The user cost of capital approach measures the total economic cost a firm incurs to use a unit of capital over a specific period, including depreciation, interest, and opportunity costs. This method helps businesses make informed investment decisions by accurately reflecting the expense of capital usage. Discover how understanding this approach can optimize Your capital management in the rest of the article.

Table of Comparison

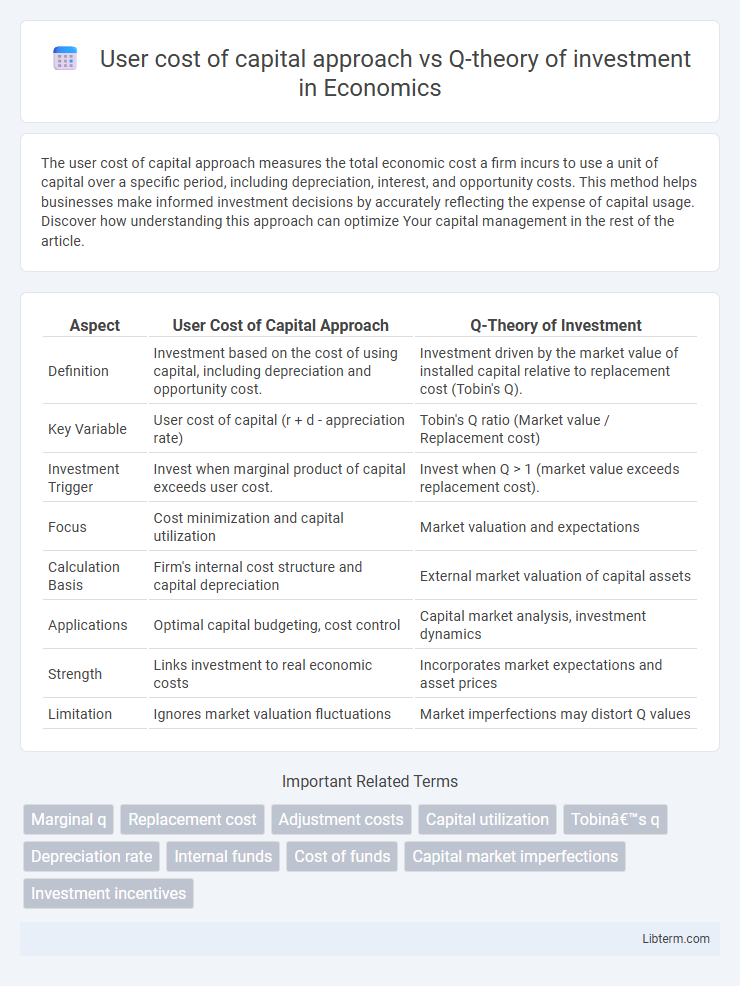

| Aspect | User Cost of Capital Approach | Q-Theory of Investment |

|---|---|---|

| Definition | Investment based on the cost of using capital, including depreciation and opportunity cost. | Investment driven by the market value of installed capital relative to replacement cost (Tobin's Q). |

| Key Variable | User cost of capital (r + d - appreciation rate) | Tobin's Q ratio (Market value / Replacement cost) |

| Investment Trigger | Invest when marginal product of capital exceeds user cost. | Invest when Q > 1 (market value exceeds replacement cost). |

| Focus | Cost minimization and capital utilization | Market valuation and expectations |

| Calculation Basis | Firm's internal cost structure and capital depreciation | External market valuation of capital assets |

| Applications | Optimal capital budgeting, cost control | Capital market analysis, investment dynamics |

| Strength | Links investment to real economic costs | Incorporates market expectations and asset prices |

| Limitation | Ignores market valuation fluctuations | Market imperfections may distort Q values |

Introduction to Investment Theories

User cost of capital approach defines investment decisions based on the cost of acquiring and using capital assets, incorporating depreciation, interest rates, and tax considerations to determine the optimal investment level. Q-theory of investment focuses on the market valuation of a firm's existing capital relative to its replacement cost, where a Tobin's Q ratio greater than one signals profitable investment opportunities. Both theories provide distinct frameworks for understanding how firms decide on capital expenditures, with user cost emphasizing internal cost structures and Q-theory relying on external market signals.

Overview of User Cost of Capital Approach

The User Cost of Capital approach quantifies the cost of utilizing capital assets, incorporating purchase price, depreciation, interest rates, and expected asset price changes to guide investment decisions. It serves as a key economic measure for firms to determine the optimal capital stock by comparing marginal revenue productivity with the user cost. Empirical studies link this approach with variations in tax policy and capital utilization, influencing macroeconomic investment patterns and firm-level capital allocation.

Essentials of Q-Theory of Investment

Q-theory of investment posits that firms invest to adjust their capital stock until the market value of capital (Tobin's Q) equals its replacement cost, linking investment directly to the ratio of market value to asset replacement cost. When Tobin's Q is greater than one, indicating high expected profitability or growth, firms are incentivized to increase investment, whereas a Q less than one signals underinvestment. This theory emphasizes the role of market expectations and marginal q in determining investment, contrasting with the user cost of capital approach that centers on the cost of using capital in production as the primary investment driver.

Key Assumptions Behind Each Approach

The User Cost of Capital approach assumes firm's investment decisions are primarily driven by the cost of using capital, including depreciation, interest rates, and tax considerations, emphasizing the dynamic adjustment to capital stock. The Q-theory of investment is based on Tobin's Q, positing that investment is driven by the ratio of market value of installed capital to its replacement cost, assuming perfect capital markets and instantaneous adjustment without adjustment costs. Both frameworks rely on the assumption of rational profit-maximizing firms but differ in their treatment of market imperfections and the role of external financial factors.

Comparing Investment Decision Mechanisms

The User Cost of Capital approach emphasizes investment decisions based on the cost of using capital, including depreciation, interest rates, and tax considerations, guiding firms to invest until the marginal benefit equals this cost. In contrast, Q-theory of investment relies on the market valuation of firms, where investment is driven by the ratio of market value to replacement cost of capital (Tobin's Q), signaling profitable expansion when Q exceeds one. While the User Cost of Capital approach focuses on direct input price signals, Q-theory incorporates market expectations and intangible assets, providing a forward-looking investment mechanism based on firms' valuation metrics.

Measurement Challenges and Practicality

The User Cost of Capital approach faces measurement challenges due to the difficulty in accurately estimating depreciation rates, interest rates, and tax effects, which affect the calculation of the true cost firms incur when using capital. Q-theory of investment relies on market valuation of firms' assets but struggles with separating Tobin's Q from market noise and the influence of external factors, complicating its practical application. While User Cost offers a more direct economic interpretation, Q-theory provides insights into investment decisions through asset prices though both approaches face empirical limitations in measurement and implementation.

Sensitivity to Market Conditions

The User Cost of Capital approach directly links investment decisions to the cost of financing and depreciation rates, making it highly sensitive to interest rate fluctuations and inflation changes in market conditions. Q-theory of investment, based on Tobin's Q ratio, reacts to market valuation of firms, showing heightened sensitivity to stock market performance and investor expectations. Therefore, User Cost emphasizes real economic factors, while Q-theory predominantly reflects financial market sentiment in investment responsiveness.

Implications for Business Policy and Strategy

The User Cost of Capital approach, emphasizing the cost of financing and depreciation, informs business policy by prioritizing optimal capital expenditure and tax strategy to minimize investment costs and maximize returns. Q-theory of investment drives strategy through market valuation signals, encouraging firms to invest when market value exceeds replacement cost, aligning investment decisions with external growth opportunities. Integrating both models allows businesses to balance internal cost control with responsive investment timing, enhancing strategic capital allocation and competitive positioning.

Empirical Evidence and Real-World Applications

Empirical evidence shows the user cost of capital approach accurately explains investment behavior in industries with predictable cost structures and stable capital prices, as it directly links investment to the price of capital and expected returns. Q-theory of investment finds strong support in firms with market valuations reflecting growth opportunities, with Tobin's Q ratios correlating positively with investment levels in technology-driven sectors. Real-world applications of the user cost approach are prominent in policy analysis for tax reforms, while Q-theory guides corporate finance decisions by assessing market signals for optimal capital allocation.

Conclusion: Choosing the Right Approach

Selecting the appropriate investment model depends on the specific context and data availability, with the User Cost of Capital approach offering simplicity and direct cost measurement, while Q-theory provides a market-based, forward-looking evaluation of investment incentives. Empirical evidence often supports Q-theory in capturing investment dynamics under conditions of market efficiency, but User Cost remains valuable when price signals or adjustment costs dominate firm behavior. A hybrid or complementary use of both approaches can enhance investment analysis by balancing theoretical rigor with practical applicability.

User cost of capital approach Infographic

libterm.com

libterm.com