Keynesian economics emphasizes the role of government intervention and fiscal policy in stabilizing the economy during periods of recession and unemployment. By advocating increased public spending and lower taxes, it aims to boost aggregate demand and promote economic growth. Discover how Keynesian principles can impact Your financial future by exploring the rest of this article.

Table of Comparison

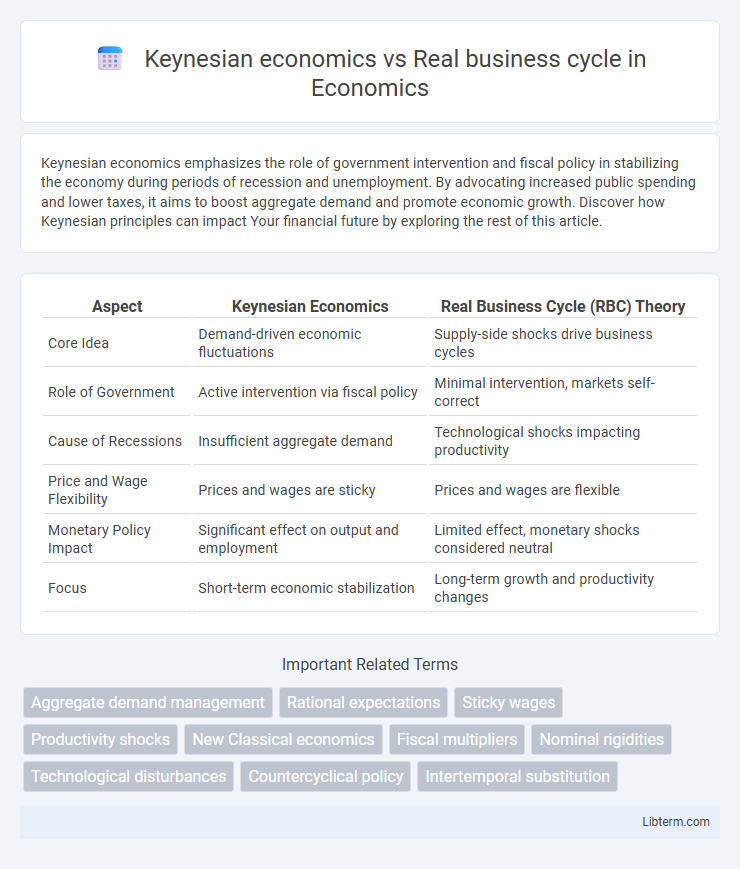

| Aspect | Keynesian Economics | Real Business Cycle (RBC) Theory |

|---|---|---|

| Core Idea | Demand-driven economic fluctuations | Supply-side shocks drive business cycles |

| Role of Government | Active intervention via fiscal policy | Minimal intervention, markets self-correct |

| Cause of Recessions | Insufficient aggregate demand | Technological shocks impacting productivity |

| Price and Wage Flexibility | Prices and wages are sticky | Prices and wages are flexible |

| Monetary Policy Impact | Significant effect on output and employment | Limited effect, monetary shocks considered neutral |

| Focus | Short-term economic stabilization | Long-term growth and productivity changes |

Introduction to Keynesian Economics and Real Business Cycle Theory

Keynesian Economics emphasizes aggregate demand as the primary driver of economic fluctuations, advocating for active government intervention to stabilize output and employment during recessions. Real Business Cycle (RBC) Theory attributes economic cycles to real shocks, such as technology changes, suggesting that fluctuations result from efficient market responses without the need for policy intervention. While Keynesian models highlight price and wage rigidities affecting economic output, RBC models assume flexible prices and emphasize the role of productivity shocks in driving business cycles.

Historical Background and Development

Keynesian economics emerged during the Great Depression in the 1930s, pioneered by John Maynard Keynes, emphasizing government intervention to stabilize output and employment through fiscal policy. In contrast, Real Business Cycle (RBC) theory developed in the 1980s, advanced by economists like Finn Kydland and Edward Prescott, attributes economic fluctuations to real shocks such as technology changes, rejecting the emphasis on monetary or fiscal interventions. Keynesian models focus on demand-side factors and market imperfections, whereas RBC theory relies on neoclassical supply-side analysis and rational expectations.

Core Assumptions of Keynesian Economics

Keynesian economics assumes that aggregate demand drives economic output and employment, emphasizing price and wage rigidities that prevent markets from clearing quickly. It posits that government intervention through fiscal policy is crucial to stabilize economic fluctuations and manage demand shortfalls. Unlike Real Business Cycle theory, which attributes business cycles to real shocks and assumes flexible prices, Keynesian models stress the importance of sticky prices and demand-side factors in economic dynamics.

Core Assumptions of Real Business Cycle Theory

Real Business Cycle (RBC) theory assumes that business cycle fluctuations result primarily from real shocks, such as changes in technology or productivity, rather than monetary or demand-side factors emphasized in Keynesian economics. RBC models rely on the premise of rational expectations and market clearing, where agents optimize consumption and labor supply intertemporally in response to these real shocks. This framework contrasts with Keynesian emphasis on price and wage rigidities and the role of aggregate demand in driving economic fluctuations.

Role of Government Intervention

Keynesian economics advocates for active government intervention through fiscal policies to stabilize economic fluctuations and manage aggregate demand during recessions. Real business cycle theory emphasizes that economic fluctuations result from real shocks, such as technology changes, and views government intervention as ineffective or potentially harmful. Empirical evidence often supports Keynesian stimulus effectiveness during demand-driven downturns, while real business cycle models highlight market self-correction without policy distortion.

Treatment of Market Shocks

Keynesian economics treats market shocks as demand-side disturbances requiring active fiscal and monetary policy interventions to stabilize output and employment. Real business cycle (RBC) theory views market shocks primarily as supply-side disruptions caused by technology or productivity changes, emphasizing market-clearing mechanisms without government intervention. Keynesian models prioritize short-term demand fluctuations, whereas RBC models stress long-term real shocks driving economic cycles.

Labor Market Dynamics: Keynesian vs. RBC Perspectives

Keynesian economics emphasizes wage rigidity and demand-driven fluctuations, suggesting unemployment rises due to insufficient aggregate demand, leading to labor market slack during recessions. Real Business Cycle (RBC) theory views labor market adjustments as efficient responses to productivity shocks, with labor supply varying based on intertemporal preferences rather than rigid wages. Keynesians advocate for active fiscal policies to mitigate unemployment, while RBC models argue that labor market dynamics reflect optimal decisions under changing economic conditions.

Policy Implications and Effectiveness

Keynesian economics advocates for active government intervention through fiscal policies, such as increased public spending and tax cuts, to stabilize economic fluctuations and reduce unemployment during recessions. In contrast, Real Business Cycle (RBC) theory emphasizes that economic fluctuations result from real shocks, like technology changes, and argues that government intervention is typically ineffective or harmful, advocating for minimal policy interference. Empirical studies show Keynesian policies can stimulate demand and shorten recessions, while RBC models caution against policy distortions that may misalign market signals and hinder long-term growth.

Empirical Evidence and Criticisms

Keynesian economics emphasizes fiscal policy's role in stabilizing output through government intervention based on empirical evidence of demand-driven fluctuations, while Real Business Cycle (RBC) theory attributes economic cycles to technology shocks and supply-side factors, supported by observed correlations in productivity and labor data. Criticisms of Keynesian models highlight their reliance on potentially unrealistic assumptions about price rigidities and government effectiveness, whereas RBC models face challenges due to their inability to fully explain observed recessions without incorporating demand-side elements. Empirical studies often show mixed results, with macroeconomic data revealing complexities that neither model alone can comprehensively address.

Conclusion: Comparative Analysis and Future Outlook

Keynesian economics emphasizes demand-side interventions through fiscal and monetary policy to stabilize economic fluctuations, while Real Business Cycle (RBC) theory attributes economic cycles to real shocks like technology changes, minimizing government role. Empirical evidence shows Keynesian models better explain short-term unemployment and demand deficiencies, whereas RBC theory highlights productivity-driven growth but struggles with demand-driven recessions. Future outlook points to hybrid approaches integrating Keynesian demand management with RBC supply-side insights to address complex macroeconomic challenges effectively.

Keynesian economics Infographic

libterm.com

libterm.com