading leads to wider bid-ask spreads, increased price volatility, and difficulty in executing large orders without influencing prices. The stark liquidity differences directly impact market efficiency, price discovery accuracy, and investor ability to enter or exit positions swiftly.

Price Discovery Mechanisms

Efficient markets exhibit rapid and accurate price discovery mechanisms due to high liquidity, numerous participants, and readily available information, allowing asset prices to quickly reflect all known data. Thin markets, characterized by low liquidity and fewer participants, experience slower price discovery, increased price volatility, and wider bid-ask spreads as limited trades reduce the ability to incorporate new information efficiently. The effectiveness of price discovery in these markets significantly impacts asset valuation accuracy and market transparency.

Impact on Trading Strategies

Efficient markets, characterized by high liquidity and rapid information dissemination, reduce opportunities for arbitrage and require trading strategies to focus on passive indexing or short-term momentum tactics. Thin markets, with low liquidity and wider bid-ask spreads, increase risks of price manipulation and slippage, compelling traders to adopt careful limit orders, reduced trade sizes, and longer holding periods to manage execution costs. Understanding market efficiency level directly impacts risk management, order execution, and expected return profiles in trading strategy development.

Market Volatility Comparison

Efficient markets exhibit lower volatility due to high liquidity and rapid information dissemination, allowing asset prices to reflect true value accurately. Thin markets experience greater volatility as low trading volume and limited participation amplify price fluctuations and delay information absorption. The disparity in market depth directly influences the stability and predictability of price movements between these two market types.

Risks and Challenges in Thin Markets

Thin markets face significant risks due to low liquidity, leading to higher price volatility and difficulty in executing large trades without impacting prices. These markets present challenges such as limited market depth, increased bid-ask spreads, and greater susceptibility to manipulation, which can erode investor confidence. The scarcity of buyers and sellers in thin markets intensifies uncertainty, making risk assessment and price discovery less reliable compared to efficient markets.

Regulatory Implications for Both Markets

Efficient markets exhibit high liquidity and transparency, facilitating accurate price discovery and reducing the need for stringent regulatory oversight to prevent market manipulation. Thin markets, characterized by low trading volume and limited participant diversity, require enhanced regulatory measures to ensure fair pricing, prevent price manipulation, and maintain investor confidence. Regulators must tailor policies to market conditions, enforcing stricter disclosure requirements and transaction reporting in thin markets while focusing on market integrity and systemic risk in efficient markets.

Conclusion: Choosing the Right Market

Selecting between an efficient market and a thin market depends on investment goals, risk tolerance, and liquidity needs. Efficient markets offer high liquidity, tighter spreads, and quicker price discovery, ideal for active trading and diversification. Thin markets may provide unique opportunities due to less competition but pose higher risks from price volatility and limited buyers or sellers.

Efficient market Infographic

libterm.com

libterm.com