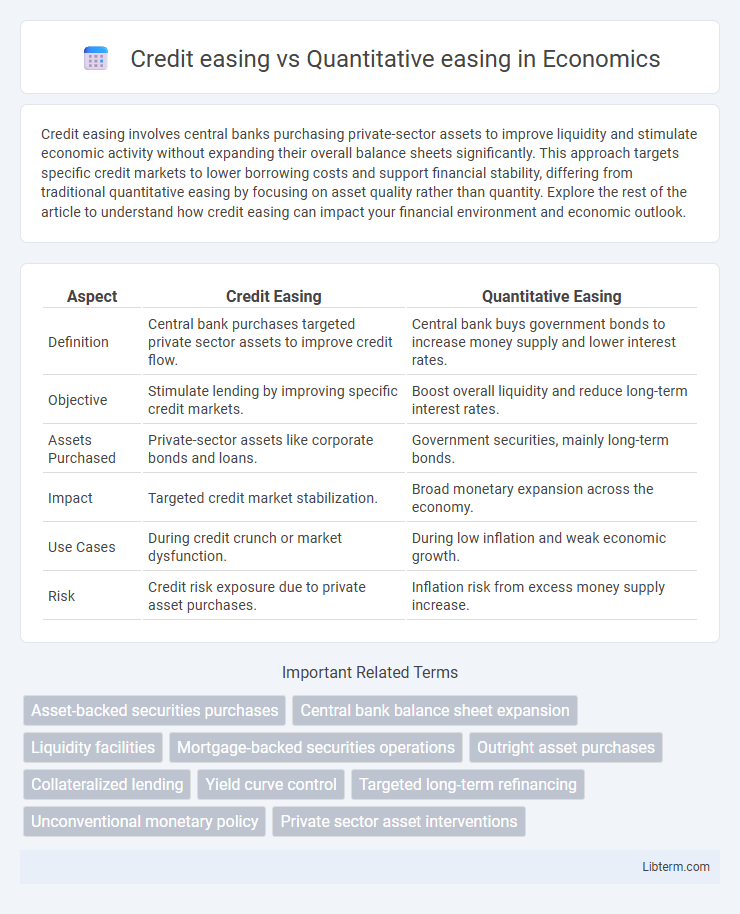

Credit easing involves central banks purchasing private-sector assets to improve liquidity and stimulate economic activity without expanding their overall balance sheets significantly. This approach targets specific credit markets to lower borrowing costs and support financial stability, differing from traditional quantitative easing by focusing on asset quality rather than quantity. Explore the rest of the article to understand how credit easing can impact your financial environment and economic outlook.

Table of Comparison

| Aspect | Credit Easing | Quantitative Easing |

|---|---|---|

| Definition | Central bank purchases targeted private sector assets to improve credit flow. | Central bank buys government bonds to increase money supply and lower interest rates. |

| Objective | Stimulate lending by improving specific credit markets. | Boost overall liquidity and reduce long-term interest rates. |

| Assets Purchased | Private-sector assets like corporate bonds and loans. | Government securities, mainly long-term bonds. |

| Impact | Targeted credit market stabilization. | Broad monetary expansion across the economy. |

| Use Cases | During credit crunch or market dysfunction. | During low inflation and weak economic growth. |

| Risk | Credit risk exposure due to private asset purchases. | Inflation risk from excess money supply increase. |

Introduction to Credit Easing and Quantitative Easing

Credit easing involves central banks purchasing private-sector assets like corporate bonds and loans to directly improve credit flow and stabilize financial markets. Quantitative easing focuses on large-scale asset purchases, primarily government securities, to increase bank reserves and lower long-term interest rates, stimulating overall economic activity. Both strategies aim to support economic recovery, but credit easing targets specific credit markets while quantitative easing addresses broader monetary expansion.

Defining Credit Easing: Key Characteristics

Credit easing is a monetary policy tool focused on altering the composition of private sector credit by purchasing specific types of assets, such as corporate bonds or mortgage-backed securities, to support targeted credit markets. Unlike quantitative easing, which primarily increases the overall money supply by buying large quantities of government bonds, credit easing aims to improve liquidity and functioning in particular credit sectors without significantly changing the central bank's balance sheet size. Key characteristics include targeted asset purchases, support for specific credit markets, and a focus on credit allocation over broad monetary expansion.

Understanding Quantitative Easing: Main Features

Quantitative easing (QE) involves central banks purchasing long-term securities to inject liquidity into the economy, aiming to lower interest rates and stimulate borrowing and investment. Unlike credit easing, which targets specific credit markets or sectors, QE broadly increases the money supply and affects financial conditions across various asset classes. Key features include purchasing government bonds or mortgage-backed securities and expanding the central bank's balance sheet to support economic growth during periods of low inflation and sluggish demand.

Core Differences Between Credit Easing and Quantitative Easing

Credit easing targets the improvement of specific credit markets by purchasing private sector assets to enhance liquidity and credit flow, while quantitative easing broadly increases the central bank's balance sheet by acquiring government securities to expand overall money supply. Credit easing focuses on altering the composition of assets held by the central bank to support particular financial sectors, whereas quantitative easing emphasizes increasing the quantity of reserves in the banking system to stimulate economic activity. The core difference lies in credit easing's asset-specific intervention versus quantitative easing's general monetary expansion approach.

Goals and Objectives of Each Policy

Credit easing targets specific credit markets by purchasing private-sector assets to improve liquidity and lower borrowing costs for particular industries or segments, aiming to restore credit flow and stabilize targeted sectors. Quantitative easing involves large-scale purchases of government securities to increase the overall money supply, reduce long-term interest rates, and stimulate broad economic growth by encouraging lending and investment. Both policies seek economic stabilization, but credit easing focuses on targeted credit conditions while quantitative easing aims at general monetary expansion.

Mechanisms of Action: How Each Policy Works

Credit easing targets specific credit markets by purchasing private sector assets to improve liquidity and lower borrowing costs for businesses and households. Quantitative easing involves large-scale purchases of government bonds to increase the money supply and reduce long-term interest rates across the broader economy. Both policies aim to stimulate economic activity but operate through different channels: credit easing through targeted credit market interventions and quantitative easing through broad monetary expansion.

Impact on Financial Markets and Institutions

Credit easing targets specific segments of financial markets by purchasing private sector assets, improving credit flow and lowering borrowing costs for targeted institutions, thereby stabilizing financial institutions and enhancing liquidity in particular asset classes. Quantitative easing broadly expands the central bank's balance sheet through large-scale purchases of government securities, reducing interest rates across various maturities and boosting overall market liquidity, which stimulates investment and supports asset prices. The targeted nature of credit easing makes it more effective in addressing sector-specific distress, while quantitative easing fosters widespread market confidence and financial stability.

Historical Examples of Credit Easing and Quantitative Easing

Credit easing was notably implemented by the Federal Reserve during the 2007-2009 financial crisis, targeting specific credit markets like commercial paper and asset-backed securities to improve liquidity. Quantitative easing (QE) has been used extensively by central banks, such as the Bank of Japan in the early 2000s and the Federal Reserve post-2008, involving large-scale purchases of government bonds to expand the monetary base. Historical examples of QE also include the European Central Bank's asset purchase programs during the Eurozone crisis, which aimed to stabilize sovereign debt markets and stimulate economic growth.

Pros and Cons of Credit Easing vs Quantitative Easing

Credit easing targets specific credit markets by purchasing private sector assets to improve liquidity and stimulate lending, boosting sectors like mortgages and small businesses; however, it risks market distortion and may favor certain industries over others. Quantitative easing involves large-scale government bond purchases to lower long-term interest rates broadly, supporting overall economic growth and stabilizing financial markets, but it can lead to asset bubbles and higher inflation if overused. Both strategies expand central bank balance sheets, with credit easing providing targeted relief while quantitative easing offers widespread economic stimulus but with varying impacts on financial inequalities and market stability.

When Should Central Banks Use Each Policy?

Central banks should use credit easing when targeted support to specific credit markets or financial institutions is needed to improve liquidity and restore credit flow, especially during sector-specific distress. Quantitative easing is more appropriate for broad economic stimulus during periods of severe recession or deflation, aiming to lower long-term interest rates by expanding the central bank's balance sheet through large-scale asset purchases. The choice depends on whether the objective is to address particular credit market dysfunctions or to boost overall economic demand.

Credit easing Infographic

libterm.com

libterm.com