A debit card provides a convenient and secure way to access your funds directly from your bank account for everyday purchases and ATM withdrawals. With enhanced fraud protection features and widespread acceptance, debit cards offer a seamless payment experience both online and in-store. Discover how to maximize your debit card benefits and manage your finances effectively by reading the rest of the article.

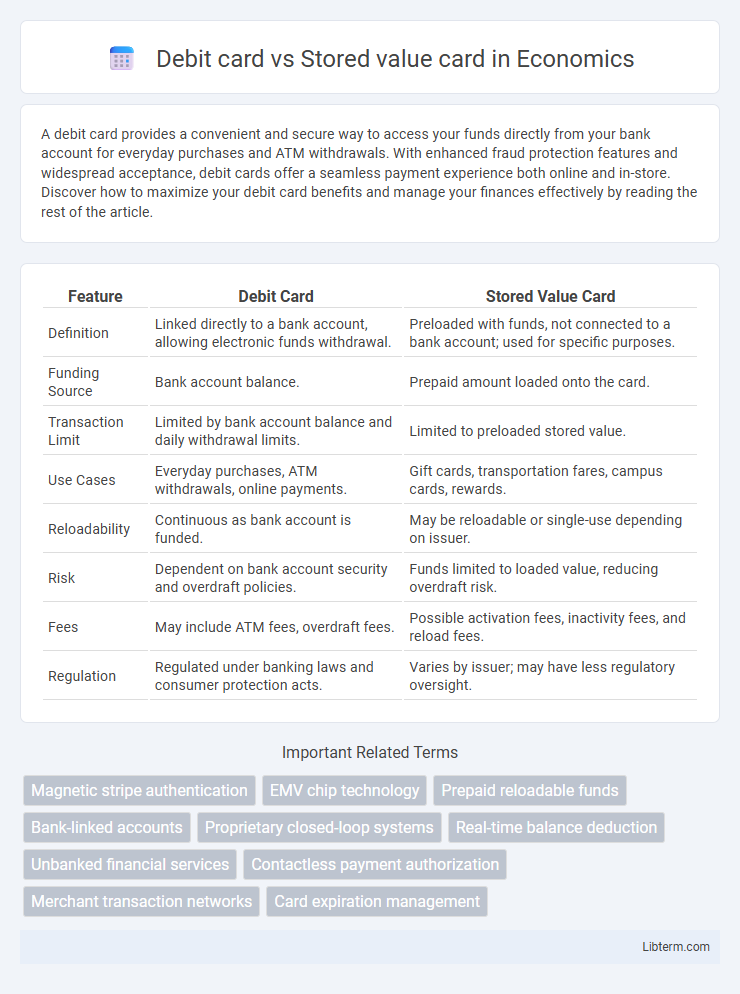

Table of Comparison

| Feature | Debit Card | Stored Value Card |

|---|---|---|

| Definition | Linked directly to a bank account, allowing electronic funds withdrawal. | Preloaded with funds, not connected to a bank account; used for specific purposes. |

| Funding Source | Bank account balance. | Prepaid amount loaded onto the card. |

| Transaction Limit | Limited by bank account balance and daily withdrawal limits. | Limited to preloaded stored value. |

| Use Cases | Everyday purchases, ATM withdrawals, online payments. | Gift cards, transportation fares, campus cards, rewards. |

| Reloadability | Continuous as bank account is funded. | May be reloadable or single-use depending on issuer. |

| Risk | Dependent on bank account security and overdraft policies. | Funds limited to loaded value, reducing overdraft risk. |

| Fees | May include ATM fees, overdraft fees. | Possible activation fees, inactivity fees, and reload fees. |

| Regulation | Regulated under banking laws and consumer protection acts. | Varies by issuer; may have less regulatory oversight. |

Introduction to Debit Cards and Stored Value Cards

Debit cards provide direct access to funds in a user's bank account for seamless purchases and ATM withdrawals, supported by major payment networks like Visa and MasterCard. Stored value cards hold a preloaded monetary value independent of any bank account, commonly used for transit, gift cards, or prepaid services. Both types offer convenient cashless payment options but differ in fund sourcing and usage restrictions.

Key Features of Debit Cards

Debit cards provide direct access to funds in a linked checking or savings account, enabling real-time transactions and ATM withdrawals. They support PIN-based authentication and offer fraud protection through EMV chip technology. Unlike stored value cards, debit cards require bank account validation and allow overdraft capabilities depending on the issuing bank's policies.

Key Features of Stored Value Cards

Stored value cards store a preloaded monetary value directly on the card, allowing users to make transactions without a bank account or credit check. These cards typically offer limited risk of overdraft and can be used for specific purposes such as gift cards, transit passes, or prepaid phone services. Unlike debit cards linked to bank accounts, stored value cards provide controlled spending by restricting usage to the available balance on the card.

Differences in Issuance and Access

Debit cards are issued by banks and linked directly to the cardholder's checking account, enabling real-time access to funds. Stored value cards, often prepaid and issued by non-bank entities, hold a fixed amount of money loaded onto the card before use, with no direct connection to a bank account. Access on debit cards depends on banking authorization and available balance, while stored value cards allow spending up to the prepaid limit without needing bank approval.

Transaction Process and Usage

Debit cards directly access funds from the cardholder's bank account during transactions, requiring real-time authorization and verification through the payment network. Stored value cards contain a prepaid balance loaded onto the card itself and deduct funds locally without needing immediate bank authorization, allowing offline usage. Debit cards are commonly used for broader purchases including high-value transactions and ATM withdrawals, while stored value cards are ideal for limited spending environments like public transit or campus campuses with predefined monetary limits.

Security Features Compared

Debit cards incorporate advanced security features such as EMV chip technology, PIN verification, and real-time fraud monitoring, providing strong protection against unauthorized transactions. Stored value cards, typically prepaid and not linked to a bank account, rely on limited balances and offline transaction capabilities, which reduce risk exposure but may lack sophisticated fraud detection. Both card types employ tokenization and encryption methods, yet debit cards generally offer enhanced security mechanisms due to their integration with banking networks.

Fees and Charges: What to Expect

Debit cards typically incur fees such as ATM withdrawal charges, foreign transaction fees, and overdraft penalties, with most banks offering fee-free transactions within their network. Stored value cards often involve activation fees, monthly maintenance charges, and reload fees, which can accumulate quickly depending on usage terms. Understanding these fee structures helps consumers choose the best option for their spending habits and avoid unexpected costs.

Suitability for Different Users

Debit cards are ideal for users seeking direct access to their bank accounts with widespread acceptance for daily transactions and ATM withdrawals. Stored value cards suit individuals who prefer prepaid spending limits, often used by parents for controlled allowances or businesses for employee expenses without linking to a bank account. Both options offer spending convenience, but suitability depends on the need for banking integration versus prepaid budget control.

Pros and Cons of Each Card Type

Debit cards provide direct access to funds in a linked bank account, offering convenience and security with fraud protection, but relying on account balance can lead to overdraft fees. Stored value cards, such as prepaid or gift cards, allow controlled spending without a bank account, reducing the risk of overspending, though they may have activation fees and limited acceptance. Choosing between debit and stored value cards depends on financial management needs, transaction types, and potential fees associated with each card.

Choosing the Right Card for Your Needs

Choosing the right card depends on your spending habits and financial goals; debit cards link directly to your checking account for easy access to funds, while stored value cards hold a prepaid balance that limits spending to a set amount. Debit cards offer broader acceptance and can help build credit history when used responsibly, whereas stored value cards provide controlled budgeting without overdraft risks. Evaluate factors like usage frequency, security features, and whether you want access to banking services or simple prepaid convenience before deciding.

Debit card Infographic

libterm.com

libterm.com