Building strong credibility is essential for gaining trust and establishing authority in any field. Demonstrating expertise consistently through reliable information and transparent communication helps reinforce your reputation. Discover how to enhance your credibility effectively by exploring the strategies outlined in this article.

Table of Comparison

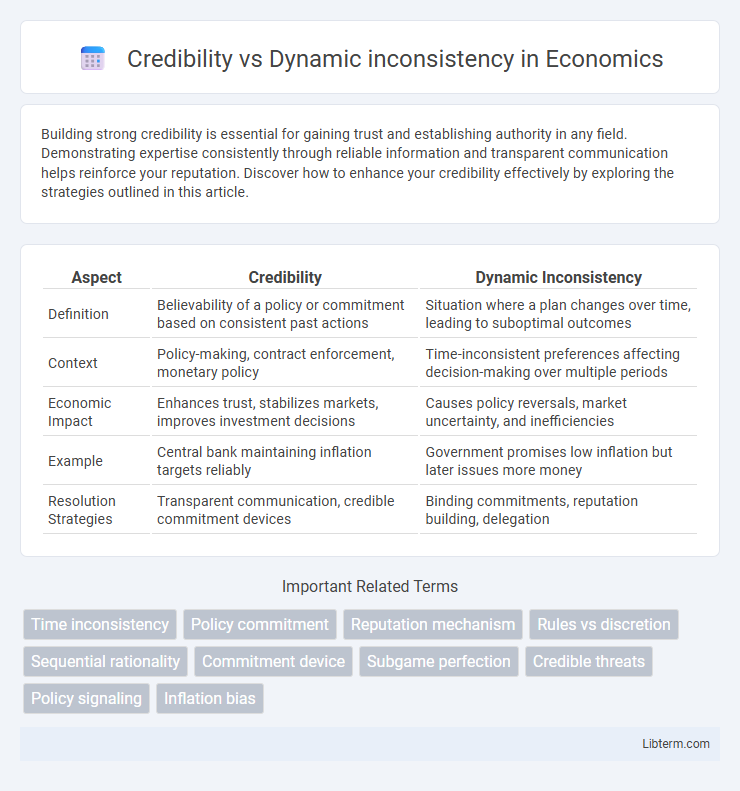

| Aspect | Credibility | Dynamic Inconsistency |

|---|---|---|

| Definition | Believability of a policy or commitment based on consistent past actions | Situation where a plan changes over time, leading to suboptimal outcomes |

| Context | Policy-making, contract enforcement, monetary policy | Time-inconsistent preferences affecting decision-making over multiple periods |

| Economic Impact | Enhances trust, stabilizes markets, improves investment decisions | Causes policy reversals, market uncertainty, and inefficiencies |

| Example | Central bank maintaining inflation targets reliably | Government promises low inflation but later issues more money |

| Resolution Strategies | Transparent communication, credible commitment devices | Binding commitments, reputation building, delegation |

Introduction to Credibility vs Dynamic Inconsistency

Credibility refers to the trustworthiness and reliability of a commitment or promise in strategic interactions, ensuring that future actions align with initial intentions. Dynamic inconsistency occurs when a decision-maker's optimal plan changes over time, making previously credible commitments no longer believable. Understanding the tension between credibility and dynamic inconsistency is crucial for designing mechanisms that enforce consistent behavior in economic models and negotiations.

Defining Credibility in Economic Policy

Credibility in economic policy refers to the commitment of policymakers to follow through on announced plans, ensuring that agents in the economy can anticipate consistent and reliable actions. This concept contrasts with dynamic inconsistency, where incentives change over time, leading policymakers to deviate from previously optimal plans, undermining trust. Establishing credibility enhances policy effectiveness by reducing uncertainty and anchoring expectations in financial markets and among economic agents.

Understanding Dynamic Inconsistency

Dynamic inconsistency occurs when a decision-maker's preferences change over time, leading to choices that contradict earlier plans or commitments. This phenomenon undermines credibility because the individual or institution cannot reliably commit to future actions, causing trust issues among stakeholders. Understanding dynamic inconsistency is crucial for designing mechanisms, such as commitment devices or credibility-enhancing strategies, that align future incentives with present commitments.

The Origins of Dynamic Inconsistency

Dynamic inconsistency arises when decision-makers' preferences change over time, causing actions planned in the present to be inconsistent with future intentions. This phenomenon originates from time-inconsistent preferences, such as hyperbolic discounting, where individuals disproportionately value immediate rewards over delayed benefits. Credibility becomes a critical issue in this context, as commitment mechanisms or credible promises are necessary to align future behavior with initial plans and overcome incentive incompatibilities.

Credibility and Policy Commitment

Credibility in policy commitment ensures that economic agents trust the government's announced policies, influencing expectations and long-term decision-making. Effective policy commitment reduces the threat of dynamic inconsistency, where policymakers might have incentives to deviate from previously stated plans for short-term gains. Strong institutional frameworks and transparent communication enhance credibility, aligning actual policy actions with announced targets.

Real-World Examples: Credibility Challenges

Credibility challenges often arise in real-world scenarios such as monetary policy, where central banks face dynamic inconsistency between short-term incentives to stimulate the economy and long-term goals of controlling inflation. For example, governments may promise fiscal discipline but later resort to excessive spending, undermining the credibility of budgetary commitments. Firms engaging in price commitment find themselves vulnerable when market conditions shift, revealing dynamic inconsistency and damaging trust with consumers and investors.

Consequences of Dynamic Inconsistency

Dynamic inconsistency leads to suboptimal decision-making where individuals or institutions abandon prior commitments, causing credibility loss in policies or contracts. This behavior undermines trust, triggers increased transaction costs, and may result in inefficient resource allocation due to the inability to enforce long-term agreements. In economic contexts, dynamic inconsistency often generates time-inconsistent preferences that distort intertemporal choices, impacting savings, investments, and regulatory credibility.

Strategies for Enhancing Policy Credibility

Strategies for enhancing policy credibility include commitment mechanisms such as transparent rule-based frameworks, which reduce uncertainty and foster trust among stakeholders. Employing credible signaling tools like long-term contracts and institutional independence strengthens policymakers' ability to commit to announced policies. Regular communication and consistent policy actions align expectations, mitigating the risks of dynamic inconsistency and reinforcing the durability of economic plans.

Credibility vs Dynamic Inconsistency: Policy Implications

Credibility plays a critical role in addressing dynamic inconsistency in economic policy-making, where policymakers face incentives to deviate from previously announced plans. Establishing credible commitments through institutional frameworks or reputational mechanisms helps reduce uncertainty and improve long-term policy effectiveness. Policy implications emphasize designing rules or constraints that align incentives, ensuring consistent actions that reinforce trust in fiscal and monetary policies.

Conclusion: Balancing Credibility and Consistency

Achieving a balance between credibility and dynamic inconsistency requires designing commitment mechanisms that ensure credible promises while allowing flexible decision-making over time. Effective policies incorporate credible threats or incentives to align future actions with initial commitments without causing rigidity or loss of trust. Striking this balance enhances strategic reliability and adapts to evolving circumstances, minimizing the risks associated with inconsistent behavior.

Credibility Infographic

libterm.com

libterm.com