Perfect competition is a market structure characterized by numerous small firms, identical products, and free entry and exit, ensuring that no single seller can influence prices. Firms are price takers, and consumers benefit from the lowest possible prices due to the high level of competition. Discover how perfect competition impacts market efficiency and consumer welfare in the rest of this article.

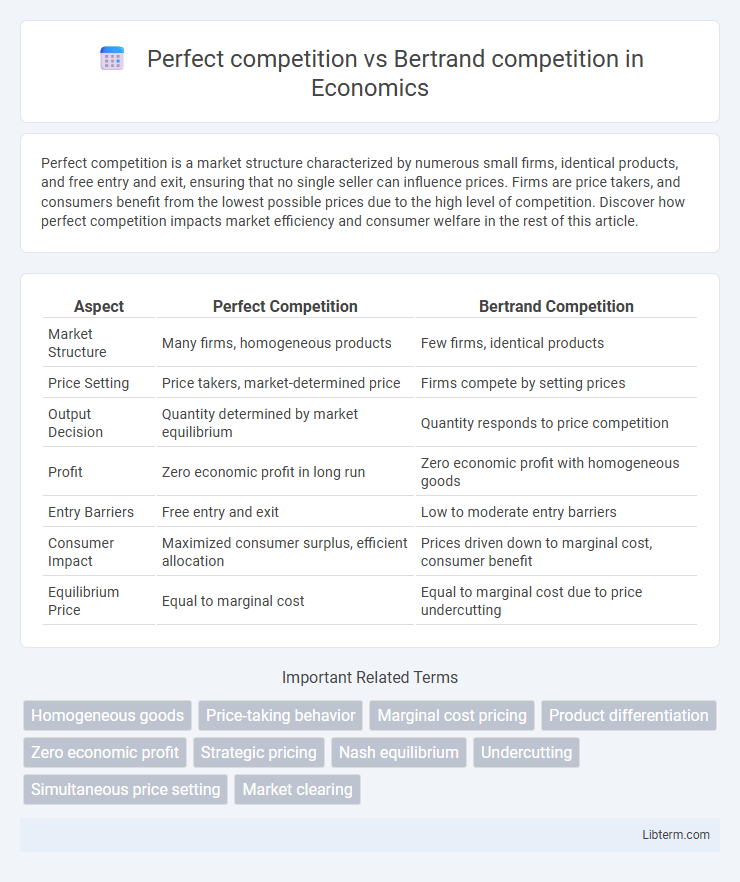

Table of Comparison

| Aspect | Perfect Competition | Bertrand Competition |

|---|---|---|

| Market Structure | Many firms, homogeneous products | Few firms, identical products |

| Price Setting | Price takers, market-determined price | Firms compete by setting prices |

| Output Decision | Quantity determined by market equilibrium | Quantity responds to price competition |

| Profit | Zero economic profit in long run | Zero economic profit with homogeneous goods |

| Entry Barriers | Free entry and exit | Low to moderate entry barriers |

| Consumer Impact | Maximized consumer surplus, efficient allocation | Prices driven down to marginal cost, consumer benefit |

| Equilibrium Price | Equal to marginal cost | Equal to marginal cost due to price undercutting |

Introduction to Market Structures

Perfect competition is characterized by numerous small firms selling identical products with no single firm influencing market price, leading to equilibrium where price equals marginal cost. Bertrand competition involves a few firms competing by setting prices simultaneously, typically resulting in price competition driving prices down to marginal cost even with few competitors. Both market structures highlight the impact of firm behavior and price-setting mechanisms on market efficiency and consumer welfare.

Defining Perfect Competition

Perfect competition is characterized by a large number of small firms selling identical products, where no single firm can influence market prices due to homogeneous goods and free entry and exit. Firms in perfect competition are price takers, and the equilibrium occurs when supply equals demand, leading to allocative and productive efficiency. This contrasts with Bertrand competition, where firms compete by setting prices, often resulting in price wars even with few competitors.

Understanding Bertrand Competition

Bertrand competition describes a market scenario where firms compete primarily on price, assuming products are homogeneous and consumers always buy from the lowest-priced seller. Unlike perfect competition, where many firms are price takers with zero economic profit in equilibrium, Bertrand competition often results in prices being driven down to marginal cost, even with only two firms. This phenomenon, known as the Bertrand paradox, highlights how price undercutting can intensify competition and reduce profit margins more aggressively than in perfect competition markets.

Key Assumptions of Each Model

Perfect competition assumes many firms selling identical products with no single firm able to influence market prices, perfect information, and free entry and exit in the market. Bertrand competition involves firms competing by setting prices rather than quantities, assumes at least two firms producing homogeneous products, and predicts prices driven down to marginal cost if firms undercut each other. Both models rely on assumptions of rational behavior and market transparency but differ fundamentally in the strategic variables firms control.

Price Determination Mechanisms

Perfect competition features many firms selling identical products, where price is determined by market supply and demand, leading to a single equilibrium price with firms as price takers. Bertrand competition involves firms competing by setting prices simultaneously for homogeneous goods, resulting in prices driven down to marginal cost due to aggressive undercutting. While perfect competition relies on market clearing price signals, Bertrand competition highlights strategic pricing interactions that can lead to zero economic profits.

Output and Efficiency Comparison

Perfect competition results in an equilibrium output where price equals marginal cost, achieving allocative efficiency and maximizing total surplus. In Bertrand competition with homogeneous products, firms price at marginal cost, leading to the same efficient output level as perfect competition despite a duopoly market structure. Both models ensure maximum consumer surplus and productive efficiency, but Bertrand competition achieves this through price competition rather than quantity setting.

Role of Product Differentiation

Perfect competition assumes homogeneous products, where no individual firm can influence market prices due to identical offerings, resulting in zero economic profit in the long run. In contrast, Bertrand competition features firms competing primarily on price with differentiated products, allowing them to maintain some market power and charge prices above marginal cost. Product differentiation in Bertrand models enhances consumer choice and softens price competition, enabling firms to secure higher profits and sustain brand loyalty.

Impact on Consumer Welfare

Perfect competition maximizes consumer welfare by ensuring goods are sold at marginal cost, leading to allocative efficiency and zero economic profits. In Bertrand competition, firms compete by setting prices, driving prices down to marginal cost as well, but with potential for fewer firms and differentiated products, consumer welfare remains high but may vary based on market structure. Both models highlight price competition's role in lowering prices and increasing consumer surplus, yet perfect competition tends to represent an idealized market outcome.

Real-World Applications and Examples

Perfect competition models markets with numerous small firms selling identical products, such as agricultural goods like wheat or corn, where no single seller can influence prices. Bertrand competition applies to markets with a few firms competing on price for homogeneous products, seen in industries like airlines or telecommunications, where companies often undercut each other's pricing to gain market share. Real-world applications of Bertrand competition highlight strategic price-setting and potential for price wars, whereas perfect competition represents an idealized benchmark rarely observed in practice due to product differentiation and market entry barriers.

Conclusion: Choosing the Right Model

Perfect competition assumes many firms with identical products and no barriers to entry, leading to price equaling marginal cost and zero economic profit in the long run. Bertrand competition models firms competing on price for homogeneous goods, often resulting in prices driven down to marginal cost even with few competitors. Selecting between these models depends on market structure: perfect competition suits markets with many small firms and free entry, while Bertrand competition applies to oligopolies where price-setting is pivotal.

Perfect competition Infographic

libterm.com

libterm.com