The Quantity Theory of Money explains the relationship between the money supply and price levels in an economy, highlighting how changes in money supply directly impact inflation. It emphasizes that when the money supply grows faster than economic output, prices tend to rise, reducing your purchasing power. Explore the rest of the article to understand how this theory affects monetary policy and your financial decisions.

Table of Comparison

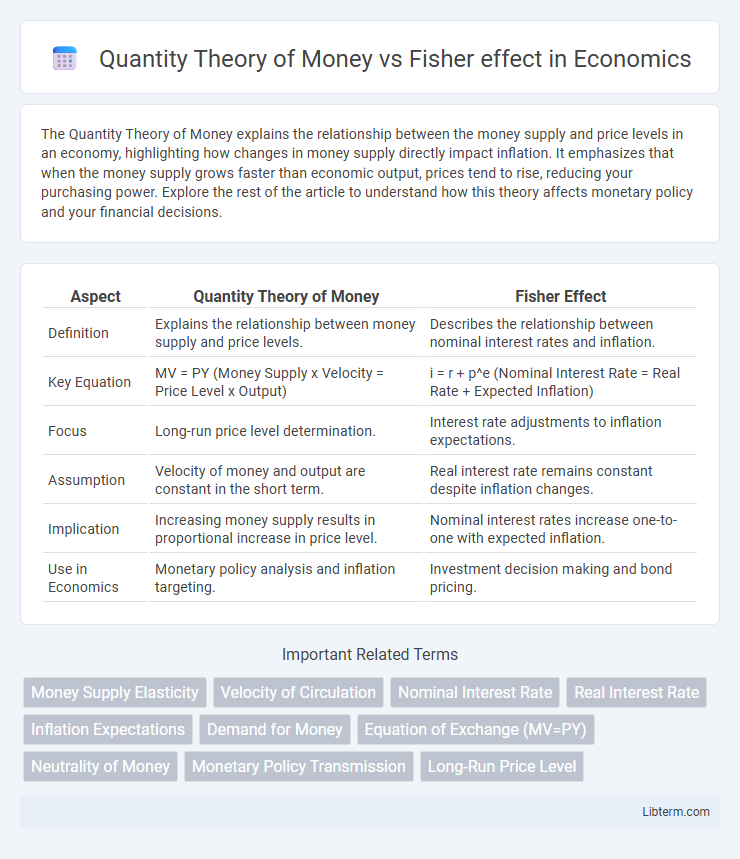

| Aspect | Quantity Theory of Money | Fisher Effect |

|---|---|---|

| Definition | Explains the relationship between money supply and price levels. | Describes the relationship between nominal interest rates and inflation. |

| Key Equation | MV = PY (Money Supply x Velocity = Price Level x Output) | i = r + p^e (Nominal Interest Rate = Real Rate + Expected Inflation) |

| Focus | Long-run price level determination. | Interest rate adjustments to inflation expectations. |

| Assumption | Velocity of money and output are constant in the short term. | Real interest rate remains constant despite inflation changes. |

| Implication | Increasing money supply results in proportional increase in price level. | Nominal interest rates increase one-to-one with expected inflation. |

| Use in Economics | Monetary policy analysis and inflation targeting. | Investment decision making and bond pricing. |

Introduction to the Quantity Theory of Money

The Quantity Theory of Money explains the relationship between money supply and the price level by positing that an increase in money supply leads to a proportional rise in prices, assuming velocity and output remain constant. This theory is encapsulated in the equation MV = PY, where M is money supply, V is velocity, P is price level, and Y is real output. Unlike the Fisher effect, which focuses on the relationship between nominal interest rates and inflation expectations, the Quantity Theory of Money emphasizes the direct impact of money supply on inflation.

Core Principles of the Fisher Effect

The Fisher effect centers on the relationship between nominal interest rates and expected inflation, positing that nominal rates adjust one-for-one with anticipated inflation to maintain constant real interest rates. Unlike the Quantity Theory of Money, which focuses on the connection between money supply and price levels, the Fisher effect emphasizes how inflation expectations influence interest rates. Core principles include the distinction between nominal and real interest rates and the assertion that real rates remain stable despite changes in inflation forecasts.

Historical Context and Evolution

The Quantity Theory of Money, rooted in classical economics and formalized by Irving Fisher in the early 20th century, explains the relationship between money supply and price levels, emphasizing velocity of money as a key factor. Fisher's work on the Fisher effect extended this understanding by linking nominal interest rates to expected inflation, helping to interpret monetary policy's impact on interest rates over time. Both theories evolved through historical economic fluctuations, such as the Great Depression and post-WWII inflation, refining their application in modern macroeconomic analysis.

Mathematical Formulations Compared

The Quantity Theory of Money is mathematically expressed as MV = PY, where M represents money supply, V is the velocity of money, P denotes the price level, and Y is real output, illustrating a direct proportionality between money supply and price level assuming V and Y are constant. The Fisher Effect formulates the relationship between nominal interest rate (i), real interest rate (r), and inflation rate (p) as i = r + p, emphasizing how expected inflation drives nominal rates upward while the real interest rate remains stable. Comparing these formulations reveals the Quantity Theory's focus on aggregate price level determination via money supply dynamics, whereas the Fisher Effect links monetary inflation expectations with interest rate adjustments.

Assumptions Underlying Each Theory

The Quantity Theory of Money assumes a direct, proportional relationship between money supply and price levels, holding velocity of money and output constant, while presuming inflation is solely driven by changes in money supply. The Fisher Effect assumes nominal interest rates adjust one-to-one with expected inflation, based on the expectations hypothesis that real interest rates remain stable in the long run. Both theories rely on ceteris paribus conditions but differ in focus: the Quantity Theory emphasizes monetary factors affecting inflation, whereas the Fisher Effect centers on the impact of inflation expectations on nominal interest rates.

Real-World Applications and Case Studies

The Quantity Theory of Money explains inflation dynamics in economies by linking money supply growth to price level changes, exemplified by Zimbabwe's hyperinflation crisis where excessive money printing led to rapid currency devaluation. The Fisher Effect highlights the relationship between nominal interest rates and expected inflation, demonstrated in the U.S. Treasury bond market where nominal yields adjust to reflect inflation expectations and preserve real returns. Central banks incorporate both theories when designing monetary policies to stabilize inflation and interest rates, as seen in the Federal Reserve's response to fluctuating inflation rates during economic shocks.

Differences in Explaining Inflation

The Quantity Theory of Money explains inflation primarily through changes in the money supply, asserting that inflation rises when money supply grows faster than real output. The Fisher effect, in contrast, attributes inflation to expected future inflation rates reflected directly in nominal interest rates, emphasizing the relationship between nominal interest rates and inflation expectations. While the Quantity Theory focuses on real variables and money supply dynamics, the Fisher effect centers on nominal interest rates and the role of inflation expectations in the economy.

Policy Implications and Central Bank Strategies

The Quantity Theory of Money emphasizes controlling money supply to manage inflation, guiding central banks to implement monetary policies that adjust liquidity for price stability. The Fisher effect highlights the relationship between nominal interest rates and expected inflation, prompting central banks to consider inflation expectations in setting interest rates for real return consistency. Integrating both, central banks strategically balance money supply adjustments with interest rate policies to achieve sustainable economic growth and stable inflation targets.

Empirical Evidence and Criticisms

Empirical evidence on the Quantity Theory of Money highlights a strong long-term correlation between money supply growth and inflation rates, but it often overlooks short-run economic fluctuations and velocity changes. The Fisher effect, which posits a one-to-one relationship between nominal interest rates and expected inflation, finds mixed empirical support, with many studies showing partial or delayed adjustment of nominal rates to inflation. Critics argue that both theories oversimplify complex monetary dynamics, neglecting factors like market imperfections, monetary policy interventions, and expectations formation.

Conclusion: Integrating Both Perspectives

The Quantity Theory of Money emphasizes the direct relationship between money supply and price levels, while the Fisher Effect highlights the connection between nominal interest rates and expected inflation. Integrating both perspectives reveals that changes in money supply influence inflation expectations, which in turn affect nominal interest rates, aligning the dynamics of monetary policy with real economic variables. This holistic view enhances economic forecasting and monetary policy formulation by accounting for both price level adjustments and interest rate responses.

Quantity Theory of Money Infographic

libterm.com

libterm.com