Proportional tax, also known as a flat tax, applies the same tax rate to all taxpayers regardless of income level, ensuring simplicity and fairness in tax calculation. This system can encourage compliance due to its transparency and predictability, making it an attractive option for many governments. Discover more about how proportional tax impacts your finances and the economy throughout this article.

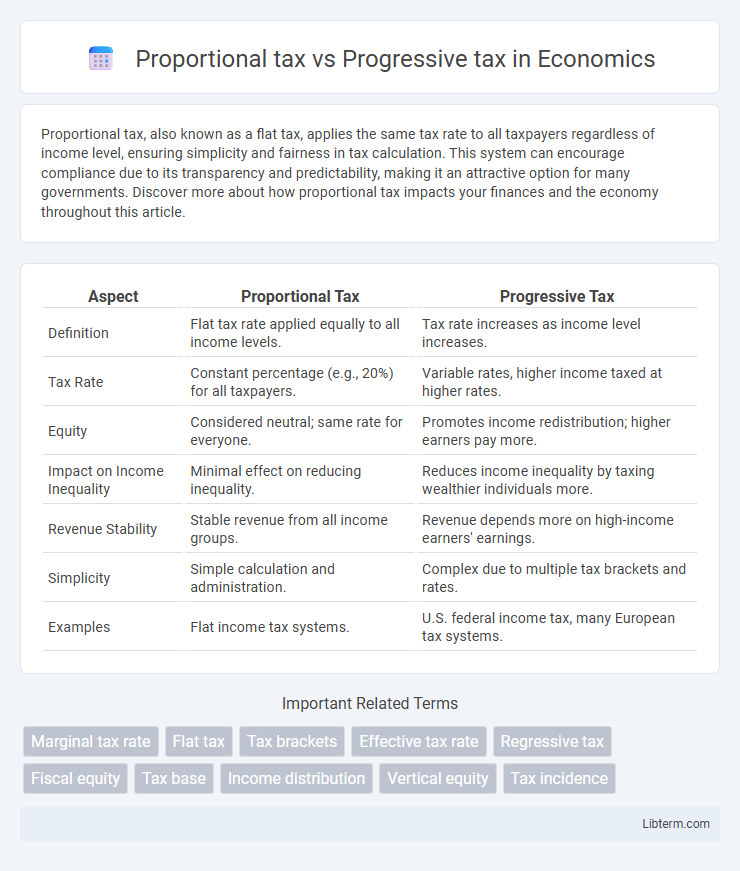

Table of Comparison

| Aspect | Proportional Tax | Progressive Tax |

|---|---|---|

| Definition | Flat tax rate applied equally to all income levels. | Tax rate increases as income level increases. |

| Tax Rate | Constant percentage (e.g., 20%) for all taxpayers. | Variable rates, higher income taxed at higher rates. |

| Equity | Considered neutral; same rate for everyone. | Promotes income redistribution; higher earners pay more. |

| Impact on Income Inequality | Minimal effect on reducing inequality. | Reduces income inequality by taxing wealthier individuals more. |

| Revenue Stability | Stable revenue from all income groups. | Revenue depends more on high-income earners' earnings. |

| Simplicity | Simple calculation and administration. | Complex due to multiple tax brackets and rates. |

| Examples | Flat income tax systems. | U.S. federal income tax, many European tax systems. |

Introduction to Taxation Methods

Proportional tax imposes a constant tax rate on all income levels, ensuring that everyone pays the same percentage regardless of earnings, which simplifies tax calculation and reduces administrative complexity. Progressive tax increases the tax rate as income rises, targeting higher earners with a larger tax burden to promote income redistribution and reduce economic inequality. Understanding these taxation methods is essential for analyzing fiscal policies and their impact on economic equity and government revenue.

What is Proportional Tax?

Proportional tax, also known as a flat tax, imposes a constant tax rate on all taxpayers regardless of their income level. This system simplifies tax calculations and ensures that every individual pays the same percentage of their income, promoting a uniform tax burden. Unlike progressive tax, where rates increase with higher income brackets, proportional tax maintains equality by applying a fixed percentage across all income ranges.

What is Progressive Tax?

Progressive tax is a tax system where the tax rate increases as the taxable income or wealth increases, meaning higher-income earners pay a larger percentage of their income compared to lower-income earners. This tax structure aims to reduce income inequality by placing a heavier tax burden on those with greater financial resources, thereby funding public services and social programs. Key examples of progressive taxation include federal income taxes in many countries, where tax brackets impose escalating rates on rising income levels.

Key Differences Between Proportional and Progressive Taxes

Proportional tax imposes a constant tax rate on all income levels, ensuring each taxpayer pays the same percentage regardless of earnings, which maintains uniformity but may place a heavier relative burden on lower-income individuals. Progressive tax rates increase as income rises, resulting in higher earners paying a larger percentage of their income, aimed at reducing income inequality and funding social programs. The key difference lies in tax rate structure and equity impact: proportional taxes apply a single fixed rate, while progressive taxes have tiered rates that escalate with income.

How Proportional Tax Works in Practice

Proportional tax, also known as a flat tax, charges the same percentage rate on all taxpayers regardless of income, ensuring simplicity and predictability in tax liabilities. For example, if the proportional tax rate is set at 15%, an individual earning $30,000 pays $4,500, while someone earning $100,000 pays $15,000, maintaining a consistent rate across all income levels. This approach contrasts with progressive tax systems, where tax rates increase with higher income brackets, often aiming to reduce income inequality.

How Progressive Tax Affects Taxpayers

Progressive tax imposes higher tax rates on individuals with greater income, increasing the tax burden as earnings rise and promoting income redistribution. This system reduces income inequality by ensuring high earners contribute a larger share of their income to public services and social programs. Lower-income taxpayers benefit from lower rates, preserving their disposable income and enhancing economic equity.

Advantages of Proportional Tax Systems

Proportional tax systems offer simplicity and fairness by applying a consistent tax rate to all income levels, which enhances transparency and reduces compliance costs. This approach promotes economic efficiency by minimizing distortions in labor supply and investment decisions, as taxpayers face the same marginal rate regardless of earnings. Proportional taxes also ensure predictable government revenue streams while encouraging higher earnings without fear of increased tax burdens.

Benefits of Progressive Tax Structures

Progressive tax structures promote economic equity by imposing higher tax rates on higher income brackets, which helps reduce income inequality and fund essential public services. This system enhances social welfare through increased government revenue, enabling investments in healthcare, education, and infrastructure that benefit lower-income populations. By aligning tax rates with taxpayers' ability to pay, progressive taxes support a more balanced distribution of wealth and economic stability.

Economic and Social Impacts Compared

Proportional tax systems, where everyone pays the same tax rate regardless of income, promote simplicity and predictability but tend to place a heavier burden on lower-income households, potentially exacerbating income inequality. Progressive tax systems impose higher rates on higher income brackets, aiming to reduce wealth disparities and fund social services, which can enhance social equity but may also influence labor market incentives and economic growth. The economic impact of progressive taxes often includes increased government revenue for social programs, while proportional taxes typically foster a more uniform tax compliance environment with less redistribution effect.

Which Tax System is More Equitable?

Proportional tax applies a constant tax rate to all income levels, ensuring simplicity but potentially placing a heavier relative burden on lower-income earners. Progressive tax increases tax rates as income rises, aiming to reduce income inequality by taxing higher earners more heavily. Studies show progressive tax systems generally achieve greater equity by aligning tax obligations with taxpayers' ability to pay.

Proportional tax Infographic

libterm.com

libterm.com