The Coase Theorem explains how private parties can resolve externalities through negotiation, without government intervention, provided property rights are well-defined and transaction costs are low. It emphasizes the importance of assigning clear property rights to ensure efficient resource allocation. Explore the article to understand how this principle might apply to your economic decisions and policy discussions.

Table of Comparison

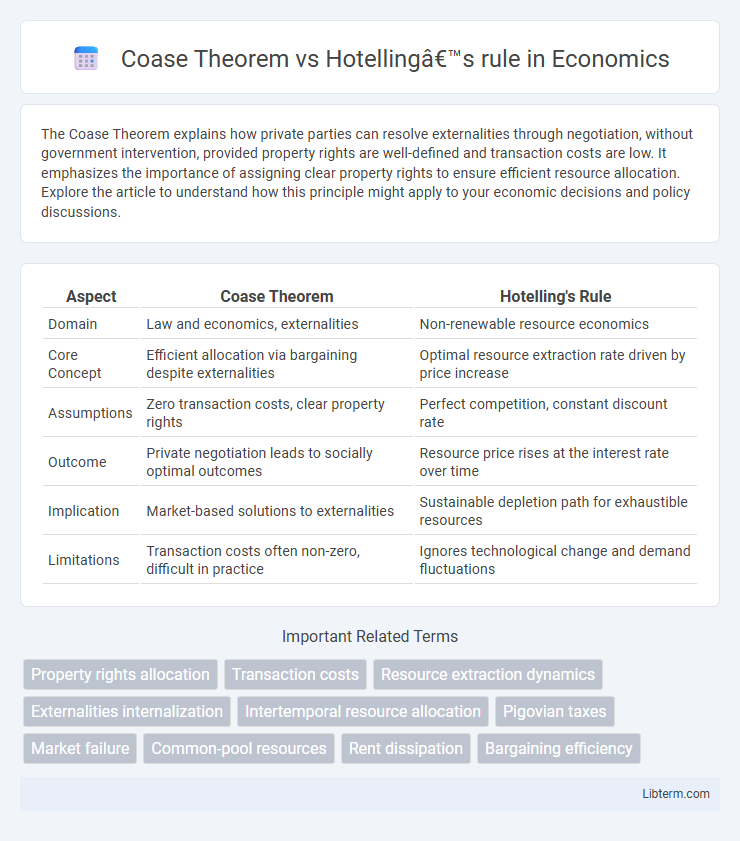

| Aspect | Coase Theorem | Hotelling's Rule |

|---|---|---|

| Domain | Law and economics, externalities | Non-renewable resource economics |

| Core Concept | Efficient allocation via bargaining despite externalities | Optimal resource extraction rate driven by price increase |

| Assumptions | Zero transaction costs, clear property rights | Perfect competition, constant discount rate |

| Outcome | Private negotiation leads to socially optimal outcomes | Resource price rises at the interest rate over time |

| Implication | Market-based solutions to externalities | Sustainable depletion path for exhaustible resources |

| Limitations | Transaction costs often non-zero, difficult in practice | Ignores technological change and demand fluctuations |

Introduction to Coase Theorem and Hotelling’s Rule

The Coase Theorem addresses the allocation of resources under well-defined property rights and zero transaction costs, emphasizing that parties will negotiate to achieve efficient outcomes regardless of initial rights assignment. Hotelling's Rule focuses on non-renewable resource extraction, stating that the net price of a resource should rise at the rate of interest to maximize economic rent over time. Both theories provide foundational frameworks for understanding resource economics, with Coase Theorem highlighting property rights and negotiation, while Hotelling's Rule centers on optimal depletion paths and scarcity rent.

Fundamental Concepts of Coase Theorem

Coase Theorem centers on the idea that when property rights are well-defined and transaction costs are negligible, parties can negotiate efficient resource allocations regardless of initial ownership. This theorem underscores the importance of clearly assigned property rights in resolving externalities through private bargaining. It contrasts with Hotelling's rule, which models resource extraction rates based on price trajectories in non-renewable resource economics.

Fundamental Concepts of Hotelling’s Rule

Hotelling's Rule is a fundamental principle in resource economics, describing the optimal extraction rate of non-renewable resources to maximize economic rents over time. It states that the net price of a resource, or its scarcity rent, should increase at the rate of interest, reflecting the opportunity cost of depleting the resource today rather than in the future. Unlike Coase Theorem which addresses externalities and private bargaining, Hotelling's Rule focuses on intertemporal resource allocation and extraction decisions under scarcity and uncertainty conditions.

Historical Context and Development

The Coase Theorem, introduced by Ronald Coase in 1960, revolutionized economic thought by emphasizing the role of property rights and transaction costs in resolving externalities through private bargaining. Hotelling's Rule, formulated by Harold Hotelling in 1931, laid foundational principles for non-renewable resource economics, linking resource prices to scarcity and future value. Both concepts emerged during pivotal periods in economic theory, shaping environmental economics and resource management disciplines.

Key Assumptions Behind Each Theory

The Coase Theorem assumes clearly defined property rights and zero transaction costs, allowing parties to negotiate efficient resource allocation regardless of initial ownership. Hotelling's rule is based on the assumption of a monopolistic owner facing a finite stock of non-renewable resources and perfect market foresight, leading to an optimal extraction rate that balances current and future marginal rents. Each theory's assumptions significantly influence their application in environmental economics and resource management.

Application of Coase Theorem in Resource Allocation

Coase Theorem applies to resource allocation by emphasizing the role of property rights and bargaining in resolving externalities efficiently without government intervention. It suggests that when transaction costs are low and property rights are clearly defined, parties can negotiate to allocate resources optimally, even in the presence of externalities. In contrast, Hotelling's rule focuses on the optimal extraction rate of non-renewable resources over time, highlighting the economic dynamics of resource depletion rather than negotiation-based solutions.

Application of Hotelling’s Rule in Resource Extraction

Hotelling's Rule provides a crucial framework for understanding the optimal rate of resource extraction, stating that the net price of a non-renewable resource should rise at the rate of interest, reflecting its increasing scarcity over time. This principle guides firms and policymakers in maximizing long-term resource value by balancing present extraction profits against future scarcity rents. In contrast, Coase Theorem emphasizes efficient resource allocation through negotiation under zero transaction costs, without specifically addressing the temporal dynamics of resource depletion captured by Hotelling's Rule.

Comparing Efficiency Outcomes

Coase Theorem emphasizes efficient resource allocation through clear property rights and bargaining, minimizing transaction costs to resolve externalities regardless of initial ownership. Hotelling's rule models the efficient extraction rate of non-renewable resources, dictating that resource prices rise at the rate of interest to optimize depletion over time. Comparing efficiency outcomes, Coase Theorem focuses on static efficiency in mitigating externalities, while Hotelling's rule addresses dynamic efficiency in resource use intertemporally.

Policy Implications and Real-World Examples

Coase Theorem emphasizes efficient resource allocation through well-defined property rights and minimal transaction costs, guiding policies that promote market-based solutions for environmental and resource disputes. Hotelling's rule informs regulatory frameworks on non-renewable resource extraction by predicting price trajectories and optimal depletion rates, crucial for managing oil, minerals, and fossil fuel reserves. Real-world applications include emissions trading systems influenced by Coasean bargaining and strategic petroleum reserve policies shaped by Hotelling's economic principles.

Limitations and Critiques of Both Approaches

Coase Theorem faces limitations including unrealistic assumptions of zero transaction costs and clearly defined property rights, which rarely hold in complex environmental and resource allocation problems. Hotelling's rule is critiqued for assuming perfect market conditions and constant extraction costs, ignoring economic, technological, and regulatory changes that affect resource depletion rates. Both approaches often fail to address uncertainty, market imperfections, and externalities, limiting their practical application in real-world natural resource economics.

Coase Theorem Infographic

libterm.com

libterm.com