The Glass-Steagall Act was a landmark banking law enacted in 1933 that separated commercial and investment banking to reduce financial risks and prevent another Great Depression. It imposed regulations that limited securities activities and affiliations between banks and investment firms. Explore the rest of the article to understand how this historic law shaped today's financial system and its lasting impact on Your banking experience.

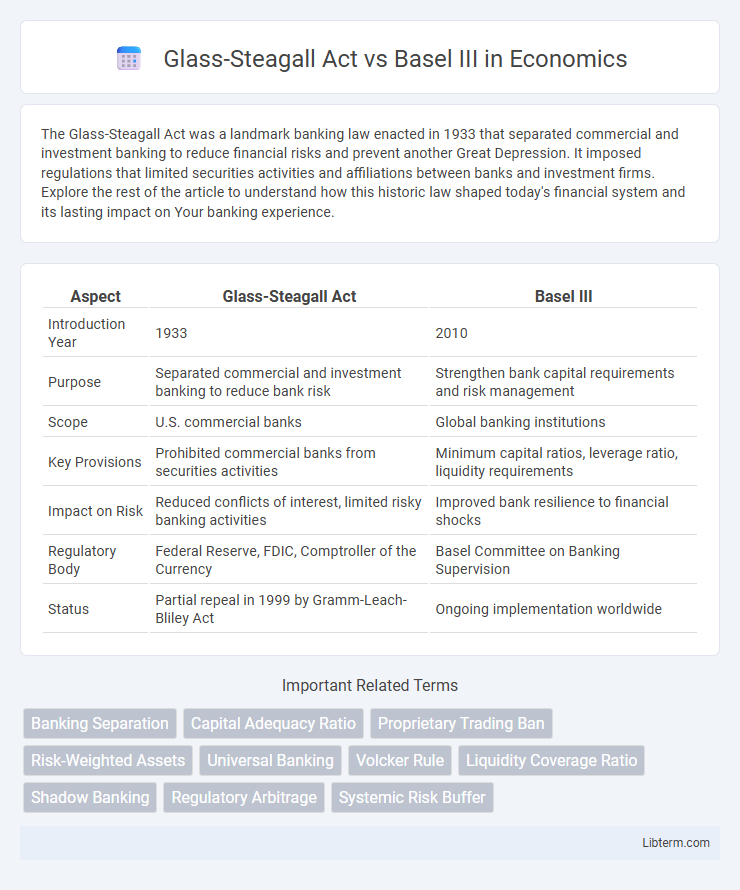

Table of Comparison

| Aspect | Glass-Steagall Act | Basel III |

|---|---|---|

| Introduction Year | 1933 | 2010 |

| Purpose | Separated commercial and investment banking to reduce bank risk | Strengthen bank capital requirements and risk management |

| Scope | U.S. commercial banks | Global banking institutions |

| Key Provisions | Prohibited commercial banks from securities activities | Minimum capital ratios, leverage ratio, liquidity requirements |

| Impact on Risk | Reduced conflicts of interest, limited risky banking activities | Improved bank resilience to financial shocks |

| Regulatory Body | Federal Reserve, FDIC, Comptroller of the Currency | Basel Committee on Banking Supervision |

| Status | Partial repeal in 1999 by Gramm-Leach-Bliley Act | Ongoing implementation worldwide |

Introduction to Glass-Steagall Act and Basel III

The Glass-Steagall Act, enacted in 1933, established a regulatory framework separating commercial and investment banking to reduce systemic risk in the U.S. financial system. Basel III, introduced by the Basel Committee on Banking Supervision post-2008 financial crisis, focuses on enhancing international banking regulations through increased capital requirements, liquidity standards, and risk management protocols. Both frameworks aim to strengthen financial stability but target different aspects and eras of banking regulation.

Historical Context: Financial Crises and Regulation

The Glass-Steagall Act, enacted in 1933, was a direct response to the 1929 stock market crash and the ensuing Great Depression, aiming to separate commercial and investment banking to reduce risk. Basel III, developed after the 2008 global financial crisis, focuses on strengthening bank capital requirements, improving risk management, and increasing liquidity to prevent systemic failures. Both regulatory frameworks emerged from periods of financial instability, shaping banking practices to enhance financial system stability and protect depositors.

Core Provisions of the Glass-Steagall Act

The Glass-Steagall Act established a strict separation between commercial and investment banking activities to reduce financial risks and prevent conflicts of interest. It imposed regulations that prohibited banks from engaging in both types of banking under a single entity, aiming to protect depositors and maintain financial stability. In contrast, Basel III primarily focuses on strengthening bank capital requirements, stress testing, and market liquidity risk to enhance the overall resilience of the banking sector.

Key Components of Basel III Framework

Basel III framework emphasizes strengthening bank capital requirements by increasing minimum common equity and Tier 1 capital ratios, introducing a leverage ratio to limit total debt relative to equity. It also incorporates liquidity standards such as the Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR) to ensure banks maintain adequate short-term liquidity and stable funding over the long term. These components enhance risk management and financial stability beyond the Glass-Steagall Act's historic focus on separating commercial and investment banking activities.

Objectives: Separation vs. Risk Management

The Glass-Steagall Act aimed to separate commercial banking from investment banking to reduce conflicts of interest and prevent financial crises by limiting speculative activities. Basel III focuses on comprehensive risk management through enhanced capital requirements, liquidity standards, and leverage ratios to strengthen the stability and resilience of banks worldwide. These frameworks reflect distinct approaches: Glass-Steagall emphasizes structural separation, while Basel III promotes robust risk control mechanisms within integrated banking operations.

Impact on Banking Structure and Operations

The Glass-Steagall Act fundamentally reshaped U.S. banking by separating commercial and investment banking, reducing risk exposure and promoting financial stability through structural barriers. Basel III, introduced globally, emphasizes enhanced capital requirements, liquidity standards, and risk management protocols, directly impacting banks' operational resilience and regulatory compliance. Together, these frameworks steer banking structure toward greater safety while influencing day-to-day risk management and capital allocation strategies.

Global vs. National Regulatory Scope

The Glass-Steagall Act primarily serves as a national regulatory framework within the United States, imposing strict separation between commercial and investment banking to reduce systemic risk. Basel III operates on a global scale, setting international standards for bank capital adequacy, stress testing, and liquidity to strengthen financial stability worldwide. While Glass-Steagall addresses risks in the U.S. banking sector, Basel III fosters regulatory consistency and risk management across diverse national banking systems.

Effectiveness in Preventing Financial Crises

The Glass-Steagall Act effectively curtailed risky bank behaviors by separating commercial and investment banking, reducing conflicts of interest and limiting exposure to speculative activities, which helped prevent financial crises during its enforcement period from 1933 to 1999. Basel III enhances bank resilience by imposing stricter capital requirements, leverage ratios, and liquidity standards globally, aiming to address weaknesses exposed in the 2008 financial crisis. While Glass-Steagall focused on structural separation within banks, Basel III provides a comprehensive regulatory framework targeting systemic risk and ensuring better shock absorption capacity across the banking sector.

Criticisms and Challenges of Implementation

The Glass-Steagall Act, established in 1933, faced criticism for restricting banks' ability to diversify, potentially limiting competitiveness and innovation in modern financial markets. Basel III, designed to enhance bank capital requirements and risk management, encounters challenges in uniform implementation across diverse global banking systems, leading to regulatory arbitrage and compliance costs. Both frameworks struggle with adapting to evolving financial technologies and complex market dynamics, which complicates enforcement and reduces effectiveness in preventing systemic risks.

Future Outlook: Financial Regulation Evolution

The future outlook for financial regulation highlights a continued evolution combining the Glass-Steagall Act's emphasis on separating commercial and investment banking with Basel III's comprehensive capital and liquidity standards. Regulatory frameworks are expected to integrate stricter risk management measures, enhanced stress testing, and increased transparency to address emerging systemic risks and technological disruptions in global finance. Innovations such as digital currencies and fintech advancements will drive further adaptation of rules to maintain financial stability and protect consumer interests.

Glass-Steagall Act Infographic

libterm.com

libterm.com