Establishing credibility is essential for gaining trust and authority in any field. Consistent accuracy, transparency, and expertise reinforce your reputation and influence. Discover how to enhance your credibility effectively in the rest of this article.

Table of Comparison

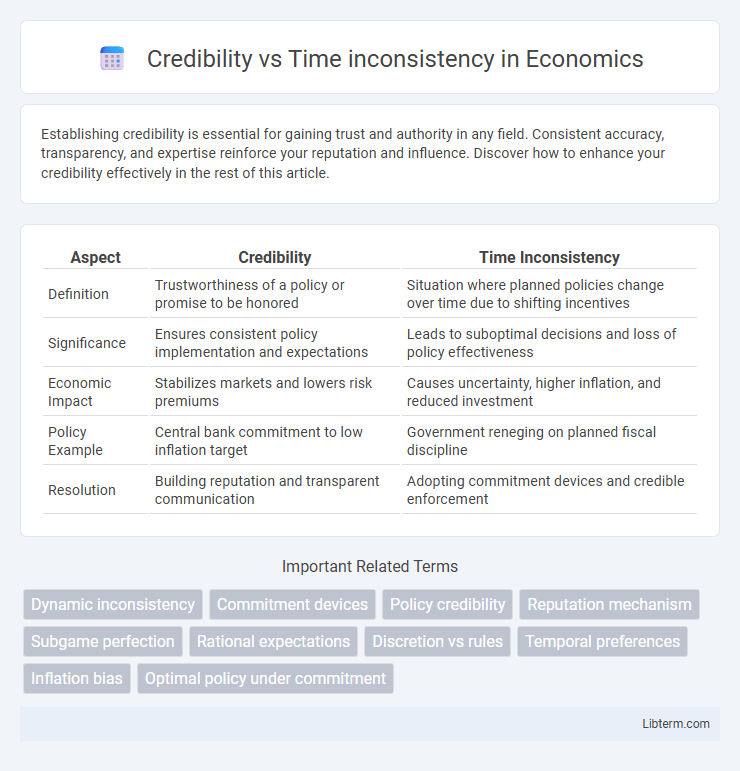

| Aspect | Credibility | Time Inconsistency |

|---|---|---|

| Definition | Trustworthiness of a policy or promise to be honored | Situation where planned policies change over time due to shifting incentives |

| Significance | Ensures consistent policy implementation and expectations | Leads to suboptimal decisions and loss of policy effectiveness |

| Economic Impact | Stabilizes markets and lowers risk premiums | Causes uncertainty, higher inflation, and reduced investment |

| Policy Example | Central bank commitment to low inflation target | Government reneging on planned fiscal discipline |

| Resolution | Building reputation and transparent communication | Adopting commitment devices and credible enforcement |

Understanding Credibility in Economic Policy

Credibility in economic policy refers to the government's commitment to maintaining consistent and predictable actions that align with announced plans, thereby influencing expectations and behavior of economic agents. Time inconsistency arises when policymakers have incentives to deviate from previously optimal plans, undermining credibility and potentially causing higher inflation or unstable growth. Ensuring credibility involves transparent communication, reputational concerns, and institutional mechanisms that commit authorities to sustained policy paths, reducing uncertainty and fostering economic stability.

Defining Time Inconsistency: Causes and Consequences

Time inconsistency occurs when decision-makers' preferences change over time, leading to policies or commitments that are not credible in the future. Causes include shifting incentives, changing information, or temptation to deviate from previously planned actions. Consequences often involve loss of trust, reduced effectiveness of long-term strategies, and difficulty in sustaining commitment to optimal policies.

The Relationship Between Credibility and Time Inconsistency

Credibility in economic policy is crucial to mitigating time inconsistency, a situation where policymakers have an incentive to deviate from previously announced plans. When a government or institution establishes strong credibility, it reduces the likelihood of reneging on commitments, thereby enhancing trust and policy effectiveness over time. The interplay between credibility and time inconsistency directly influences expectations formation and the success of long-term economic strategies.

Historical Examples of Time Inconsistency Problems

Historical examples of time inconsistency problems reveal how policymakers' inability to commit to future actions often undermines credibility. The 1970s U.S. inflation crisis exemplifies this, where government promises of low inflation were contradicted by expansionary policies, eroding public trust and leading to stagflation. Similarly, the hyperinflation episodes in Weimar Germany demonstrate how inconsistent fiscal policies damaged credibility, fueling expectations of rapid monetary devaluation and economic instability.

Policy Commitment and the Role of Credibility

Policy commitment strengthens credibility by assuring economic agents that government actions will remain consistent over time, reducing uncertainty and enhancing the effectiveness of monetary or fiscal policies. Time inconsistency arises when policymakers have incentives to deviate from previously announced policies, undermining trust and leading to suboptimal economic outcomes. Credibility plays a crucial role in overcoming time inconsistency by anchoring expectations and encouraging forward-looking behavior in markets and individuals.

Strategies to Enhance Policy Credibility

Building policy credibility requires commitment mechanisms such as legislative constraints, independent central banks, and transparent communication to reduce incentives for policymakers to deviate over time. Establishing clear, rule-based frameworks enhances predictability and aligns expectations, mitigating the problem of time inconsistency. Empirical evidence shows that countries with credible policy institutions experience lower inflation rates and more stable economic growth.

Institutional Solutions to Time Inconsistency

Institutional solutions to time inconsistency focus on creating commitment mechanisms that enhance policy credibility and reduce temptation to deviate from optimal plans. Examples include independent central banks with clear mandates, constitutional budget rules, and delegation of authority to insulated agencies, all designed to align incentives over time. These frameworks help anchor expectations, minimizing the risk of short-term political pressures undermining long-term economic policies.

Case Studies: Successful Credibility in Practice

Case studies highlighting successful credibility in overcoming time inconsistency demonstrate how firms establish commitment mechanisms that align long-term goals with short-term actions. Companies like Apple and Toyota utilize transparent corporate governance and consistent innovation strategies to build trust, ensuring stakeholders believe in sustained performance despite fluctuating market pressures. Effective credibility management in these cases reduces opportunistic behaviors and secures lasting competitive advantages.

Risks and Costs of Time Inconsistent Policies

Time inconsistent policies generate significant risks, including loss of policy credibility and increased uncertainty among stakeholders. These policies often incur high costs due to unanticipated adjustments, reduced investment incentives, and inefficient resource allocation caused by changing commitments over time. Persistent time inconsistency undermines long-term economic stability, increasing volatility and eroding trust in institutional frameworks.

Future Directions for Strengthening Credibility in Policy Making

Future directions for strengthening credibility in policy making emphasize enhancing transparency and accountability through real-time data sharing and robust monitoring systems. Integrating adaptive frameworks that allow for policy adjustments based on empirical feedback can mitigate time inconsistency challenges. Leveraging predictive analytics and stakeholder engagement tools fosters trust by aligning long-term objectives with short-term actions.

Credibility Infographic

libterm.com

libterm.com