Bimetallism is an economic system that uses two metals, typically gold and silver, as the standard for currency. This method aims to stabilize the economy by allowing fixed exchange rates between the two metals, providing more flexibility than a single-metal standard. Explore the rest of the article to understand how bimetallism impacts monetary policy and your financial decisions.

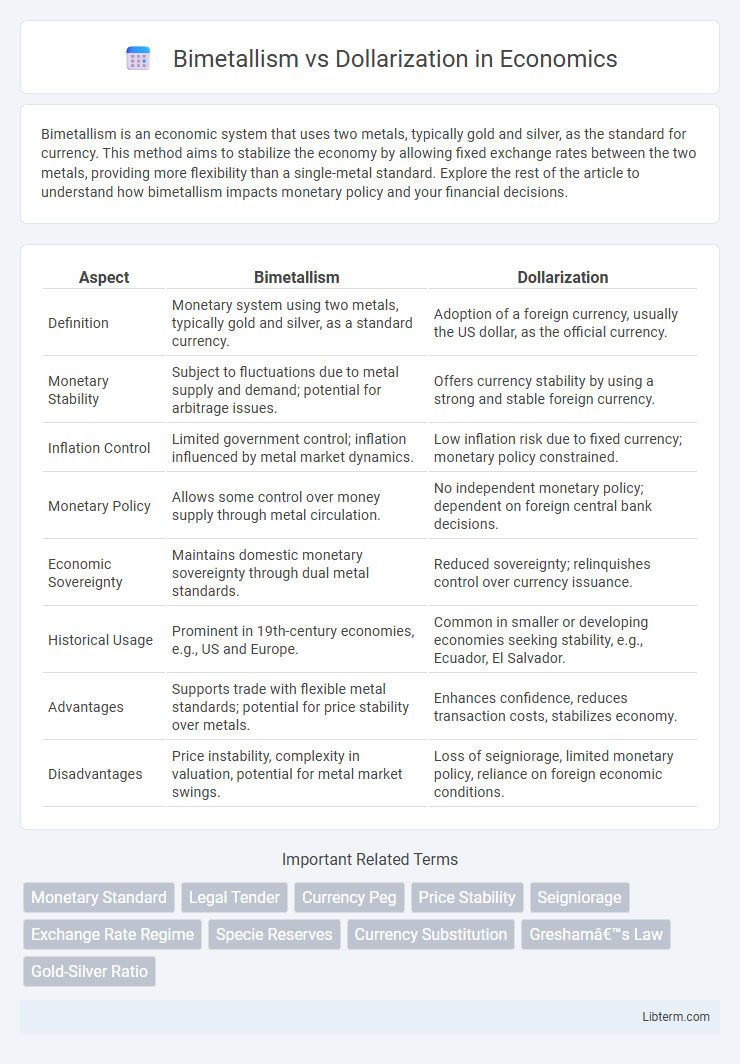

Table of Comparison

| Aspect | Bimetallism | Dollarization |

|---|---|---|

| Definition | Monetary system using two metals, typically gold and silver, as a standard currency. | Adoption of a foreign currency, usually the US dollar, as the official currency. |

| Monetary Stability | Subject to fluctuations due to metal supply and demand; potential for arbitrage issues. | Offers currency stability by using a strong and stable foreign currency. |

| Inflation Control | Limited government control; inflation influenced by metal market dynamics. | Low inflation risk due to fixed currency; monetary policy constrained. |

| Monetary Policy | Allows some control over money supply through metal circulation. | No independent monetary policy; dependent on foreign central bank decisions. |

| Economic Sovereignty | Maintains domestic monetary sovereignty through dual metal standards. | Reduced sovereignty; relinquishes control over currency issuance. |

| Historical Usage | Prominent in 19th-century economies, e.g., US and Europe. | Common in smaller or developing economies seeking stability, e.g., Ecuador, El Salvador. |

| Advantages | Supports trade with flexible metal standards; potential for price stability over metals. | Enhances confidence, reduces transaction costs, stabilizes economy. |

| Disadvantages | Price instability, complexity in valuation, potential for metal market swings. | Loss of seigniorage, limited monetary policy, reliance on foreign economic conditions. |

Introduction to Bimetallism and Dollarization

Bimetallism is a monetary system where two metals, typically gold and silver, are used as legal tender at a fixed ratio, aiming to stabilize currency value and support economic growth. Dollarization occurs when a country adopts a foreign currency, usually the US dollar, as its official medium of exchange to control inflation and enhance financial stability. Both systems address currency management but differ in approach, with bimetallism relying on domestic metal reserves and dollarization depending on external currency influence.

Historical Background of Bimetallism

Bimetallism emerged in the 19th century as a monetary system allowing the simultaneous use of gold and silver as legal tender, aiming to stabilize currency value and facilitate trade. It gained prominence during the 1870s, notably in the United States and Europe, where fluctuations in silver prices and gold discoveries prompted debates on fixed exchange rates between the two metals. The eventual abandonment of bimetallism in favor of the gold standard was influenced by economic challenges and the need for more stable and uniform currency systems.

Emergence and Evolution of Dollarization

Dollarization emerged as a response to chronic inflation and currency instability, initially appearing in Latin American countries during the late 20th century. The process evolved as nations adopted the US dollar to stabilize their economies, attract foreign investment, and facilitate trade, moving away from traditional bimetallic or national currency systems. Over time, dollarization has expanded beyond its origins, influencing fiscal policies and monetary sovereignty in numerous developing economies worldwide.

Key Differences Between Bimetallism and Dollarization

Bimetallism involves using two metals, typically gold and silver, as legal tender with a fixed rate of exchange, impacting money supply and price stability differently compared to dollarization, where a country adopts a foreign currency such as the US dollar as its official currency, eliminating independent monetary policy. Bimetallism allows for domestic control over money supply whereas dollarization relies on the stability and policy of the foreign currency issuer. The key difference lies in sovereignty over monetary policy; bimetallism retains national control over currency, while dollarization cedes it to another country's central bank.

Economic Impacts of Bimetallism

Bimetallism, involving the use of both gold and silver as legal tender, can stabilize currency value by providing a dual-metal standard that mitigates the risks of reliance on a single metal. This system often leads to increased monetary supply flexibility, potentially reducing deflationary pressures and supporting economic growth through enhanced liquidity. However, bimetallism may also cause price volatility and market uncertainty due to fluctuating relative metal values, impacting trade balances and fiscal stability.

Macroeconomic Effects of Dollarization

Dollarization stabilizes macroeconomic variables by anchoring a country's currency to the US dollar, reducing inflation volatility and interest rates while enhancing investor confidence. It limits a nation's monetary policy flexibility, preventing independent adjustments to money supply and interest rates in response to economic shocks. This system often increases financial integration with global markets but can expose the economy to external monetary policy decisions of the United States Federal Reserve.

Case Studies: Countries Adopting Bimetallism

Countries adopting bimetallism, such as India in the late 19th century and China during the Qing dynasty, showcased mixed monetary systems based on both gold and silver standards to stabilize currency and facilitate trade. India's bimetallic policies aimed to balance silver depreciation against gold, while Qing China struggled with coinage standardization amid fluctuating silver prices. These historical case studies reveal challenges in maintaining fixed exchange ratios and highlight the complexities that led many nations, including those initially practicing bimetallism, to eventually adopt single-metal standards or move towards dollarization in modern economic frameworks.

Case Studies: Countries Embracing Dollarization

Countries embracing dollarization include Ecuador, El Salvador, and Zimbabwe, each adopting the US dollar to stabilize volatile economies and curb hyperinflation. Ecuador officially dollarized in 2000 after a banking crisis, resulting in increased investor confidence and inflation control. El Salvador followed in 2001 to attract foreign investment and facilitate remittances, while Zimbabwe's 2009 dollarization ended hyperinflation by replacing the Zimbabwean dollar with multiple foreign currencies, including the US dollar.

Pros and Cons of Bimetallism vs Dollarization

Bimetallism offers the advantage of stabilizing currency value through the use of both gold and silver, reducing dependence on a single metal and potentially curbing inflation, but it can lead to monetary confusion and market instability due to fluctuating metal values. Dollarization provides economic stability, lower inflation rates, and increased investor confidence by adopting a strong foreign currency, though it sacrifices monetary sovereignty and limits the ability to implement independent monetary policies. While bimetallism encourages diversification of reserve assets, dollarization simplifies transactions and trade, often benefiting economies with weak or unstable native currencies.

Future Trends and Policy Implications

Future trends indicate growing interest in bimetallism as central banks explore diversified reserves to hedge against dollar volatility and inflation risks. Dollarization continues to influence emerging markets, offering stability but limiting monetary policy autonomy, prompting debates on optimal currency frameworks. Policymakers face challenges balancing economic sovereignty with global financial integration, necessitating adaptive strategies to manage currency risk and inflation control.

Bimetallism Infographic

libterm.com

libterm.com