Currency depreciation occurs when the value of a nation's currency declines relative to foreign currencies, impacting import costs and export competitiveness. This shift can lead to higher inflation and changes in international trade dynamics, affecting both consumers and businesses. Discover how currency depreciation influences your financial decisions and global markets by reading the full article.

Table of Comparison

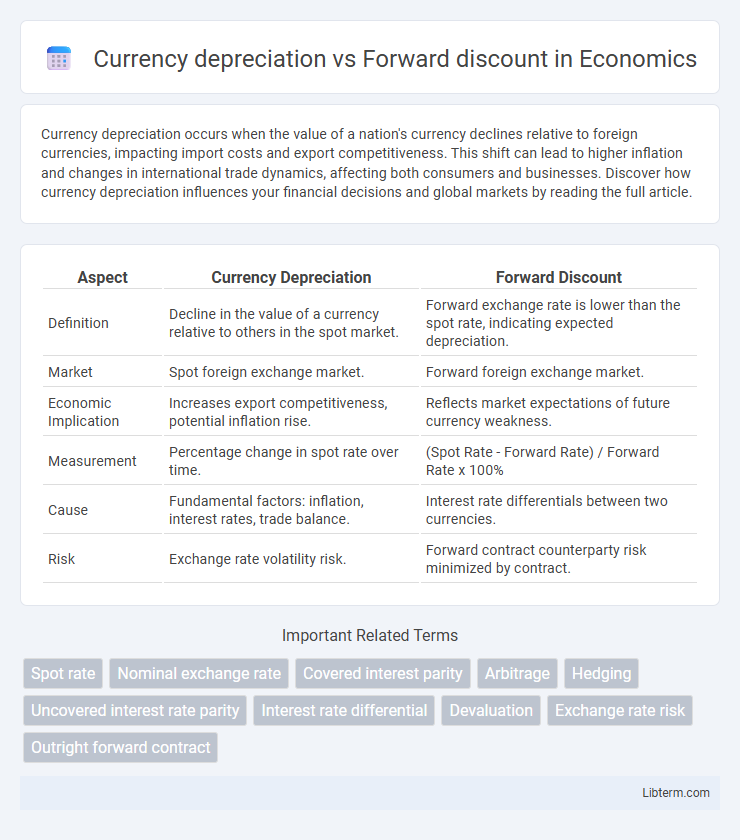

| Aspect | Currency Depreciation | Forward Discount |

|---|---|---|

| Definition | Decline in the value of a currency relative to others in the spot market. | Forward exchange rate is lower than the spot rate, indicating expected depreciation. |

| Market | Spot foreign exchange market. | Forward foreign exchange market. |

| Economic Implication | Increases export competitiveness, potential inflation rise. | Reflects market expectations of future currency weakness. |

| Measurement | Percentage change in spot rate over time. | (Spot Rate - Forward Rate) / Forward Rate x 100% |

| Cause | Fundamental factors: inflation, interest rates, trade balance. | Interest rate differentials between two currencies. |

| Risk | Exchange rate volatility risk. | Forward contract counterparty risk minimized by contract. |

Introduction to Currency Depreciation and Forward Discount

Currency depreciation refers to a decline in a currency's value relative to another currency, impacting import costs and export competitiveness. Forward discount occurs when the forward exchange rate of a currency is lower than its spot rate, reflecting market expectations of depreciation. Both concepts are crucial for managing foreign exchange risk and forecasting future currency movements.

Defining Currency Depreciation

Currency depreciation refers to the decrease in the value of a nation's currency relative to foreign currencies in the foreign exchange market. It impacts import prices, inflation rates, and export competitiveness, reflecting changes in economic fundamentals or market sentiment. Forward discount occurs when the forward exchange rate of a currency is lower than its spot rate, often signaling expectations of future currency depreciation.

Understanding Forward Discount in Forex Markets

Forward discount in forex markets occurs when a currency's forward exchange rate is lower than its spot rate, reflecting expectations of currency depreciation. This discount compensates for interest rate differentials between two countries, indicating the currency with higher interest rates is expected to depreciate relative to the other. Understanding forward discount helps traders hedge currency risk and forecast future exchange rate movements based on macroeconomic indicators and monetary policies.

Key Differences Between Currency Depreciation and Forward Discount

Currency depreciation refers to the decrease in the value of a currency relative to another currency in the spot market, driven by factors such as economic conditions, inflation, and political stability. Forward discount, on the other hand, occurs when the forward exchange rate is lower than the spot exchange rate, reflecting expectations of future currency depreciation and interest rate differentials between two countries. The key difference lies in currency depreciation being an actual market movement, while forward discount represents a pricing mechanism based on anticipated changes in currency value.

Causes of Currency Depreciation

Currency depreciation occurs when a currency loses value relative to another currency due to factors such as higher inflation rates, trade deficits, or political instability. Forward discount reflects the expected future depreciation of a currency as indicated by the forward exchange rate being lower than the spot rate. Causes of currency depreciation often include macroeconomic imbalances, reduced investor confidence, and monetary policy decisions that lead to lower interest rates compared to other countries.

Factors Influencing Forward Discounts

Forward discounts reflect expectations of currency depreciation driven by interest rate differentials, inflation rates, and political stability. Higher domestic interest rates relative to foreign rates typically lead to a forward discount to prevent arbitrage opportunities, while elevated inflation rates erode purchasing power, intensifying forward discount pressure. Political uncertainty and economic instability increase risk premiums, causing forward contracts to adjust rates that reflect anticipated currency depreciation.

Economic Impacts of Currency Depreciation

Currency depreciation leads to increased export competitiveness by making domestic goods cheaper for foreign buyers, boosting trade balances. However, it raises the cost of imported goods and foreign debt servicing, fueling inflation and reducing purchasing power. Forward discounts often reflect market expectations of depreciation, influencing investment decisions and capital flows in international markets.

Implications of Forward Discount for Investors

A forward discount occurs when a currency's forward exchange rate is lower than its spot rate, indicating expectations of currency depreciation. For investors, this signals potential losses on foreign investments due to adverse exchange rate movements. Hedging strategies become crucial to mitigate risks associated with forward discounts in international portfolios.

Real-World Examples: Currency Depreciation vs Forward Discount

Currency depreciation occurs when a nation's currency loses value against foreign currencies in the spot market, exemplified by the Turkish lira falling over 20% against the U.S. dollar in 2021 due to economic instability. Forward discount, on the other hand, reflects the forward exchange rate being lower than the spot rate, often seen in the Indian rupee's forward contracts pricing in a consistent discount relative to the dollar amid inflation concerns. These phenomena illustrate how market expectations and macroeconomic factors influence the real-world interaction between spot depreciation and forward discount pricing in forex markets.

Conclusion: Managing Risks in International Finance

Currency depreciation directly impacts spot exchange rates by reducing a currency's value relative to others, while forward discount reflects expected future depreciation through forward exchange rates. Effective risk management in international finance involves using forward contracts to hedge against potential losses from currency depreciation, stabilizing cash flows and protecting profit margins. Businesses must monitor both spot market trends and forward rates to strategically manage exposure and ensure financial stability.

Currency depreciation Infographic

libterm.com

libterm.com