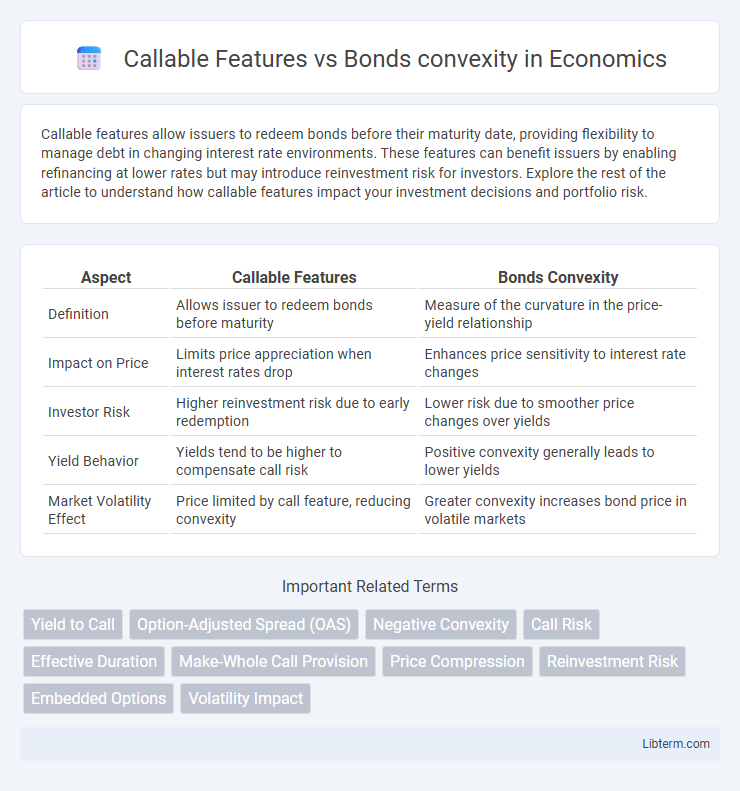

Callable features allow issuers to redeem bonds before their maturity date, providing flexibility to manage debt in changing interest rate environments. These features can benefit issuers by enabling refinancing at lower rates but may introduce reinvestment risk for investors. Explore the rest of the article to understand how callable features impact your investment decisions and portfolio risk.

Table of Comparison

| Aspect | Callable Features | Bonds Convexity |

|---|---|---|

| Definition | Allows issuer to redeem bonds before maturity | Measure of the curvature in the price-yield relationship |

| Impact on Price | Limits price appreciation when interest rates drop | Enhances price sensitivity to interest rate changes |

| Investor Risk | Higher reinvestment risk due to early redemption | Lower risk due to smoother price changes over yields |

| Yield Behavior | Yields tend to be higher to compensate call risk | Positive convexity generally leads to lower yields |

| Market Volatility Effect | Price limited by call feature, reducing convexity | Greater convexity increases bond price in volatile markets |

Introduction to Callable Features and Bond Convexity

Callable features grant issuers the right to redeem bonds before maturity, introducing embedded options that affect the bond's price sensitivity and yield behavior. Bond convexity measures the curvature of a bond's price-yield relationship, reflecting how duration changes with interest rate fluctuations and indicating interest rate risk. Understanding the interplay between callable features and bond convexity is crucial for accurate bond valuation and risk management.

What Are Callable Bonds?

Callable bonds are fixed-income securities that give issuers the right to redeem the bond before its maturity date, typically at a premium specified in the call schedule. The callable feature introduces negative convexity, meaning the bond's price appreciation potential is limited when interest rates decline, as the issuer is more likely to call the bond. This negative convexity contrasts with traditional bonds, which usually exhibit positive convexity, enhancing price sensitivity to interest rate movements.

Fundamentals of Bond Convexity

Callable bonds exhibit negative convexity because the issuer's option to redeem the bond early limits price appreciation when interest rates fall, contrasting with non-callable bonds that show positive convexity, reflecting greater price sensitivity to interest rate changes. Bond convexity measures the curvature of price-yield relationship, providing a more accurate estimate of price volatility than duration alone, essential for assessing interest rate risk. Understanding the fundamental difference in convexity helps investors evaluate the risk-return tradeoff in callable bonds versus traditional fixed-income securities.

How Call Provisions Affect Bond Pricing

Call provisions increase bond pricing complexity by embedding issuer option risk, which causes callable bonds to exhibit lower convexity compared to non-callable bonds. This feature limits price appreciation in declining interest rate environments since the issuer is likely to call the bond, capping potential capital gains. Consequently, investors demand higher yields for callable bonds to compensate for the reduced price sensitivity and reinvestment risk inherent in call features.

Relationship Between Callable Features and Convexity

Callable features in bonds introduce negative convexity, meaning the bond's price increases at a decreasing rate as yields fall. This relationship occurs because the issuer can call the bond when interest rates drop, capping potential price appreciation for investors. The embedded call option reduces sensitivity to interest rate declines, altering the bond's risk-return profile compared to non-callable bonds with positive convexity.

Negative Convexity in Callable Bonds

Callable bonds exhibit negative convexity due to the embedded call option, which allows issuers to redeem the bond before maturity, especially when interest rates decline. This negative convexity causes the bond's price to increase at a decreasing rate as rates fall, limiting price appreciation and increasing price volatility compared to non-callable bonds with positive convexity. Investors face higher reinvestment risk in callable bonds because decreasing yields may lead to early calls, reducing expected cash flows and altering the bond's convexity profile.

Yield Curve Impact on Callable Bonds

Callable bonds exhibit negative convexity due to the issuer's option to redeem before maturity, causing their price appreciation to be limited when interest rates decline. The yield curve's shape significantly impacts callable bonds, as a steepening curve increases the likelihood of call risk by raising short-term rates faster than long-term rates, reducing expected cash flows. This dynamic makes managing interest rate risk in callable bonds more complex compared to non-callable bonds, requiring advanced models to capture the embedded option value.

Risks Associated with Callable Features

Callable features in bonds introduce significant reinvestment risk as issuers are likely to redeem the bond when interest rates decline, limiting price appreciation and reducing potential capital gains. These bonds exhibit negative convexity, meaning their price increases at a decreasing rate as yields fall, which can disadvantage investors during declining rate environments. The embedded call option essentially caps upside potential, increasing yield volatility and complicating duration management relative to non-callable bonds.

Strategies for Investors: Callable vs. Non-Callable Bonds

Investors seeking higher yields often favor callable bonds despite their negative convexity, which increases price sensitivity to interest rate changes and can lead to reinvestment risk when issuers call the bond early. Non-callable bonds offer positive convexity, providing more predictable price appreciation as interest rates decline, making them suitable for risk-averse strategies focused on capital preservation. Balancing these features, investors may use callable bonds to enhance income in stable rate environments while relying on non-callable bonds during volatile or declining interest rate periods to minimize potential losses.

Conclusion: Weighing Callable Features Against Convexity

Callable features reduce a bond's convexity by limiting price appreciation when interest rates fall, creating negative convexity risk for investors. Bonds without callable features typically exhibit higher positive convexity, providing greater price sensitivity and potential gains as rates decline. Balancing callable features against convexity is critical for investors seeking stable income with manageable interest rate risk exposure.

Callable Features Infographic

libterm.com

libterm.com