A progressive tax system imposes higher tax rates on individuals with higher incomes, ensuring that those who earn more contribute a larger portion of their earnings to public revenues. This approach aims to reduce income inequality and fund essential government services more equitably. Explore the full article to understand how progressive taxation impacts your finances and society.

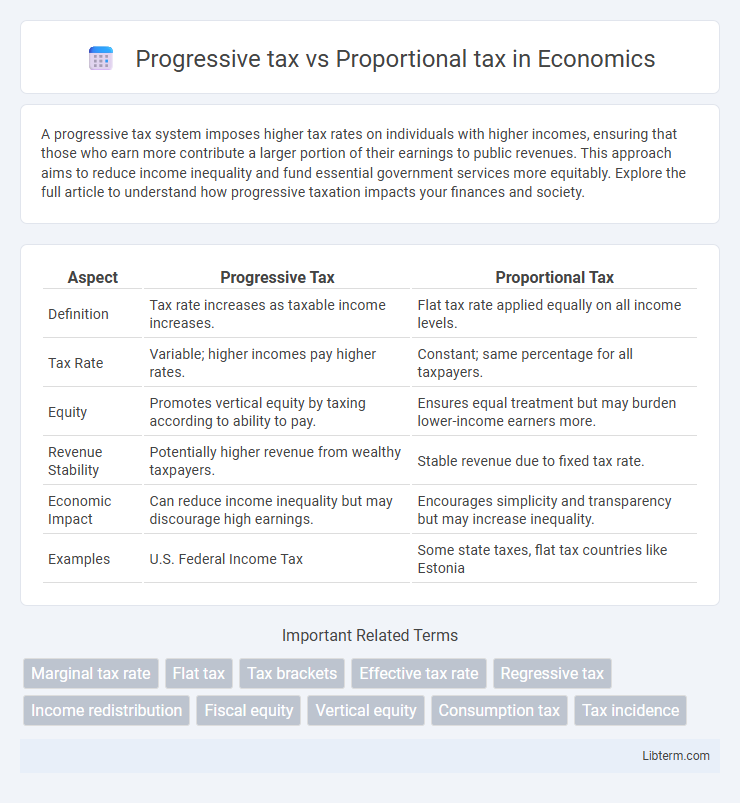

Table of Comparison

| Aspect | Progressive Tax | Proportional Tax |

|---|---|---|

| Definition | Tax rate increases as taxable income increases. | Flat tax rate applied equally on all income levels. |

| Tax Rate | Variable; higher incomes pay higher rates. | Constant; same percentage for all taxpayers. |

| Equity | Promotes vertical equity by taxing according to ability to pay. | Ensures equal treatment but may burden lower-income earners more. |

| Revenue Stability | Potentially higher revenue from wealthy taxpayers. | Stable revenue due to fixed tax rate. |

| Economic Impact | Can reduce income inequality but may discourage high earnings. | Encourages simplicity and transparency but may increase inequality. |

| Examples | U.S. Federal Income Tax | Some state taxes, flat tax countries like Estonia |

Introduction to Taxation Systems

Progressive tax systems impose higher tax rates on increased income levels, ensuring that individuals with greater earnings contribute a larger percentage of their income. Proportional tax systems, also known as flat taxes, apply a uniform rate across all income brackets, maintaining simplicity and consistency in tax collection. Understanding these fundamental taxation models is crucial for evaluating government revenue strategies and social equity implications.

Defining Progressive Tax

Progressive tax is a taxation system where the tax rate increases as the taxable income increases, meaning higher earners pay a larger percentage of their income compared to lower earners. This structure aims to reduce income inequality by imposing heavier tax burdens on those with greater financial capacity. In contrast, proportional tax applies a constant tax rate regardless of income level, resulting in equal percentage taxation across all income brackets.

Defining Proportional Tax

Proportional tax, also known as a flat tax, applies a constant tax rate to all income levels, ensuring every taxpayer pays the same percentage regardless of earnings. This system contrasts with a progressive tax, where tax rates increase with higher income brackets to reduce income inequality. Proportional tax creates simplicity in tax administration but may be viewed as less equitable due to its uniform treatment of all income groups.

Key Differences Between Progressive and Proportional Tax

Progressive tax imposes higher rates as income increases, ensuring those with greater earnings contribute a larger percentage, while proportional tax applies a constant rate regardless of income level. The effective tax rate in a progressive system rises with income, contrasting with the flat rate maintained in proportional taxation. Progressive taxes aim to reduce income inequality, whereas proportional taxes promote simplicity and uniformity in tax collection.

Economic Impact of Progressive Taxation

Progressive taxation, where tax rates increase with income, reduces income inequality by redistributing wealth and funding social programs that support economic mobility. Higher-income earners contribute a larger share, which can boost government revenues used for public investments in education, healthcare, and infrastructure, stimulating long-term economic growth. Critics argue that excessive progressivity may discourage investment and work incentives, but empirical evidence often shows moderate progressive taxes balance equity with economic efficiency.

Economic Impact of Proportional Taxation

Proportional taxation maintains a constant tax rate regardless of income, potentially encouraging investment and economic growth by ensuring predictability for taxpayers. This tax system reduces distortions in labor supply decisions since higher earners are not penalized with increased rates, fostering a stable environment for work and productivity. However, proportional taxes may place a relatively heavier burden on lower-income individuals, which can affect aggregate demand and economic equity.

Equity and Fairness in Taxation

Progressive tax systems enhance equity by taxing higher incomes at increasing rates, ensuring that those with greater financial capacity contribute a larger share, which reduces income inequality. Proportional tax, or flat tax, applies a constant rate to all income levels, promoting simplicity and perceived fairness by treating all taxpayers equally regardless of income. Equity debates center on vertical equity, where progressivity supports fairness through ability to pay, while proportional tax appeals to horizontal equity by taxing individuals with similar incomes equally.

Administrative Complexity and Compliance

Progressive tax systems involve multiple tax brackets and varying rates, increasing administrative complexity due to detailed income assessments and calculations. Proportional tax, or flat tax, applies a single rate to all income levels, simplifying compliance and reducing administrative costs for tax authorities. Efficient administration and taxpayer understanding are typically higher in proportional tax systems, while progressive taxes demand more resources for enforcement and accurate reporting.

Global Examples: Progressive vs Proportional Tax

Countries like the United States and Canada implement progressive tax systems where tax rates increase with higher income brackets, aiming to reduce income inequality. In contrast, nations such as Russia and Estonia utilize proportional tax systems with a flat rate applied uniformly to all income levels, simplifying tax compliance and administration. These global examples highlight how progressive taxes promote redistribution, while proportional taxes emphasize fairness through equal percentage rates.

Which Tax System is More Effective?

Progressive tax systems, where tax rates increase with income, effectively reduce income inequality by imposing higher rates on wealthier individuals, enhancing government revenue for social programs. Proportional tax systems apply a constant rate regardless of income, offering simplicity and perceived fairness but may place a heavier burden on low-income taxpayers. Studies show progressive taxation better addresses economic disparity and funds public services, making it more effective for equitable wealth distribution and social welfare.

Progressive tax Infographic

libterm.com

libterm.com