A fixed exchange rate system pegs a country's currency value to another major currency or basket of currencies, providing stability in international trade and investment. This arrangement minimizes exchange rate fluctuations but requires the government to actively intervene in foreign exchange markets to maintain the peg. Discover how fixed exchange rates impact your business decisions and global economic strategy in the rest of this article.

Table of Comparison

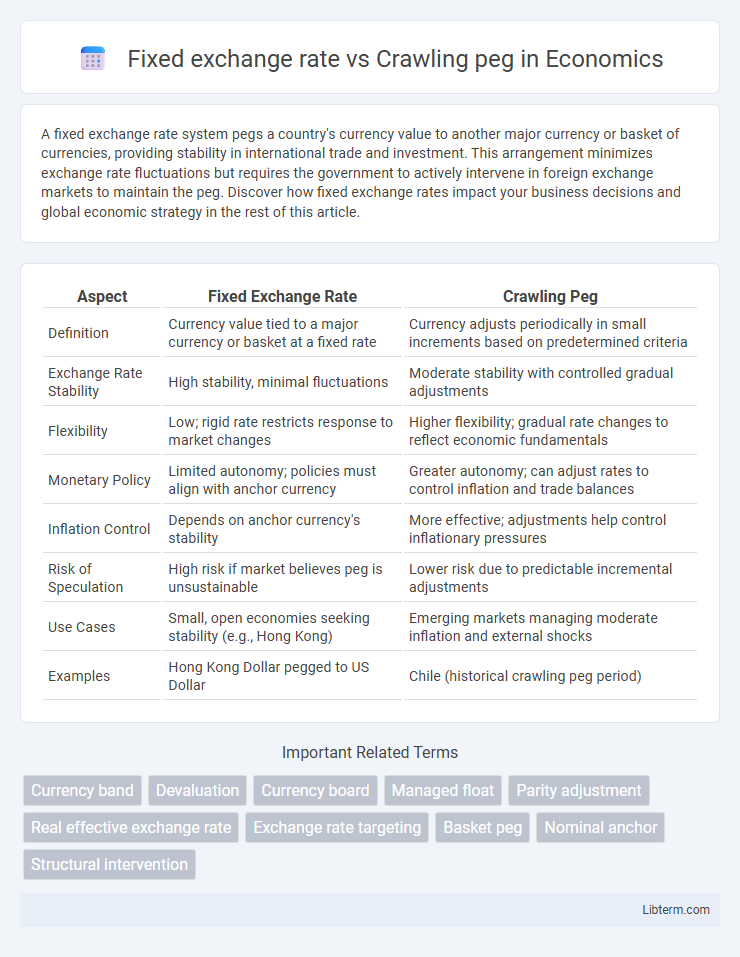

| Aspect | Fixed Exchange Rate | Crawling Peg |

|---|---|---|

| Definition | Currency value tied to a major currency or basket at a fixed rate | Currency adjusts periodically in small increments based on predetermined criteria |

| Exchange Rate Stability | High stability, minimal fluctuations | Moderate stability with controlled gradual adjustments |

| Flexibility | Low; rigid rate restricts response to market changes | Higher flexibility; gradual rate changes to reflect economic fundamentals |

| Monetary Policy | Limited autonomy; policies must align with anchor currency | Greater autonomy; can adjust rates to control inflation and trade balances |

| Inflation Control | Depends on anchor currency's stability | More effective; adjustments help control inflationary pressures |

| Risk of Speculation | High risk if market believes peg is unsustainable | Lower risk due to predictable incremental adjustments |

| Use Cases | Small, open economies seeking stability (e.g., Hong Kong) | Emerging markets managing moderate inflation and external shocks |

| Examples | Hong Kong Dollar pegged to US Dollar | Chile (historical crawling peg period) |

Introduction to Exchange Rate Systems

Fixed exchange rate systems maintain a country's currency value by pegging it to a major currency or basket of currencies, providing stability and predictability in international trade and investment. Crawling peg systems adjust the nominal exchange rate periodically at a fixed, pre-announced rate or in response to certain indicators, allowing for gradual corrections to inflation differentials or economic conditions. Both systems aim to balance exchange rate stability with flexibility to respond to economic shifts.

Defining Fixed Exchange Rate

A fixed exchange rate is a currency valuation system where a country's government or central bank pegs its currency's value to another major currency, such as the US dollar or gold, maintaining stability and reducing exchange rate volatility. Unlike a crawling peg, which allows periodic adjustments to the exchange rate based on predetermined criteria or market conditions, a fixed exchange rate remains constant over time. Fixed exchange rates support predictable international trade and investment by providing a stable economic environment.

Understanding the Crawling Peg Mechanism

The crawling peg mechanism allows a country's currency exchange rate to adjust gradually in small, pre-announced increments, maintaining stability while accommodating inflation differentials and external shocks. Unlike a fixed exchange rate that remains constant against a reference currency, the crawling peg provides flexibility to avoid sudden devaluations and speculative attacks. This system is particularly effective in emerging markets to balance exchange rate predictability with necessary economic adjustments.

Key Differences Between Fixed Exchange Rate and Crawling Peg

A fixed exchange rate maintains a constant currency value against another currency or basket of currencies, offering stability and predictability in international trade, whereas a crawling peg involves periodic adjustments to the exchange rate based on preset criteria or economic indicators, allowing gradual realignment with market conditions. Fixed exchange rate regimes typically require substantial foreign exchange reserves to defend the parity, while crawling pegs enable more flexibility and reduce the risk of abrupt devaluations or speculative attacks. The choice between the two depends on a country's economic goals, inflation rates, and the need for monetary policy autonomy.

Advantages of Fixed Exchange Rate

Fixed exchange rate systems provide currency stability by pegging a nation's currency to a major currency like the US dollar or gold, reducing exchange rate volatility and fostering investor confidence. This stability promotes international trade and investment by minimizing the risks associated with fluctuating currency values, which can disrupt pricing and profit margins. Governments benefit from greater predictability in monetary policy and inflation control, supporting economic planning and long-term growth.

Benefits of Crawling Peg Arrangements

Crawling peg arrangements offer greater flexibility by allowing gradual adjustments of the exchange rate in response to market conditions, reducing the risk of sudden currency shocks. They help maintain export competitiveness and control inflation by aligning currency values with economic fundamentals over time. This system also mitigates speculative attacks compared to rigid fixed exchange rate regimes, providing a more stable yet adaptable monetary environment.

Drawbacks and Risks of Fixed Exchange Rates

Fixed exchange rates limit a country's ability to respond to economic shocks, often leading to excessive depletion of foreign reserves during currency crises. Maintaining a fixed rate can result in persistent misalignment with market fundamentals, causing trade imbalances and reduced competitiveness. Additionally, fixed exchange rate systems are vulnerable to speculative attacks, which can destabilize the economy and require costly interventions.

Challenges Associated with Crawling Pegs

Crawling pegs present challenges such as increased complexity in managing frequent, incremental adjustments to the exchange rate, which can complicate monetary policy and create uncertainty for investors. The need for constant monitoring and interventions strains central bank resources and may lead to speculative attacks if market participants anticipate misalignments. Unlike fixed exchange rates, crawling pegs require a delicate balance to avoid excessive volatility while maintaining competitiveness.

Real-World Examples and Case Studies

China's fixed exchange rate system from 1994 to 2005, pegged tightly to the US dollar, provided stability for trade but faced criticism for overvaluation and trade imbalances. In contrast, Chile's crawling peg approach from the 1990s allowed gradual currency adjustments in line with inflation and competitive pressures, helping to maintain export competitiveness and macroeconomic stability. Both cases illustrate how fixed regimes offer predictability, while crawling pegs provide flexibility to respond to economic shifts and external shocks.

Choosing the Right System: Factors for Policymakers

Policymakers selecting between a fixed exchange rate and a crawling peg must evaluate economic stability, inflation control, and external shock resilience. A fixed exchange rate offers predictability and reduces currency risk for international trade, while a crawling peg provides flexibility through gradual adjustments to reflect market conditions and inflation differentials. Considerations include the country's openness to capital flows, monetary policy autonomy, and the administrative capacity to manage exchange rate interventions effectively.

Fixed exchange rate Infographic

libterm.com

libterm.com