Accounting profit measures a company's financial performance by subtracting total explicit costs from total revenue, reflecting the actual monetary gain during a specific period. This figure is essential for tax reporting and financial statements, providing a clear snapshot of business profitability. Explore the full article to understand how accounting profit impacts your business decisions and financial planning.

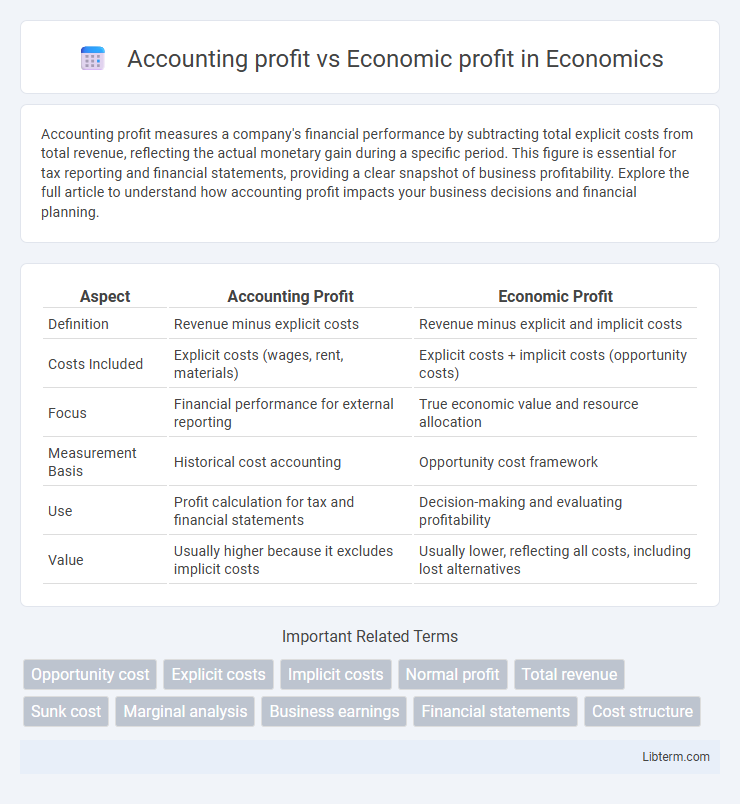

Table of Comparison

| Aspect | Accounting Profit | Economic Profit |

|---|---|---|

| Definition | Revenue minus explicit costs | Revenue minus explicit and implicit costs |

| Costs Included | Explicit costs (wages, rent, materials) | Explicit costs + implicit costs (opportunity costs) |

| Focus | Financial performance for external reporting | True economic value and resource allocation |

| Measurement Basis | Historical cost accounting | Opportunity cost framework |

| Use | Profit calculation for tax and financial statements | Decision-making and evaluating profitability |

| Value | Usually higher because it excludes implicit costs | Usually lower, reflecting all costs, including lost alternatives |

Understanding Accounting Profit

Accounting profit refers to the net income calculated by subtracting explicit costs, such as wages, rent, and materials, from total revenue, providing a clear measure of a company's financial performance based on recorded transactions. It is the figure reported on financial statements and used for tax purposes, reflecting the tangible cash inflows and outflows during a specific period. Unlike economic profit, accounting profit does not consider implicit costs like opportunity costs, making it essential for regulatory compliance but limited in assessing true business profitability.

Defining Economic Profit

Economic profit measures the true profitability of a business by subtracting both explicit costs (accounting expenses) and implicit costs (opportunity costs) from total revenue. Unlike accounting profit, which only deducts explicit costs, economic profit provides a comprehensive view of financial performance by including foregone alternatives as costs. This concept helps businesses assess the real value created beyond traditional accounting measures.

Key Differences Between Accounting and Economic Profit

Accounting profit measures total revenue minus explicit costs, reflecting the firm's net income reported on financial statements. Economic profit calculates total revenue minus both explicit and implicit costs, including opportunity costs, to assess true profitability from resource allocation. The key difference lies in economic profit accounting for opportunity costs, providing a more comprehensive evaluation of financial performance than accounting profit.

Components of Accounting Profit

Accounting profit consists primarily of total revenue minus explicit costs, which include wages, rent, materials, and other direct expenses recorded in financial statements. It excludes implicit costs such as opportunity costs, which are considered in economic profit calculations. Understanding the breakdown of accounting profit is crucial for financial reporting, tax assessments, and evaluating business performance.

Components of Economic Profit

Economic profit accounts for explicit costs such as wages, rent, and materials, as well as implicit costs including opportunity costs of capital and entrepreneurial effort. Unlike accounting profit, which considers only explicit expenses and total revenue, economic profit subtracts both explicit and implicit costs from total revenue, providing a more comprehensive measure of business profitability. Components of economic profit include explicit costs recorded in financial statements and implicit costs representing foregone alternatives, essential for evaluating true economic viability.

Opportunity Costs in Economic Profit

Economic profit accounts for opportunity costs, reflecting the true profitability by subtracting both explicit and implicit costs from total revenue, unlike accounting profit, which only deducts explicit costs. Opportunity costs represent the value of the next best alternative foregone, making economic profit a more comprehensive measure of business performance. This distinction highlights that a positive accounting profit can coincide with zero or negative economic profit if implicit costs are high.

Importance of Accounting Profit for Businesses

Accounting profit represents the financial gain calculated by subtracting explicit costs from total revenue, serving as a key indicator of a business's operational success and tax obligations. It provides essential data for financial reporting, helping stakeholders assess profitability, make informed decisions, and secure investments or loans. Businesses rely on accounting profit to gauge performance, plan budgets, and comply with regulatory requirements, making it crucial for day-to-day management and long-term strategy.

Why Economic Profit Matters for Decision Making

Economic profit matters for decision making because it accounts for both explicit and implicit costs, providing a more comprehensive measure of true profitability. This broader perspective enables businesses to evaluate opportunity costs and assess whether resources are utilized in the most value-generating way. Unlike accounting profit, which only considers explicit costs, economic profit ensures decisions lead to sustainable growth and resource optimization.

Real-World Examples: Accounting vs Economic Profit

Accounting profit measures a company's total revenue minus explicit costs, reflecting financial statements reported to stakeholders, such as a retailer earning $1 million revenue with $700,000 in direct expenses, resulting in $300,000 accounting profit. Economic profit incorporates both explicit costs and implicit opportunity costs, evaluating true profitability by considering alternative uses of resources; for example, if the retailer could have earned $250,000 working elsewhere, economic profit would be $50,000. Firms in competitive markets often have positive accounting profits but zero or negative economic profits, highlighting the importance of opportunity cost in decision-making.

Choosing the Right Profit Metric for Your Business

Choosing the right profit metric for your business hinges on understanding that accounting profit measures explicit revenues minus explicit costs, offering a clear view of financial performance based on market transactions. Economic profit incorporates implicit costs, such as opportunity costs, providing a more comprehensive assessment of profitability that reflects true business value and long-term sustainability. Businesses aiming for strategic growth should prioritize economic profit to evaluate resource allocation and investment decisions beyond mere accounting statements.

Accounting profit Infographic

libterm.com

libterm.com