Consumption externality occurs when a consumer's use of a good or service affects the well-being of others without direct compensation. These external effects can be either positive, like when someone's vaccination reduces disease spread, or negative, such as pollution from smoking impacting nearby individuals. Explore this article to understand how consumption externalities influence markets and what measures can address these impacts effectively.

Table of Comparison

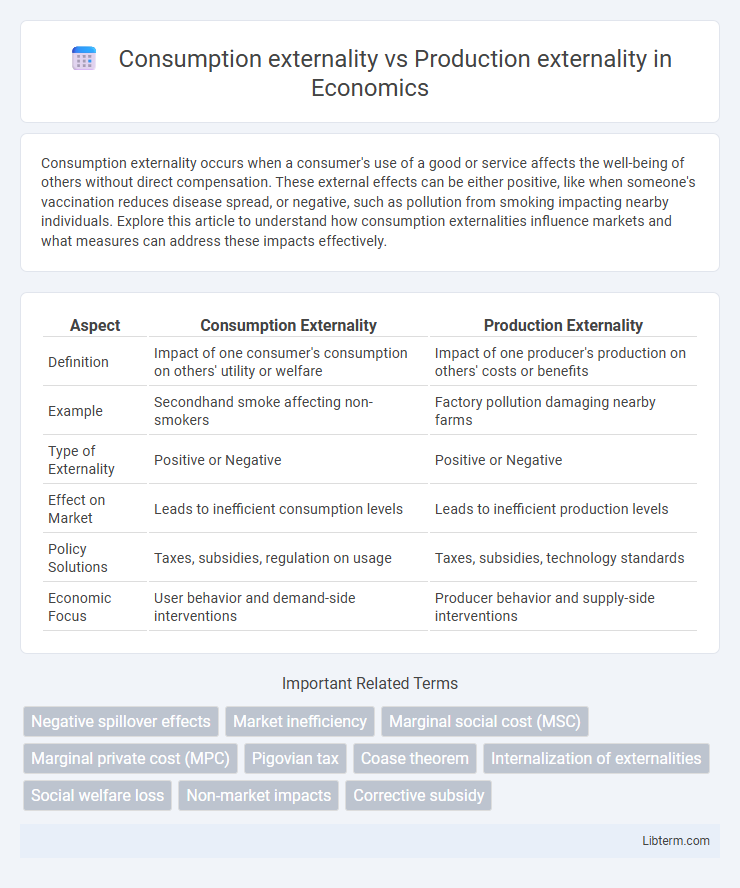

| Aspect | Consumption Externality | Production Externality |

|---|---|---|

| Definition | Impact of one consumer's consumption on others' utility or welfare | Impact of one producer's production on others' costs or benefits |

| Example | Secondhand smoke affecting non-smokers | Factory pollution damaging nearby farms |

| Type of Externality | Positive or Negative | Positive or Negative |

| Effect on Market | Leads to inefficient consumption levels | Leads to inefficient production levels |

| Policy Solutions | Taxes, subsidies, regulation on usage | Taxes, subsidies, technology standards |

| Economic Focus | User behavior and demand-side interventions | Producer behavior and supply-side interventions |

Introduction to Externalities

Externalities occur when a third party experiences costs or benefits from an economic transaction without compensation. Consumption externalities arise when an individual's use of a good affects others, such as secondhand smoke impacting public health. Production externalities happen when a firm's production process imposes costs or benefits on others, like industrial pollution affecting surrounding communities.

Defining Consumption Externalities

Consumption externalities occur when an individual's consumption of goods or services imposes costs or benefits on others not reflected in market prices, such as secondhand smoke affecting non-smokers. These externalities can lead to market inefficiencies where social costs or benefits deviate from private ones, prompting potential government intervention like taxes or subsidies. Understanding consumption externalities helps address issues like pollution and public health by aligning private consumption choices with societal welfare.

Defining Production Externalities

Production externalities occur when a firm's production activities impose costs or benefits on unrelated third parties, influencing social welfare without being reflected in market prices. These external effects can be negative, such as pollution from manufacturing, or positive, like technological spillovers that enhance industry productivity. Addressing production externalities often involves regulatory measures, taxes, or subsidies to internalize the external costs or benefits and achieve efficient resource allocation.

Key Differences Between Consumption and Production Externalities

Consumption externalities occur when the consumption of a good or service by one individual impacts the utility or well-being of others, such as secondhand smoke affecting non-smokers. Production externalities arise when a firm's production activity imposes costs or benefits on third parties, exemplified by pollution from a factory impacting local residents. The key difference lies in the source of the external effect: consumption externalities stem from usage or enjoyment of goods, while production externalities originate from the manufacturing or creation process.

Positive and Negative Consumption Externalities

Positive consumption externalities occur when an individual's consumption yields benefits to others, such as vaccinations preventing disease spread, while negative consumption externalities happen when consumption imposes costs on society, like secondhand smoke from cigarettes. In contrast, production externalities arise from the firm's production process, creating either positive effects like technological spillovers or negative impacts such as environmental pollution. Understanding these distinctions highlights the need for policies like subsidies for positive consumption externalities and taxes or regulations to mitigate negative consumption externalities.

Positive and Negative Production Externalities

Positive production externalities occur when a firm's production activities generate benefits for third parties, such as technological innovations that improve overall industry efficiency or pollution reduction from cleaner manufacturing processes. Negative production externalities arise when production imposes costs on others, like air and water pollution from factories, leading to health problems and environmental degradation. Addressing these externalities often requires government intervention through taxes, subsidies, or regulations to align private incentives with social welfare.

Real-world Examples of Consumption Externalities

Consumption externalities occur when the consumption of a good or service imposes costs or benefits on third parties not involved in the transaction, such as pollution from smoking affecting public health, noise disturbances from loud music in residential areas, or vaccination reducing disease spread in a community. Production externalities arise when the manufacturing process impacts external parties, including factory emissions contaminating air and water or industrial waste affecting local ecosystems. Real-world examples of consumption externalities include secondhand smoke exposing non-smokers to health risks and excessive alcohol consumption contributing to drunk driving accidents, highlighting the need for regulatory measures like taxes or bans.

Real-world Examples of Production Externalities

Production externalities occur when a firm's manufacturing activities impose costs or benefits on third parties without compensation, such as pollution emitted by factories affecting nearby residents' health. A notable example includes industrial plants releasing carbon emissions into the atmosphere, contributing to climate change and imposing health costs on broader communities. Another real-world case involves agricultural runoff contaminating water supplies, demonstrating negative production externalities that require regulatory intervention to mitigate environmental and public health impacts.

Policy Approaches to Addressing Externalities

Policy approaches to addressing consumption externalities often involve taxes, subsidies, or regulations aimed at modifying individual behavior, such as carbon taxes on gasoline to reduce pollution. In contrast, production externalities are typically managed through pollution permits, emission standards, or incentives for cleaner technology adoption to limit environmental damage caused by firms. Both approaches rely on internalizing external costs to align private incentives with social welfare and promote efficient resource allocation.

Economic Impact and Societal Implications

Consumption externalities occur when an individual's consumption affects third parties, often leading to inefficient market outcomes such as overconsumption of goods like tobacco or pollution-causing products, which impose health and environmental costs on society. Production externalities arise when a firm's production activities generate unaccounted costs or benefits, such as factory emissions polluting air or positive spillovers from innovation, impacting economic productivity and public health. Both types of externalities necessitate government intervention like taxes, subsidies, or regulations to internalize costs, improve resource allocation, and mitigate negative societal implications such as social welfare losses and environmental degradation.

Consumption externality Infographic

libterm.com

libterm.com