Purchasing power parity (PPP) deviation occurs when there is a difference between the actual exchange rate and the rate predicted by PPP, reflecting disparities in price levels between countries. This deviation can result from factors such as trade barriers, market imperfections, or short-term fluctuations in capital flows. Explore the rest of the article to understand how PPP deviations impact your international investments and global economic analysis.

Table of Comparison

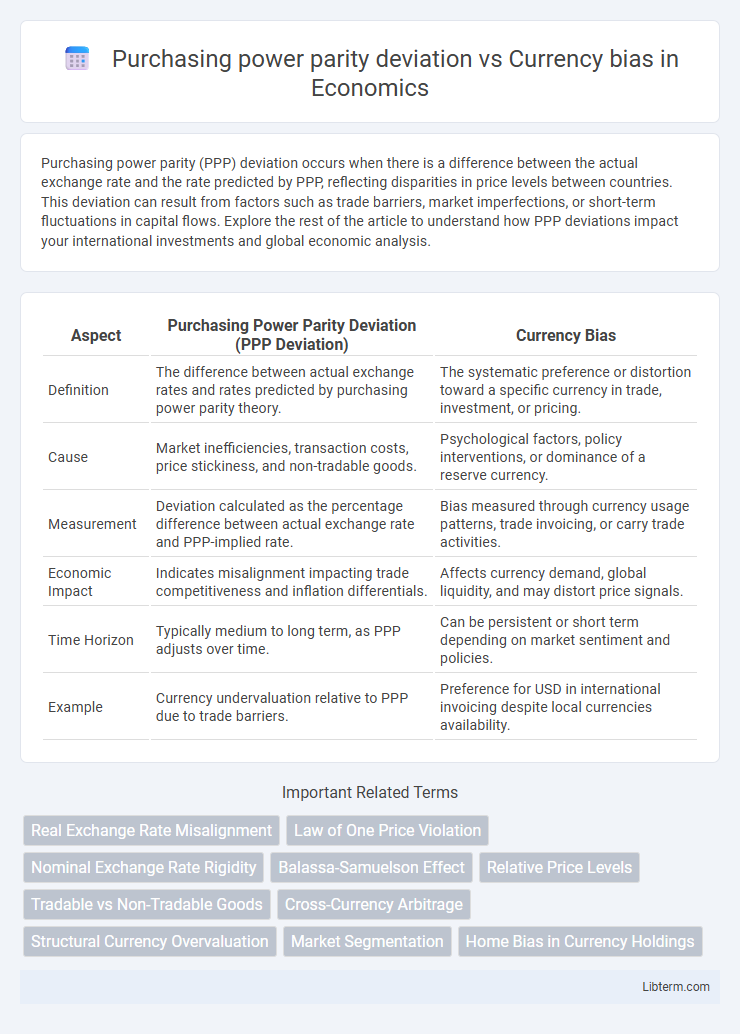

| Aspect | Purchasing Power Parity Deviation (PPP Deviation) | Currency Bias |

|---|---|---|

| Definition | The difference between actual exchange rates and rates predicted by purchasing power parity theory. | The systematic preference or distortion toward a specific currency in trade, investment, or pricing. |

| Cause | Market inefficiencies, transaction costs, price stickiness, and non-tradable goods. | Psychological factors, policy interventions, or dominance of a reserve currency. |

| Measurement | Deviation calculated as the percentage difference between actual exchange rate and PPP-implied rate. | Bias measured through currency usage patterns, trade invoicing, or carry trade activities. |

| Economic Impact | Indicates misalignment impacting trade competitiveness and inflation differentials. | Affects currency demand, global liquidity, and may distort price signals. |

| Time Horizon | Typically medium to long term, as PPP adjusts over time. | Can be persistent or short term depending on market sentiment and policies. |

| Example | Currency undervaluation relative to PPP due to trade barriers. | Preference for USD in international invoicing despite local currencies availability. |

Introduction to Purchasing Power Parity (PPP) Deviation

Purchasing Power Parity (PPP) deviation refers to the difference between the theoretical exchange rate implied by relative price levels and the actual market exchange rate. Currency bias occurs when persistent deviations from PPP favor certain currencies due to factors like market sentiment, monetary policy, or trade dynamics. Understanding PPP deviation is crucial for analyzing currency valuation discrepancies and guiding international trade and investment decisions.

Understanding Currency Bias in International Markets

Currency bias in international markets refers to systematic deviations in foreign exchange rates caused by market preferences or institutional factors, rather than fundamental economic differences. Unlike purchasing power parity (PPP) deviations, which arise from relative price levels and inflation disparities between countries, currency bias stems from investor behavior, capital controls, or central bank interventions that distort exchange rate valuations. Understanding currency bias is crucial for accurate currency risk assessment and for developing effective hedging strategies in global investment portfolios.

Key Factors Influencing PPP Deviation

Key factors influencing Purchasing Power Parity (PPP) deviation include transaction costs, market segmentation, and product differentiation, which prevent price equalization across countries. Currency bias occurs when exchange rates systematically deviate due to persistent trade imbalances, monetary policy differences, and investor behavior. Understanding these elements helps explain why PPP deviations persist despite theoretical expectations of currency adjustments.

The Role of Behavioral Biases in Currency Valuation

Purchasing power parity (PPP) deviations occur when exchange rates diverge from the relative price levels between countries, often influenced by behavioral biases such as overconfidence, herding, and anchoring in currency valuation. These biases lead investors and traders to misprice currencies, perpetuating currency bias that deviates from fundamental values predicted by PPP theory. Empirical studies highlight that cognitive distortions, sentiment-driven trading, and market psychology significantly contribute to sustained PPP deviations and persistent currency misalignments.

Measuring PPP Deviations: Common Approaches

Measuring purchasing power parity (PPP) deviations often involves comparing exchange rates to relative price levels using indices like the Big Mac Index or the Penn World Table. Currency bias occurs when market exchange rates systematically deviate from PPP due to factors such as interest rate differentials, capital flows, or trade barriers. Statistical techniques like variance ratio tests and panel regressions help isolate PPP deviations from persistent currency mispricing, enhancing accuracy in international price comparisons.

Empirical Evidence of Currency Bias Across Economies

Empirical evidence reveals persistent deviations from Purchasing Power Parity (PPP) often stem from currency bias, where market participants favor certain currencies due to factors like liquidity, transaction costs, and risk perceptions. Studies across developed and emerging economies demonstrate that currency bias leads to systematic overvaluation or undervaluation, challenging the PPP's assumption of equalized price levels. Research utilizing panel data and exchange rate dynamics highlights that currency bias significantly influences real exchange rates beyond fundamental economic variables.

Macroeconomic Consequences of PPP Deviations

Purchasing power parity (PPP) deviations impact exchange rate stability and influence inflation differentials across countries, leading to misaligned currency values that distort trade balances. Currency bias, manifesting as persistent overvaluation or undervaluation, exacerbates global imbalances by altering competitiveness and affecting capital flows. These macroeconomic consequences hinder effective monetary policy, undermine economic growth, and increase volatility in international financial markets.

Currency Bias Impact on International Investment Strategies

Currency bias significantly affects international investment strategies by skewing the perceived value of foreign assets relative to domestic ones, leading to suboptimal portfolio allocations and increased currency risk exposure. Unlike purchasing power parity deviations, which reflect fundamental economic disparities, currency bias arises from behavioral factors and market imperfections, causing investors to either underweight or overweight certain currencies irrationally. Recognizing and adjusting for currency bias enables investors to enhance portfolio diversification and improve returns by exploiting mispricings and managing currency risk more effectively.

Policy Responses to Address PPP Deviation and Currency Bias

Policy responses to address purchasing power parity (PPP) deviations and currency bias typically include coordinated exchange rate interventions and monetary policy adjustments aimed at stabilizing currency values. Central banks may implement interest rate changes or engage in foreign exchange market operations to correct misalignments caused by currency overvaluation or undervaluation, thereby reducing trade imbalances. Structural reforms that enhance market transparency and promote price level convergence across countries also play a critical role in mitigating persistent PPP deviations and currency biases.

Future Research Directions: Bridging PPP Deviations and Currency Bias

Future research should explore the intricate relationship between Purchasing Power Parity (PPP) deviations and currency bias by employing high-frequency exchange rate data and advanced econometric models. Investigating the role of market frictions, behavioral finance factors, and macroeconomic shocks can provide deeper insights into persistent PPP deviations and systemic currency biases. Integrating machine learning techniques to capture nonlinear dynamics and cross-country spillover effects promises to enhance predictive accuracy and policy relevance in currency valuation studies.

Purchasing power parity deviation Infographic

libterm.com

libterm.com