Precautionary saving is the practice of setting aside extra funds to protect against unexpected financial hardships or emergencies. It helps create a financial buffer that ensures stability during uncertain times by covering unforeseen expenses such as medical bills, job loss, or urgent repairs. Discover how building precautionary savings can secure your financial future by reading the rest of this article.

Table of Comparison

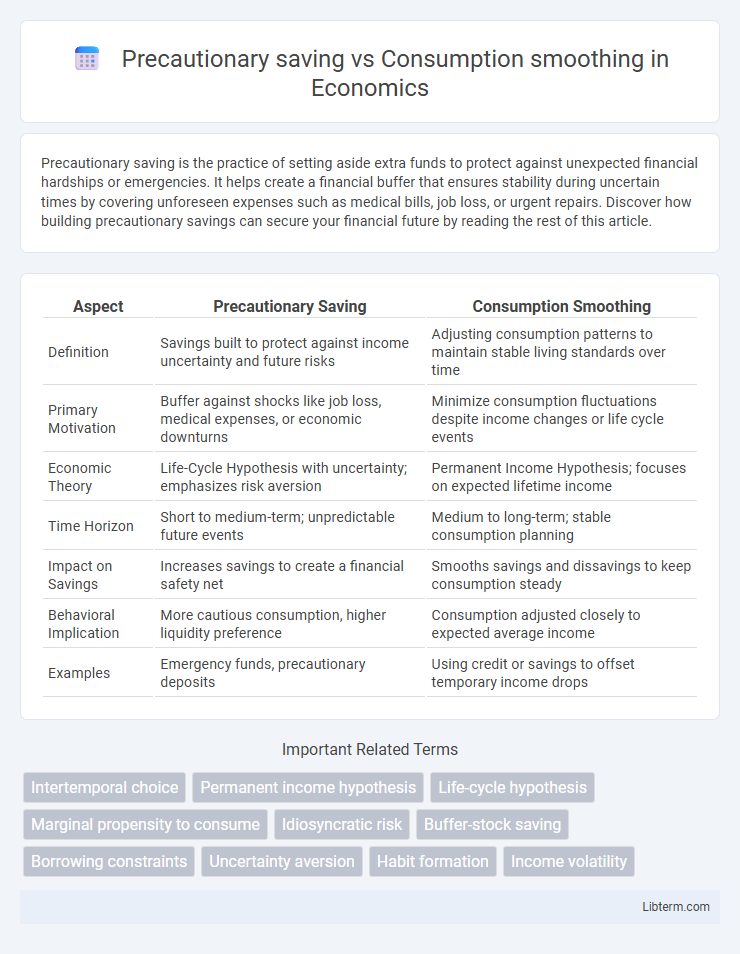

| Aspect | Precautionary Saving | Consumption Smoothing |

|---|---|---|

| Definition | Savings built to protect against income uncertainty and future risks | Adjusting consumption patterns to maintain stable living standards over time |

| Primary Motivation | Buffer against shocks like job loss, medical expenses, or economic downturns | Minimize consumption fluctuations despite income changes or life cycle events |

| Economic Theory | Life-Cycle Hypothesis with uncertainty; emphasizes risk aversion | Permanent Income Hypothesis; focuses on expected lifetime income |

| Time Horizon | Short to medium-term; unpredictable future events | Medium to long-term; stable consumption planning |

| Impact on Savings | Increases savings to create a financial safety net | Smooths savings and dissavings to keep consumption steady |

| Behavioral Implication | More cautious consumption, higher liquidity preference | Consumption adjusted closely to expected average income |

| Examples | Emergency funds, precautionary deposits | Using credit or savings to offset temporary income drops |

Introduction to Precautionary Saving and Consumption Smoothing

Precautionary saving refers to the extra savings accumulated to protect against future income uncertainty and unexpected expenses, serving as a financial buffer. Consumption smoothing aims to maintain a stable consumption level over time by adjusting savings and borrowing in response to income fluctuations. Both concepts are integral to understanding individual financial behavior under uncertainty, with precautionary saving emphasizing risk aversion and consumption smoothing focusing on intertemporal welfare optimization.

Defining Precautionary Saving

Precautionary saving refers to the extra saving accumulated by individuals to guard against future income uncertainty or unexpected expenses, ensuring financial security during economic downturns or personal shocks. This behavior contrasts with consumption smoothing, where individuals plan spending to maintain a stable consumption level over time despite income fluctuations. Precautionary saving is driven by risk aversion and the desire to buffer against unpredictable financial risks, leading to greater savings than would be required for planned future consumption alone.

Understanding Consumption Smoothing

Consumption smoothing involves managing income and expenditure to maintain a stable standard of living despite fluctuations in income. It relies on mechanisms like savings, credit, or insurance to allocate resources over time, reducing the impact of temporary income shocks. This concept is essential for households to avoid drastic changes in consumption patterns and sustain financial well-being.

Key Differences Between Precautionary Saving and Consumption Smoothing

Precautionary saving involves setting aside extra funds to guard against future income uncertainty or unexpected expenses, emphasizing risk mitigation and financial security. Consumption smoothing aims to maintain a stable level of consumption over time despite income fluctuations, focusing on optimizing utility by balancing spending and saving. While precautionary saving prioritizes building a buffer for potential shocks, consumption smoothing centers on consistent consumption patterns across varying income periods.

Factors Influencing Precautionary Saving Decisions

Precautionary saving decisions are primarily influenced by income uncertainty, risk tolerance, and access to credit, driving households to accumulate savings as a buffer against future shocks. Factors such as unpredictable medical expenses, job loss risk, and economic volatility increase the demand for precautionary savings compared to consumption smoothing, which aims to stabilize consumption over time. Wealth levels, social safety nets, and degree of financial literacy also play crucial roles in determining the extent of precautionary saving behavior.

The Role of Income Uncertainty in Consumption Smoothing

Income uncertainty plays a critical role in consumption smoothing by motivating households to engage in precautionary saving, which acts as a buffer against unpredictable income shocks. When future earnings are volatile or uncertain, individuals allocate a portion of their current income to savings to maintain stable consumption levels during downturns or periods of financial instability. This behavior helps reduce the need for abrupt consumption adjustments, promoting smoother intertemporal consumption patterns despite income fluctuations.

Behavioral Economics and Saving vs. Spending Choices

Precautionary saving reflects behavioral economics insights where individuals prioritize saving to mitigate future uncertainties, such as income shocks or emergencies, leading to increased financial buffers. Consumption smoothing involves adjusting spending patterns to maintain stable consumption levels despite income fluctuations, driven by the desire for predictable utility over time. Behavioral factors like loss aversion and time inconsistency impact saving versus spending decisions, influencing whether individuals favor immediate consumption or delayed financial security.

Empirical Evidence: Household Financial Behavior

Empirical evidence reveals households engage in precautionary saving to buffer against income shocks, showing higher savings rates during economic uncertainty. Consumption smoothing is observed as families adjust spending to maintain stable consumption levels despite fluctuations in income. Studies using panel data highlight that liquidity constraints and risk aversion significantly influence these financial behaviors in diverse populations.

Policy Implications for Savings and Consumption Patterns

Precautionary saving encourages households to accumulate higher buffers in response to income uncertainty, influencing policy designs aimed at enhancing social safety nets and unemployment insurance to reduce excessive saving and stimulate consumption. Consumption smoothing policies focus on stabilizing consumption by providing reliable credit access and countercyclical fiscal measures, which help maintain consistent spending despite income fluctuations. Policymakers must balance interventions that minimize the need for precautionary savings while promoting effective consumption smoothing to optimize economic demand and financial stability.

Conclusion: Balancing Precautionary Saving and Consumption Smoothing

Balancing precautionary saving and consumption smoothing is essential for financial stability and long-term welfare. Effective management of uncertain income and future risks requires households to maintain a sufficient buffer stock of savings while ensuring stable consumption patterns over time. Optimal strategies vary based on income volatility, risk preferences, and access to credit, highlighting the need for tailored financial planning approaches.

Precautionary saving Infographic

libterm.com

libterm.com