BRICS economies--comprising Brazil, Russia, India, China, and South Africa--hold significant influence on global trade, investment, and economic growth due to their large populations and emerging markets. These nations are driving innovation, infrastructure development, and resource exchange, reshaping the global economic landscape. Explore this article to understand how BRICS economies impact your financial prospects and the world economy.

Table of Comparison

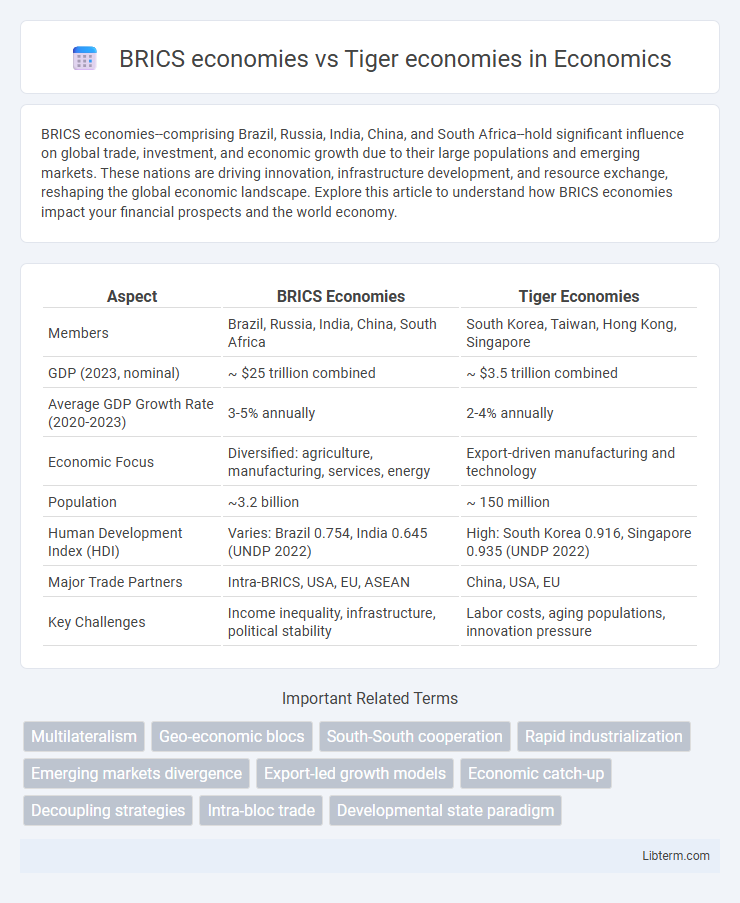

| Aspect | BRICS Economies | Tiger Economies |

|---|---|---|

| Members | Brazil, Russia, India, China, South Africa | South Korea, Taiwan, Hong Kong, Singapore |

| GDP (2023, nominal) | ~ $25 trillion combined | ~ $3.5 trillion combined |

| Average GDP Growth Rate (2020-2023) | 3-5% annually | 2-4% annually |

| Economic Focus | Diversified: agriculture, manufacturing, services, energy | Export-driven manufacturing and technology |

| Population | ~3.2 billion | ~ 150 million |

| Human Development Index (HDI) | Varies: Brazil 0.754, India 0.645 (UNDP 2022) | High: South Korea 0.916, Singapore 0.935 (UNDP 2022) |

| Major Trade Partners | Intra-BRICS, USA, EU, ASEAN | China, USA, EU |

| Key Challenges | Income inequality, infrastructure, political stability | Labor costs, aging populations, innovation pressure |

Introduction to BRICS and Tiger Economies

BRICS economies--comprised of Brazil, Russia, India, China, and South Africa--represent major emerging markets characterized by rapid industrialization, large population bases, and significant influence on global trade and investment. Tiger economies, including South Korea, Taiwan, Hong Kong, and Singapore, are noted for their high growth rates from the 1960s to 1990s driven by export-oriented industrialization and advanced technological development. Both groups exemplify distinct models of economic development, with BRICS economies focusing on resource wealth and manufacturing scale, while Tiger economies emphasize innovation, export competitiveness, and financial services.

Historical Background and Formation

BRICS economies--comprising Brazil, Russia, India, China, and South Africa--emerged in the early 2000s as a coalition of major emerging markets aiming to reshape global economic governance and foster South-South cooperation. In contrast, the Tiger economies--South Korea, Taiwan, Hong Kong, and Singapore--rose during the late 20th century through export-oriented industrialization, rapid technological adoption, and strong state-led development policies. The formation of BRICS reflects a strategic alliance to counterbalance Western economic dominance, while the Tiger economies epitomize successful post-war modernization and integration into the global economy.

Key Economic Indicators: A Comparative Overview

BRICS economies, comprising Brazil, Russia, India, China, and South Africa, exhibit diverse GDP growth rates ranging from 1% to over 6%, supported by vast natural resources and expanding industrial sectors. Tiger economies, such as South Korea, Taiwan, Hong Kong, and Singapore, demonstrate robust GDP growth often exceeding 3%, with high GDP per capita and advanced technological infrastructure driving innovation and export competitiveness. Key economic indicators reveal BRICS' larger population base and resource-driven growth contrast with Tigers' export-oriented, high-income economies with strong human capital and technological advancement.

Growth Drivers and Economic Models

BRICS economies--Brazil, Russia, India, China, and South Africa--leverage abundant natural resources, vast domestic markets, and state-led investments as primary growth drivers, emphasizing mixed economic models with significant government intervention. Tiger economies, including South Korea, Taiwan, Hong Kong, and Singapore, focus on export-oriented industrialization, technological innovation, and human capital development, relying on open-market policies and agile, export-driven economic frameworks. Both groups exhibit rapid growth but differ fundamentally in their economic strategies: BRICS prioritize scale and resource integration, while Tiger economies optimize efficiency and global trade connectivity.

Trade Patterns and Global Integration

BRICS economies exhibit diversified trade patterns with a strong emphasis on commodity exports, manufacturing, and increasing intra-BRICS trade, driving global integration through strategic partnerships and participation in multilateral forums. Tiger economies, including South Korea, Taiwan, Hong Kong, and Singapore, showcase highly export-oriented trade patterns centered on advanced technology, electronics, and capital goods, maintaining deep global supply chain integration and robust foreign direct investment inflows. Both groups leverage trade openness for economic growth, but Tiger economies focus more on innovation-driven exports while BRICS emphasize resource-driven trade diversification and emerging market connectivity.

Investment Trends and Capital Flows

BRICS economies, comprising Brazil, Russia, India, China, and South Africa, attract substantial foreign direct investment (FDI) driven by their large markets, abundant natural resources, and growing consumer bases, with China leading in outbound capital flows targeting infrastructure and technology sectors globally. Tiger economies, such as South Korea, Taiwan, Hong Kong, and Singapore, emphasize high-tech industries and export-oriented manufacturing, channeling investment into innovation, digital transformation, and financial services, supported by stable regulatory environments and robust governance. Capital flows in BRICS tend to be more volatile due to geopolitical and commodity price risks, whereas Tiger economies benefit from steady, diversified investments fostered by advanced financial markets and integration into global value chains.

Innovation and Technological Advancements

BRICS economies, including Brazil, Russia, India, China, and South Africa, have accelerated innovation through large-scale investments in AI, renewable energy, and digital infrastructure, positioning themselves as emerging global technology hubs. Tiger economies like South Korea, Singapore, Taiwan, and Hong Kong lead in advanced manufacturing, semiconductor technology, and high R&D expenditure, driving rapid innovation in electronics and biotechnology. The contrasting innovation models show BRICS focusing on broad-based digital transformation, while Tiger economies excel in specialized, high-tech industrial advancements.

Challenges and Structural Weaknesses

BRICS economies face significant challenges including high income inequality, reliance on commodity exports, and institutional inefficiencies, which hinder sustainable growth and economic diversification. Tiger economies, while advanced in technology and manufacturing, grapple with aging populations, rising labor costs, and limited natural resources that threaten long-term competitiveness. Structural weaknesses in both groups stem from governance issues and the need for innovation-driven growth to maintain global economic relevance.

Future Prospects and Strategic Alliances

BRICS economies, comprising Brazil, Russia, India, China, and South Africa, are poised for robust growth driven by large domestic markets, abundant natural resources, and expanding technological capabilities, positioning them as key players in global trade and investment. Tiger economies, including South Korea, Taiwan, Hong Kong, and Singapore, leverage advanced manufacturing, innovation ecosystems, and strategic geopolitical positioning to sustain high growth and foster competitive export industries. Strategic alliances between BRICS and Tiger economies facilitate knowledge transfer, investment flows, and regional market integration, enhancing future economic resilience and diversification prospects across emerging and developed markets.

Conclusion: Lessons and Implications for Emerging Markets

BRICS economies demonstrate the potential for large, resource-rich countries to drive growth through industrial diversification and infrastructure investment, while Tiger economies highlight the importance of export-led growth, human capital development, and technological innovation. Emerging markets can learn from BRICS' scale and market potential combined with Tiger economies' agility, policy discipline, and integration into global value chains. Strategically balancing these lessons fosters sustainable economic expansion and enhances competitiveness amid global uncertainties.

BRICS economies Infographic

libterm.com

libterm.com