The balanced budget multiplier illustrates how equal changes in government spending and taxation can increase overall economic output without increasing the budget deficit. It demonstrates that a simultaneous rise in public expenditure and taxes can stimulate aggregate demand and boost GDP. Discover how understanding this concept can help you grasp fiscal policy effects by reading the rest of the article.

Table of Comparison

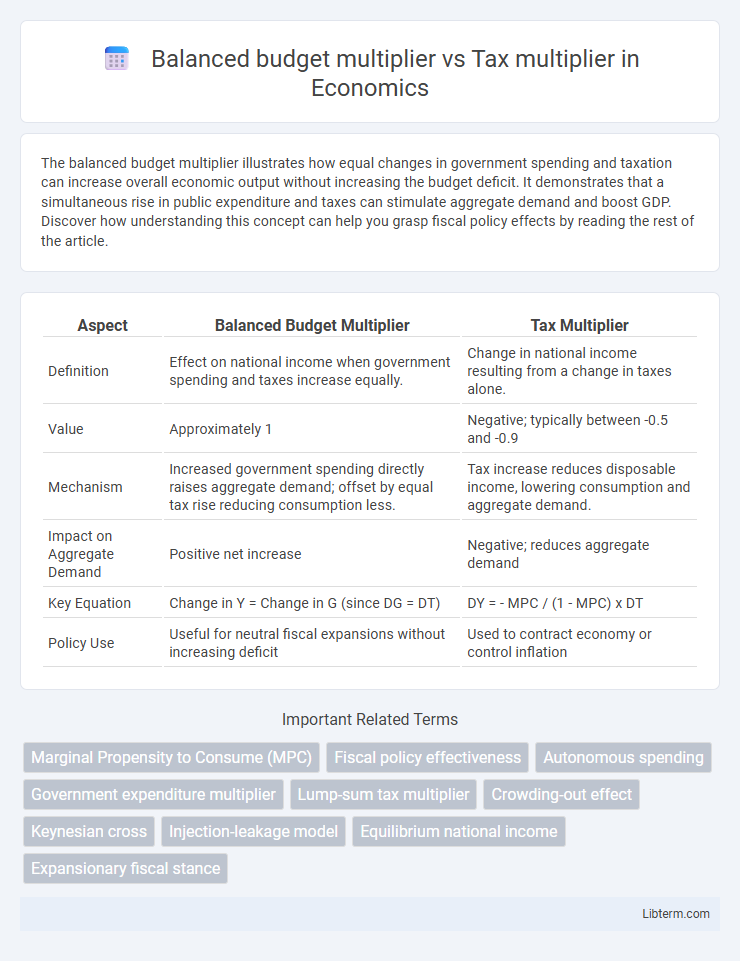

| Aspect | Balanced Budget Multiplier | Tax Multiplier |

|---|---|---|

| Definition | Effect on national income when government spending and taxes increase equally. | Change in national income resulting from a change in taxes alone. |

| Value | Approximately 1 | Negative; typically between -0.5 and -0.9 |

| Mechanism | Increased government spending directly raises aggregate demand; offset by equal tax rise reducing consumption less. | Tax increase reduces disposable income, lowering consumption and aggregate demand. |

| Impact on Aggregate Demand | Positive net increase | Negative; reduces aggregate demand |

| Key Equation | Change in Y = Change in G (since DG = DT) | DY = - MPC / (1 - MPC) x DT |

| Policy Use | Useful for neutral fiscal expansions without increasing deficit | Used to contract economy or control inflation |

Introduction to Fiscal Multipliers

Fiscal multipliers measure the impact of government spending or taxation changes on economic output, with the balanced budget multiplier reflecting how equal increases in spending and taxes influence GDP. The balanced budget multiplier typically equals one, indicating that a simultaneous rise in government spending and taxes increases aggregate demand by the amount of spending. In contrast, the tax multiplier is usually negative and smaller in magnitude, showing that tax increases reduce disposable income and consumption, thereby contracting economic output.

Understanding the Balanced Budget Multiplier

The balanced budget multiplier measures the change in national income resulting from equal increases in government spending and taxes, typically equaling one, meaning output rises by the same amount as the spending increase. This contrasts with the tax multiplier, which is negative and smaller in absolute value, reflecting the decrease in aggregate demand due to higher taxes alone. Understanding the balanced budget multiplier is essential for policymakers aiming to stimulate the economy without increasing the budget deficit.

Exploring the Tax Multiplier

The tax multiplier measures the effect of a change in taxes on aggregate demand, typically smaller in magnitude than the balanced budget multiplier, which equals one when government spending and taxes change by the same amount. Unlike the balanced budget multiplier, the tax multiplier is negative because a tax increase reduces disposable income, leading to a decrease in consumption and aggregate demand. Empirical studies estimate that the tax multiplier ranges between -0.5 and -1, indicating that tax cuts generally have a less potent stimulative effect on GDP compared to equivalent government spending increases.

Mathematical Formulation of Both Multipliers

The balanced budget multiplier is mathematically expressed as a value of 1, derived from the simultaneous increase in government spending and taxation by the same amount, resulting in a net zero effect on the budget but a full increase in aggregate demand. The tax multiplier is calculated as \(-MPC/(1-MPC)\), where MPC represents the marginal propensity to consume, indicating the change in aggregate demand resulting from a change in taxes. Both multipliers rely on the marginal propensity to consume and the Keynesian aggregate expenditure model, with the balanced budget multiplier always equating to one due to offsetting fiscal changes.

Key Differences between Balanced Budget Multiplier and Tax Multiplier

The balanced budget multiplier measures the impact on aggregate demand when government spending and taxes increase by the same amount, typically resulting in a multiplier effect of one. The tax multiplier quantifies the change in aggregate demand due to a change in taxes alone, generally producing a negative effect smaller in magnitude compared to government spending multipliers. Key differences include the balanced budget multiplier's neutral fiscal stance leading to a net positive effect on output, while the tax multiplier reflects the direct influence of tax changes on disposable income and consumption patterns.

Assumptions Underlying the Multipliers

The balanced budget multiplier assumes proportional changes in government spending and taxation, maintaining overall fiscal neutrality while influencing aggregate demand. The tax multiplier relies on the assumption that changes in taxes directly affect disposable income and consumption, with marginal propensity to consume playing a key role. Both multipliers presuppose stable economic conditions, constant prices, and no crowding out effects to isolate their impact on national income.

Real-World Applications and Examples

The balanced budget multiplier demonstrates that simultaneous equal changes in government spending and taxation can stimulate aggregate demand without increasing the deficit, as seen in targeted fiscal policy responses during economic recessions. The tax multiplier measures the impact of tax changes on disposable income and consumer spending, essential for evaluating tax cut effectiveness in boosting short-term economic activity, like the 2008 U.S. stimulus package. Empirical evidence from various economies indicates that government spending multipliers typically exceed tax multipliers, guiding policymakers in designing expansionary fiscal policies with optimal economic impact.

Limitations and Criticisms

The balanced budget multiplier and tax multiplier face limitations due to their reliance on simplifying assumptions like constant marginal propensity to consume and absence of supply-side constraints. Both multipliers often overlook factors such as inflationary pressures, crowding-out effects, and dynamic behavioral responses that can diminish policy effectiveness. Critics argue these models fail to account for real-world complexities, including variations in tax compliance and government spending efficiency.

Policy Implications and Effectiveness

The balanced budget multiplier equals one, implying that simultaneous increases in government spending and taxation of the same amount boost aggregate demand without affecting the budget deficit, making it a powerful tool for stabilizing output without increasing debt. In contrast, the tax multiplier is less than one in absolute value, indicating that tax changes alone have a weaker effect on aggregate demand and economic growth. Policymakers prioritize balanced budget adjustments to achieve fiscal neutrality while stimulating the economy, while relying solely on tax policy may limit stimulus effectiveness and slow recovery during downturns.

Conclusion: Choosing Between the Two Multipliers

The balanced budget multiplier ensures that government spending changes multiplied by the marginal propensity to consume generate a one-to-one increase in aggregate demand without increasing the deficit. The tax multiplier typically has a smaller absolute value since tax changes influence disposable income indirectly, resulting in a less potent effect on aggregate demand. Policymakers prefer the balanced budget multiplier to stimulate economic output without exacerbating budget deficits, while tax multipliers are more suitable for moderate adjustments to consumption and savings behavior.

Balanced budget multiplier Infographic

libterm.com

libterm.com