Quantitative easing (QE) is a monetary policy where central banks purchase long-term securities to inject liquidity into the economy, aiming to lower interest rates and stimulate borrowing and investment. This strategy can influence inflation, asset prices, and overall economic growth, affecting your financial decisions and market dynamics. Explore the rest of the article to understand how quantitative easing impacts your economy and investments.

Table of Comparison

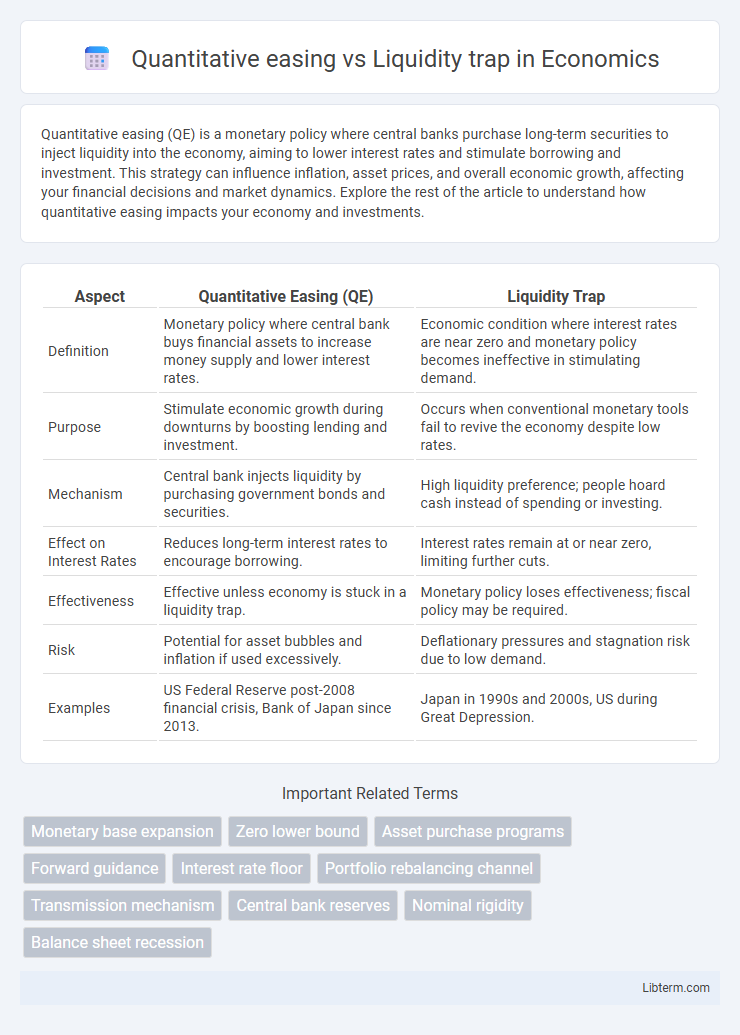

| Aspect | Quantitative Easing (QE) | Liquidity Trap |

|---|---|---|

| Definition | Monetary policy where central bank buys financial assets to increase money supply and lower interest rates. | Economic condition where interest rates are near zero and monetary policy becomes ineffective in stimulating demand. |

| Purpose | Stimulate economic growth during downturns by boosting lending and investment. | Occurs when conventional monetary tools fail to revive the economy despite low rates. |

| Mechanism | Central bank injects liquidity by purchasing government bonds and securities. | High liquidity preference; people hoard cash instead of spending or investing. |

| Effect on Interest Rates | Reduces long-term interest rates to encourage borrowing. | Interest rates remain at or near zero, limiting further cuts. |

| Effectiveness | Effective unless economy is stuck in a liquidity trap. | Monetary policy loses effectiveness; fiscal policy may be required. |

| Risk | Potential for asset bubbles and inflation if used excessively. | Deflationary pressures and stagnation risk due to low demand. |

| Examples | US Federal Reserve post-2008 financial crisis, Bank of Japan since 2013. | Japan in 1990s and 2000s, US during Great Depression. |

Introduction to Quantitative Easing and Liquidity Trap

Quantitative easing (QE) is a monetary policy tool where central banks purchase long-term securities to inject liquidity into the financial system, aiming to lower interest rates and stimulate economic growth. A liquidity trap occurs when interest rates are near zero, and despite increased money supply from policies like QE, consumers and businesses hoard cash rather than invest or spend, rendering monetary policy ineffective. Understanding the interplay between QE and liquidity traps is crucial for designing strategies that address economic stagnation during low-interest-rate environments.

Defining Quantitative Easing: Purpose and Mechanism

Quantitative easing (QE) is a monetary policy tool used by central banks to stimulate the economy by purchasing long-term securities, thereby increasing the money supply and lowering interest rates. Its primary purpose is to encourage borrowing and investment when conventional monetary policy becomes ineffective, especially during periods of low inflation and sluggish growth. QE aims to avoid a liquidity trap, a situation where interest rates are near zero and monetary policy fails to boost economic activity despite abundant liquidity.

Understanding the Liquidity Trap: Key Characteristics

A liquidity trap occurs when interest rates are near zero and monetary policy loses effectiveness as people hoard cash instead of investing or spending, rendering quantitative easing less impactful. In this situation, despite central banks increasing the money supply through asset purchases, expected returns remain low, leading to stagnant demand and economic stagnation. Key characteristics include a flat or upward-sloping demand for money curve and diminished sensitivity of investment to interest rates, highlighting the limitations of traditional monetary policy tools.

Historical Context: Instances of QE and Liquidity Traps

During the 2008 global financial crisis, the Federal Reserve implemented quantitative easing (QE) by purchasing large-scale assets to inject liquidity and stimulate economic growth, reflecting a direct response to a severe liquidity trap where traditional monetary policies failed. Japan's prolonged deflationary period since the 1990s exemplifies a classic liquidity trap, with the Bank of Japan repeatedly deploying QE measures, including negative interest rates and massive government bond purchases, yet struggling to revive demand. The European Central Bank's QE in the 2010s aimed to counteract stagnation and near-zero interest rates across the Eurozone, illustrating the challenge of escaping liquidity traps in advanced economies with persistent low inflation.

Central Bank Strategies: QE Implementation During Economic Slumps

Quantitative easing (QE) is a central bank strategy aimed at stimulating the economy by purchasing financial assets to increase money supply and lower interest rates during economic slumps. In contrast, a liquidity trap occurs when interest rates approach zero, rendering traditional monetary policy ineffective as consumers and businesses hoard cash instead of investing. Central banks implement QE to overcome liquidity traps by directly injecting liquidity into the financial system, encouraging lending and spending to revive economic growth.

Comparing Effects: QE vs. Liquidity Trap on Inflation and Interest Rates

Quantitative easing (QE) typically lowers interest rates and stimulates inflation by increasing the money supply and encouraging lending and investment. In contrast, a liquidity trap occurs when interest rates are near zero and monetary policy loses effectiveness, causing inflation to remain stubbornly low despite central bank efforts. While QE aims to boost inflation and reduce borrowing costs, a liquidity trap limits these effects, resulting in persistently low inflation and stagnant interest rates.

Implications for Financial Markets and Asset Prices

Quantitative easing (QE) increases money supply by central banks purchasing financial assets, aiming to lower interest rates and boost asset prices, thereby stimulating investment and consumption. In a liquidity trap, despite near-zero interest rates and abundant liquidity, demand for borrowing remains weak, limiting QE's effectiveness in driving economic growth or inflating asset prices. Financial markets may experience subdued confidence and muted asset price increases during a liquidity trap, contrasting with the typically bullish impacts of QE in normal economic conditions.

Challenges and Criticisms of Quantitative Easing in a Liquidity Trap

Quantitative easing (QE) faces significant challenges in a liquidity trap as low interest rates fail to stimulate borrowing and spending despite increased money supply. Critics argue that QE can lead to asset bubbles and exacerbate income inequality without effectively boosting real economic growth during such periods. Moreover, the diminished effectiveness of QE in a liquidity trap raises concerns about its long-term impact on central bank balance sheets and financial stability.

Policy Alternatives to Overcome Liquidity Traps

Quantitative easing (QE) aims to stimulate economic activity by increasing money supply through large-scale asset purchases, but it may lose effectiveness during a liquidity trap when interest rates are near zero and monetary policy transmission weakens. Policy alternatives to overcome liquidity traps include fiscal stimulus, such as direct government spending or tax cuts, which can boost demand independently of interest rates. Furthermore, negative interest rate policies and forward guidance can help lower real interest rates and influence expectations, encouraging investment and consumption despite constrained monetary policy.

Conclusion: Evaluating QE’s Effectiveness Amidst Liquidity Traps

Quantitative easing (QE) shows limited effectiveness in a liquidity trap because the excess money supply fails to stimulate demand or increase inflation expectations. Central banks' asset purchases struggle to lower long-term interest rates further when rates are already near zero, reducing QE's traditional transmission mechanisms. Therefore, fiscal policy and structural reforms often become essential complements to QE in overcoming prolonged economic stagnation within liquidity traps.

Quantitative easing Infographic

libterm.com

libterm.com