Liquidity mismatch occurs when a company's short-term liabilities exceed its liquid assets, creating a risk of insufficient cash flow to meet immediate obligations. This imbalance can lead to financial strain, impacting operational stability and creditworthiness. Explore how managing liquidity mismatch effectively can safeguard your business by reading the rest of the article.

Table of Comparison

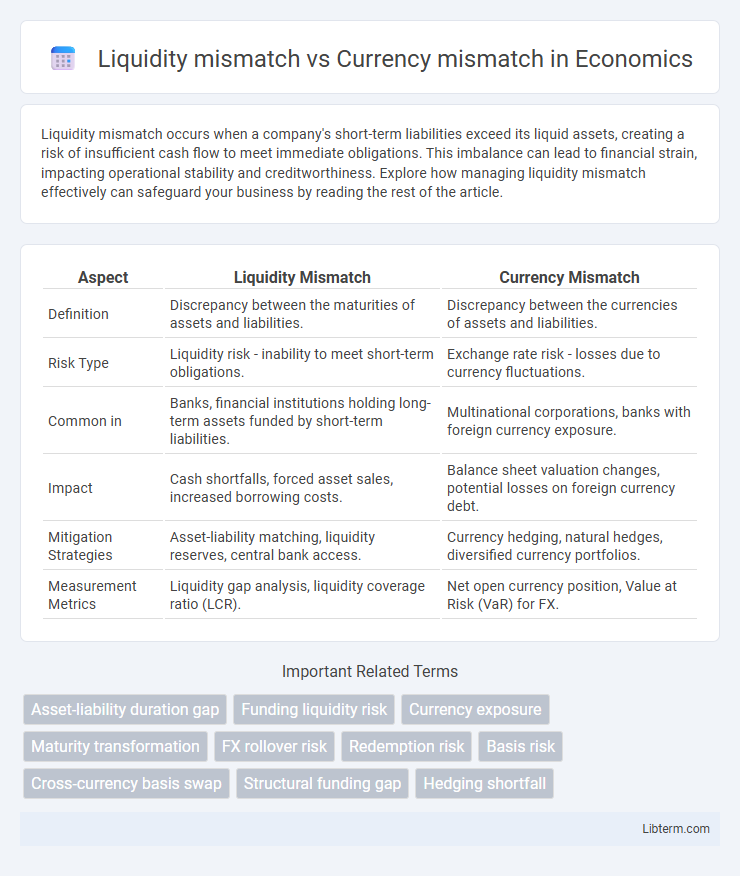

| Aspect | Liquidity Mismatch | Currency Mismatch |

|---|---|---|

| Definition | Discrepancy between the maturities of assets and liabilities. | Discrepancy between the currencies of assets and liabilities. |

| Risk Type | Liquidity risk - inability to meet short-term obligations. | Exchange rate risk - losses due to currency fluctuations. |

| Common in | Banks, financial institutions holding long-term assets funded by short-term liabilities. | Multinational corporations, banks with foreign currency exposure. |

| Impact | Cash shortfalls, forced asset sales, increased borrowing costs. | Balance sheet valuation changes, potential losses on foreign currency debt. |

| Mitigation Strategies | Asset-liability matching, liquidity reserves, central bank access. | Currency hedging, natural hedges, diversified currency portfolios. |

| Measurement Metrics | Liquidity gap analysis, liquidity coverage ratio (LCR). | Net open currency position, Value at Risk (VaR) for FX. |

Understanding Liquidity Mismatch

Liquidity mismatch occurs when an entity's short-term obligations exceed its liquid assets, leading to potential cash flow problems during times of financial stress. This situation arises when liabilities mature faster than assets can be converted into cash without significant loss. Understanding liquidity mismatch is crucial for managing financial risk, ensuring firms maintain sufficient liquid reserves to meet immediate demands while balancing long-term investments.

Defining Currency Mismatch

Currency mismatch occurs when a firm's assets and liabilities are denominated in different currencies, exposing it to exchange rate risk that can impact its financial stability. Liquidity mismatch refers to the gap between the maturities of assets and liabilities, affecting the ability to meet short-term obligations. While liquidity mismatch focuses on timing differences, currency mismatch centers on the risk arising from fluctuating foreign exchange rates.

Key Differences Between Liquidity and Currency Mismatches

Liquidity mismatch occurs when short-term liabilities exceed liquid assets, leading to potential cash flow crises, while currency mismatch arises from assets and liabilities being denominated in different currencies, exposing entities to exchange rate risk. The key difference lies in liquidity mismatch impacting an organization's immediate solvency and operational stability, whereas currency mismatch affects financial performance through foreign exchange fluctuations. Effective risk management requires distinct strategies: liquidity mismatch demands adequate liquid reserves and cash flow planning, whereas currency mismatch calls for hedging and currency diversification.

Common Causes of Liquidity Mismatch

Common causes of liquidity mismatch include asset-liability duration gaps where short-term liabilities exceed liquid assets, causing funding shortfalls during cash outflows. Another key factor is reliance on unstable funding sources such as wholesale deposits or short-term borrowings that can be withdrawn quickly during market stress. Poor cash flow forecasting and inadequate liquidity buffers further exacerbate the inability to meet immediate obligations, leading to liquidity strain.

Typical Sources of Currency Mismatch

Typical sources of currency mismatch arise from cross-border trade, foreign currency-denominated borrowing, and investments in assets priced in different currencies. Multinational companies often face currency mismatch when their revenues are in one currency but liabilities and expenses are denominated in another. Central banks and financial institutions encounter currency mismatches due to reserve management and lending practices involving multiple currencies.

Risks Associated with Liquidity Mismatch

Liquidity mismatch risk arises when an institution's short-term liabilities exceed its liquid assets, creating potential cash flow problems during periods of financial stress. This risk can force forced asset sales at unfavorable prices, increasing market risk and potentially triggering insolvency. Managing liquidity mismatch is essential to maintaining operational stability and avoiding adverse impacts on profitability and creditworthiness.

Risks Stemming from Currency Mismatch

Currency mismatch risk arises when a country's foreign currency liabilities exceed its foreign currency assets, exposing borrowers to exchange rate volatility and potential default. This risk can trigger sudden capital outflows, sharp depreciation of the domestic currency, and liquidity shortages in foreign currencies. Managing currency mismatch is crucial to maintaining financial stability and preventing crises linked to debt repayment in devalued currencies.

Real-World Examples of Liquidity vs Currency Mismatches

Liquidity mismatch occurs when short-term liabilities exceed liquid assets, exemplified by the 2008 Lehman Brothers collapse where inability to meet immediate obligations triggered insolvency. Currency mismatch involves assets and liabilities denominated in different currencies, as seen in Argentina's 2001 crisis when peso-debt holders faced foreign currency redenomination risks causing massive default. Real-world examples demonstrate liquidity mismatch primarily impacts cash flow timing, while currency mismatch exposes entities to exchange rate volatility and potential solvency risk.

Strategies for Managing Liquidity and Currency Mismatches

Effective strategies for managing liquidity mismatches involve maintaining adequate cash reserves, utilizing short-term borrowing facilities, and implementing robust cash flow forecasting to ensure obligations are met promptly. To address currency mismatches, hedging instruments such as forward contracts, options, and swaps are commonly employed to mitigate exchange rate risks and stabilize cash flows. Combined liquidity and currency risk management enhances financial resilience by aligning asset-liability profiles with market conditions and currency exposures.

Regulatory Approaches and Market Best Practices

Liquidity mismatch, where asset maturities and liabilities differ, is addressed by regulatory frameworks like Basel III, enforcing liquidity coverage ratios (LCR) and net stable funding ratios (NSFR) to ensure banks maintain sufficient high-quality liquid assets. Currency mismatch, arising from asset and liability denomination discrepancies, prompts supervisory guidelines requiring robust foreign exchange risk management, including limits on open currency positions and stress testing under varying exchange rate scenarios. Market best practices emphasize scenario analysis, continuous monitoring, and the use of natural hedging or derivatives to mitigate both liquidity and currency mismatches effectively.

Liquidity mismatch Infographic

libterm.com

libterm.com