The trinomial tree model is a versatile method for option pricing that divides each time step into three possible price movements: up, down, or unchanged. This approach enhances accuracy over binomial models by better capturing the range of potential market behaviors and volatility. Explore the rest of the article to understand how the trinomial tree model can improve your financial decision-making.

Table of Comparison

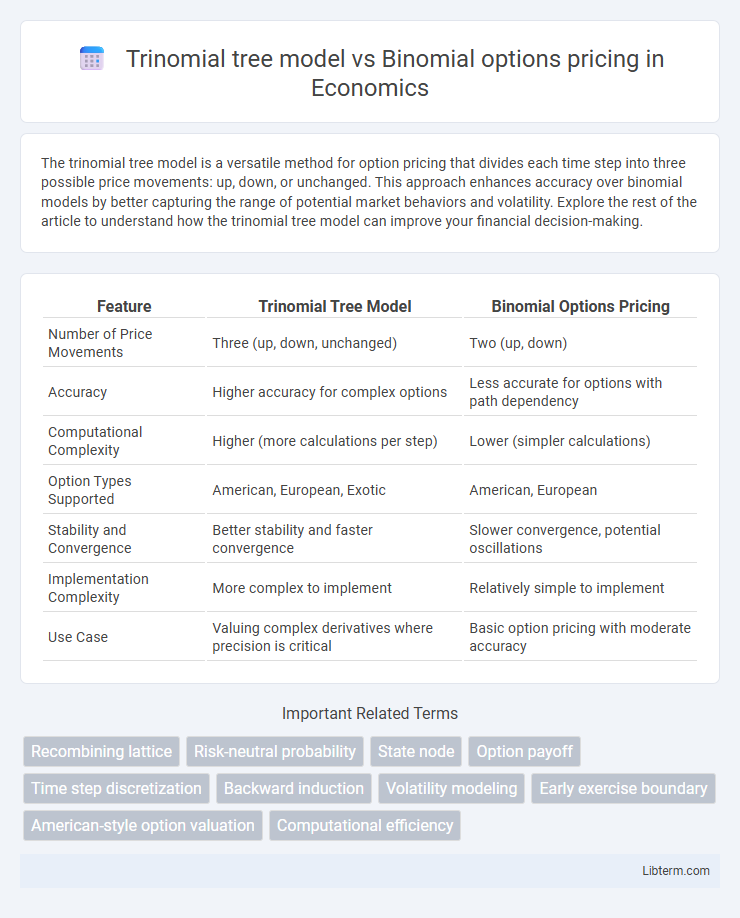

| Feature | Trinomial Tree Model | Binomial Options Pricing |

|---|---|---|

| Number of Price Movements | Three (up, down, unchanged) | Two (up, down) |

| Accuracy | Higher accuracy for complex options | Less accurate for options with path dependency |

| Computational Complexity | Higher (more calculations per step) | Lower (simpler calculations) |

| Option Types Supported | American, European, Exotic | American, European |

| Stability and Convergence | Better stability and faster convergence | Slower convergence, potential oscillations |

| Implementation Complexity | More complex to implement | Relatively simple to implement |

| Use Case | Valuing complex derivatives where precision is critical | Basic option pricing with moderate accuracy |

Introduction to Options Pricing Models

Options pricing models such as the Binomial and Trinomial trees use discrete-time lattice frameworks to estimate the fair value of options by simulating possible price paths of the underlying asset. The Binomial model divides each time step into two possible price movements--up or down--while the Trinomial model enhances accuracy by incorporating a middle, or no-change, price movement in each step. Trinomial models typically offer greater precision and stability in pricing complex options, especially those with longer maturities or path-dependent features, compared to the simpler Binomial model.

Overview of the Binomial Options Pricing Model

The Binomial Options Pricing Model uses a discrete-time framework to estimate the potential future prices of an underlying asset by constructing a binomial lattice or tree, representing possible price movements at each step. This model captures the option's value by working backward from expiration, considering the payoff at each node and applying risk-neutral probabilities. Compared to the Trinomial tree model, the binomial approach is simpler and computationally efficient but may require more time steps for accuracy, especially for American-style options with multiple possible path outcomes.

Understanding the Trinomial Tree Model

The Trinomial Tree Model enhances option pricing by allowing three possible price movements at each step: up, down, or unchanged, compared to the Binomial Model's two outcomes, leading to more accurate representation of asset price dynamics. This model reduces discretization error and improves convergence speed, making it especially effective for valuing American options with early exercise features. Its structured approach balances computational efficiency and precision, offering a robust framework for complex derivative pricing.

Structural Differences: Binomial vs Trinomial

The trinomial tree model introduces three possible price movements at each node: up, down, and unchanged, contrasting with the binomial model's two outcomes of up or down. This structural difference allows the trinomial tree to capture price dynamics with greater accuracy and stability, especially for options with long maturities or complex payoffs. The increased branching in the trinomial model improves convergence to theoretical option values, reducing numerical errors seen in binomial approximations.

Mathematical Formulation of Each Model

The Trinomial tree model enhances the Binomial options pricing framework by incorporating three possible price movements--up, down, and unchanged--compared to the binomial model's two movements. Mathematically, the trinomial model defines probabilities \(p_u\), \(p_m\), and \(p_d\) for upward, middle, and downward price transitions, ensuring risk-neutral valuation with a more accurate approximation of the underlying asset's diffusion process. The binomial model uses a simpler two-state stochastic process with parameters \(u\), \(d\), and risk-neutral probability \(p\), solving backward induction for option valuation but may require finer time steps for comparable precision.

Accuracy and Convergence Comparison

The trinomial tree model enhances accuracy by incorporating three possible price movements at each step, offering a finer approximation of underlying asset price dynamics compared to the two-move binomial model. This additional branch structure improves convergence speed towards the true option price, reducing numerical errors especially in cases of American and exotic options. Empirical studies show that trinomial trees require fewer time steps than binomial trees to achieve similar precision, making them more computationally efficient for high-accuracy option pricing tasks.

Flexibility in Handling Complex Derivatives

The Trinomial tree model offers greater flexibility in handling complex derivatives by allowing three possible price movements per time step, improving accuracy in modeling options with path-dependent features and early exercise opportunities. Unlike the Binomial model, which restricts price changes to two outcomes, the Trinomial approach better captures volatility skew and adapts more effectively to exotic options such as barrier and Asian options. This enhanced structure results in more precise pricing and risk management for derivatives with intricate payoff structures.

Computational Efficiency and Resource Requirements

The Trinomial tree model offers greater accuracy in option pricing by incorporating three possible price movements per step but requires significantly more computational resources than the Binomial model, which considers only two price movements. Due to its additional state at each node, the Trinomial tree's memory usage and computational time grow approximately 1.5 times that of the Binomial model for the same number of time steps. Consequently, the Binomial model is preferred in scenarios demanding faster computations with constrained resources, while the Trinomial model suits applications where improved precision justifies higher computational costs.

Practical Applications in the Financial Industry

The Trinomial tree model enhances option pricing accuracy by incorporating three possible price movements--up, down, or unchanged--offering finer granularity than the Binomial model's two states. In practical applications, the Trinomial model is favored for pricing American options and complex derivatives where early exercise features and variable volatility demand higher precision. Financial institutions leverage the Trinomial framework to optimize risk management strategies and improve the valuation of exotic options in dynamic market conditions.

Choosing Between Binomial and Trinomial Models

Choosing between binomial and trinomial options pricing models depends on the desired balance between computational efficiency and accuracy. The binomial model uses two possible price movements per time step, making it simpler and faster for large-scale problems, while the trinomial model incorporates three price movements, offering improved convergence and more accurate results for complex derivatives. Traders prioritize the trinomial model for options with higher precision requirements or path-dependent features, whereas the binomial model remains preferred for quicker, less computationally intensive valuations.

Trinomial tree model Infographic

libterm.com

libterm.com