Tail Value at Risk (TVaR) measures the expected loss in the worst-case scenarios beyond a specified confidence level, providing a more comprehensive risk assessment than standard Value at Risk (VaR). This metric is crucial for understanding potential extreme losses in your investment portfolio or insurance liabilities. Explore the rest of the article to uncover how TVaR can enhance your risk management strategies.

Table of Comparison

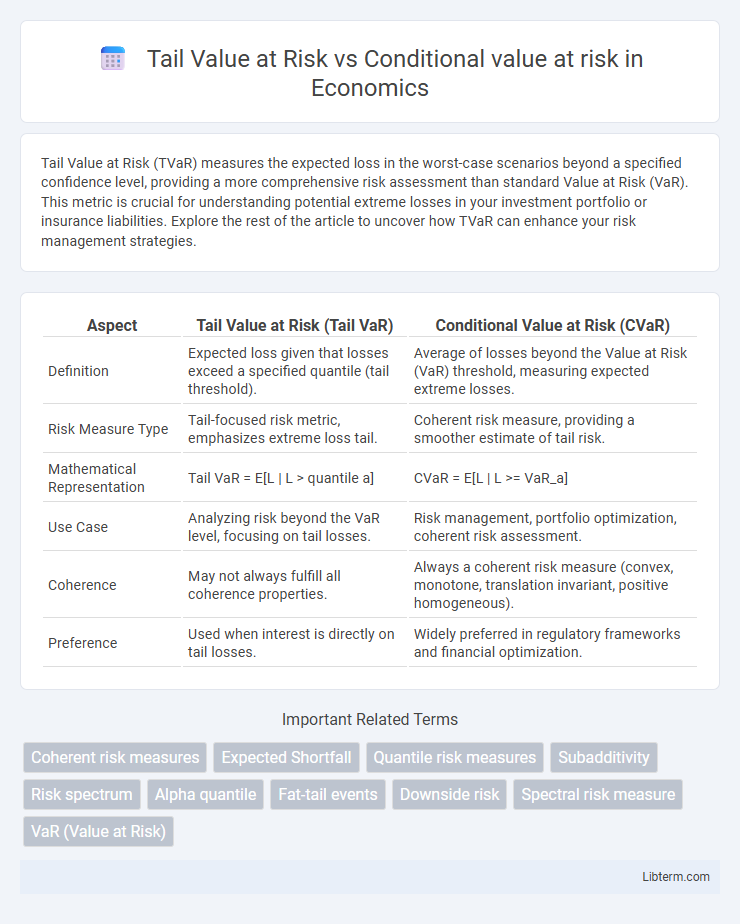

| Aspect | Tail Value at Risk (Tail VaR) | Conditional Value at Risk (CVaR) |

|---|---|---|

| Definition | Expected loss given that losses exceed a specified quantile (tail threshold). | Average of losses beyond the Value at Risk (VaR) threshold, measuring expected extreme losses. |

| Risk Measure Type | Tail-focused risk metric, emphasizes extreme loss tail. | Coherent risk measure, providing a smoother estimate of tail risk. |

| Mathematical Representation | Tail VaR = E[L | L > quantile a] | CVaR = E[L | L >= VaR_a] |

| Use Case | Analyzing risk beyond the VaR level, focusing on tail losses. | Risk management, portfolio optimization, coherent risk assessment. |

| Coherence | May not always fulfill all coherence properties. | Always a coherent risk measure (convex, monotone, translation invariant, positive homogeneous). |

| Preference | Used when interest is directly on tail losses. | Widely preferred in regulatory frameworks and financial optimization. |

Understanding Tail Value at Risk (TVaR)

Tail Value at Risk (TVaR), also known as Conditional Value at Risk (CVaR), measures the expected loss given that losses exceed a specific Value at Risk (VaR) threshold, providing a more comprehensive risk assessment of the tail end of a loss distribution. Unlike VaR, which only identifies a loss cutoff point at a certain confidence level, TVaR accounts for the severity of losses beyond that cutoff, making it a critical metric in risk management and insurance. TVaR is widely used in financial portfolios and insurance to quantify extreme risks and improve capital allocation strategies.

Defining Conditional Value at Risk (CVaR)

Conditional Value at Risk (CVaR), also known as Expected Shortfall, measures the average loss exceeding the Value at Risk (VaR) at a given confidence level, providing a more comprehensive risk assessment of extreme tail events. Unlike Tail Value at Risk, which focuses on the quantile beyond the VaR threshold, CVaR captures the expected magnitude of losses in the tail, enhancing portfolio risk management and regulatory compliance. This makes CVaR a preferred metric for financial institutions seeking to quantify and mitigate potential losses during severe market downturns.

Mathematical Formulations of TVaR and CVaR

Tail Value at Risk (TVaR) is mathematically defined as the expected loss exceeding the Value at Risk (VaR) at a given confidence level a, expressed as TVaR_a(X) = E[X | X > VaR_a(X)]. Conditional Value at Risk (CVaR) generalizes this concept by calculating the conditional expectation of losses beyond the VaR, often formulated as CVaR_a(X) = (1/(1-a)) _a^1 VaR_u(X) du, capturing the average of the tail losses. Both TVaR and CVaR serve as coherent risk measures, with CVaR providing a more comprehensive risk assessment by integrating the entire tail distribution beyond the VaR threshold.

Key Differences Between TVaR and CVaR

Tail Value at Risk (TVaR) measures the expected loss given that losses exceed a specific quantile, focusing on the tail of the loss distribution beyond the Value at Risk (VaR) threshold. Conditional Value at Risk (CVaR) is often used interchangeably with TVaR but can sometimes emphasize the average loss beyond VaR, especially in continuous distributions. The key difference lies in the interpretation: TVaR strictly refers to the tail expectation conditional on losses exceeding VaR, while CVaR may represent a broader concept including mixture models or discrete cases, influencing risk management and regulatory applications.

Applications of TVaR in Risk Management

Tail Value at Risk (TVaR) is widely applied in risk management for assessing extreme losses beyond a specified quantile, providing a more comprehensive risk measure than Value at Risk (VaR) by accounting for the severity of tail events. TVaR is crucial in insurance and financial sectors for setting capital reserves, pricing risk-sensitive products, and optimizing portfolios under heavy-tailed loss distributions. Its application enhances decision-making in regulatory compliance, stress testing, and risk mitigation strategies by quantifying potential losses in worst-case scenarios.

Real-World Uses of CVaR in Finance

Conditional Value at Risk (CVaR) offers a more comprehensive risk assessment than Tail Value at Risk (TVaR) by evaluating the expected loss beyond the Value at Risk (VaR) threshold, making CVaR particularly valuable in portfolio optimization and risk management. Financial institutions employ CVaR to measure potential extreme losses in asset portfolios, enhance regulatory compliance, and develop robust strategies for managing tail risks during market downturns. The real-world application of CVaR extends to stress testing, capital allocation, and optimizing hedge fund performance by minimizing expected shortfall under adverse conditions.

Advantages and Limitations of Tail Value at Risk

Tail Value at Risk (TVaR) offers advantages such as providing a coherent risk measure that captures the average loss beyond a specified percentile, enhancing risk sensitivity compared to traditional Value at Risk (VaR). TVaR effectively accounts for tail risk by considering extreme losses, making it useful in insurance and financial risk management for more accurate capital allocation. However, TVaR's limitations include its computational intensity for complex portfolios and potential sensitivity to the choice of confidence level, which may impact its stability and interpretability.

Pros and Cons of Conditional Value at Risk

Conditional Value at Risk (CVaR) offers a more comprehensive risk assessment than Tail Value at Risk (TVaR) by considering the average loss beyond the VaR threshold, capturing tail risk more effectively. CVaR's advantage lies in its coherent risk measure properties, ensuring subadditivity and providing better optimization in portfolio risk management. However, CVaR may require more complex calculations and assumptions about loss distributions, potentially limiting its practicality in scenarios with limited data or non-standard risk profiles.

Selecting Between TVaR and CVaR: Decision Criteria

Selecting between Tail Value at Risk (TVaR) and Conditional Value at Risk (CVaR) hinges on the desired risk sensitivity and the tail distribution characteristics. TVaR provides a more comprehensive assessment by averaging losses beyond the VaR threshold, making it suitable for heavy-tailed risk profiles, while CVaR focuses on the expected loss given that the loss exceeds the VaR, offering a conditional perspective ideal for regulatory compliance. Decision criteria include the risk measure's coherence, sensitivity to tail events, and alignment with portfolio risk management objectives.

Future Trends in Risk Assessment Techniques

Future trends in risk assessment techniques emphasize enhanced precision in Tail Value at Risk (TVaR) and Conditional Value at Risk (CVaR) through machine learning algorithms and real-time data integration. Advanced predictive analytics enable more accurate modeling of extreme financial losses by capturing tail dependencies and improving scenario analysis. Increasing adoption of AI-driven methodologies facilitates dynamic risk adjustments, crucial for managing complex portfolios under volatile market conditions.

Tail Value at Risk Infographic

libterm.com

libterm.com